Although geopolitical and financial risks increased significantly over the weekend, the main trading floors are far from panicking. Asian exchanges are trading in the green zone, with the Japanese Nikkei225 and Shanghai composite up by 0.2%. Dow Jones also rose by 0.65%, while the exchanges of Australia, India, Singapore and South Korea are in plus.

There is also no change in the balance of risks in the debt market, in particular, yields are growing in China and India. Changes in most other countries are minimal.

As for the latest CFTC report, it is outdated because it does not include the market reaction to the outbreak of hostilities in Ukraine. Nevertheless, it is of interest to long-term investors, provided that no geopolitical events shake the markets.

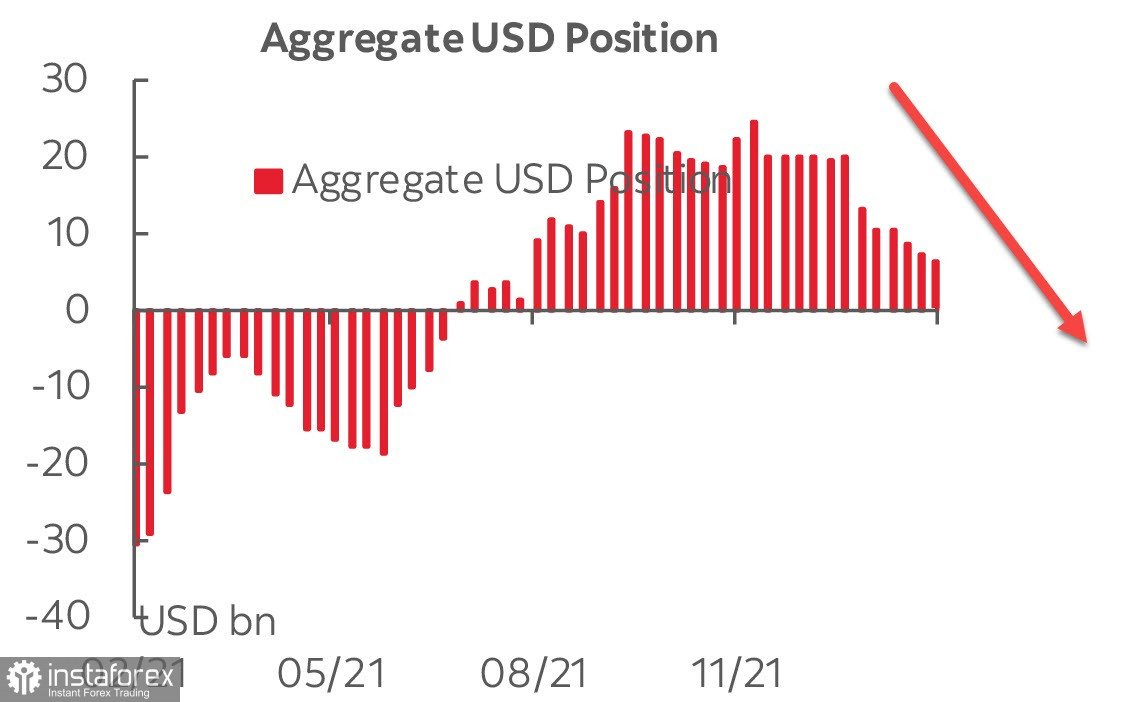

At the moment, sentiment is still not in favor of dollar as the cumulative long position in USD has been falling for the seventh consecutive week. It even fell to 6.16 billion dollars on Tuesday.

This means that the financial market sees no economic grounds for an increase in demand for USD. Yields, which are likely to continue to rise following the start of the Fed's rate hike cycle, do not look attractive for long-term investments as real inflation-adjusted returns are lower than in the Euro area and even lower than in a number of commodity countries. Obviously, the flow of capital into risky assets is constrained by geopolitical risks, and in the absence of such risks, dollar demand, as the CFTC report shows, would continue to decline.

But these conclusions are now irrelevant, and it is clear that the next report will show a sharp change in sentiment. Spot demand for the dollar is growing and is likely to continue for some time.

It is also significant that the rise in oil prices has stopped. Gas prices in Europe closed down to $1,050/100 cubic meters on Friday, but there was no panic at all. The opening of trading on Monday will no doubt raise prices, but it is unlikely that it will be great.

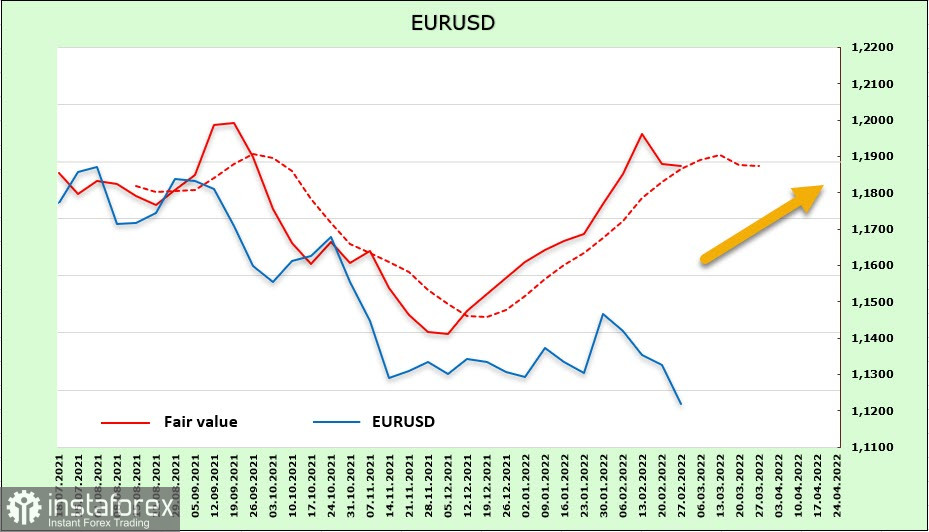

EUR/USD

The net long position on EUR increased during the reporting week by 1.64 billion to 8.4 billion. The settlement price, including short-term movements in the debt, stock and currency markets, turned down, but still remains above the long-term average.

Spot euro went down, but this is not surprising because Europe currently bears the maximum risks. Fortunately, the decline was not large-scale, and 1.1122 stayed as the support level. If tensions in Ukraine ease, then EUR/USD will immediately resume growth.

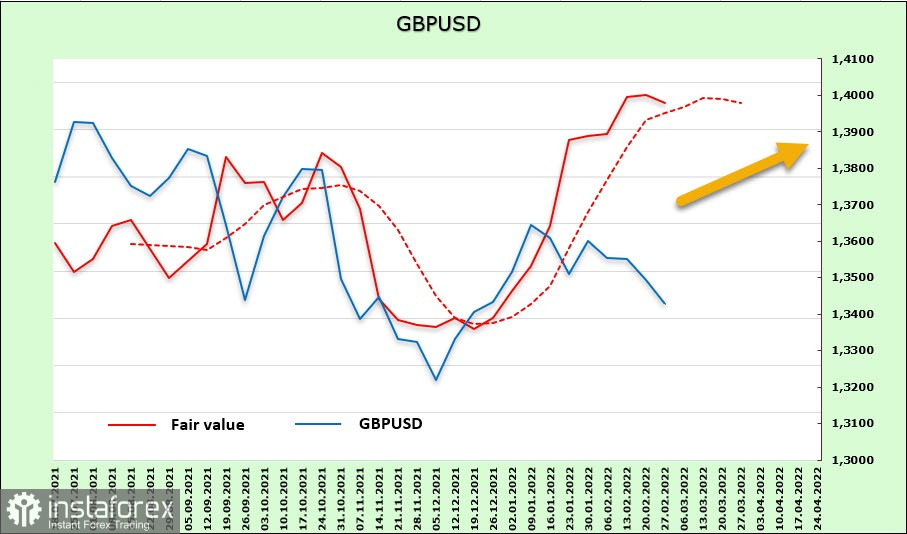

GBP/USD

Pound continues to fluctuate, bringing the weekly change to -682 million. The settlement price is above zero, but the momentum is lost.

Most likely, GBP/USD will stay within the range as there is no reason for either growth or fall. Support will still be 0.3250/70, while the nearest target is 0.3550/70.