To open long positions on EURUSD, you need:

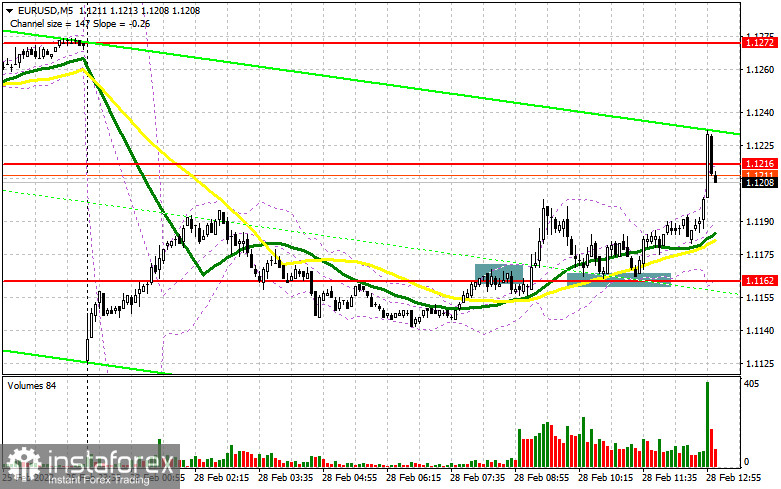

In my morning forecast, I paid attention to the level of 1.1162 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. A false breakdown at the level of 1.1162 in the first half of the day led to the formation of a sell signal for the euro. The deal made sense, as risky assets were under enormous pressure after the Asian sell-off. However, the good news about the start of negotiations between Russia and Ukraine had a positive effect, which led to the strengthening of the pair. The breakout and reverse test from top to bottom of the 1.1162 level formed an excellent entry point into long positions. At the time of writing, the upward movement was more than 65 points. From a technical point of view, nothing has changed for the second half of the day. And what were the entry points for the pound this morning?

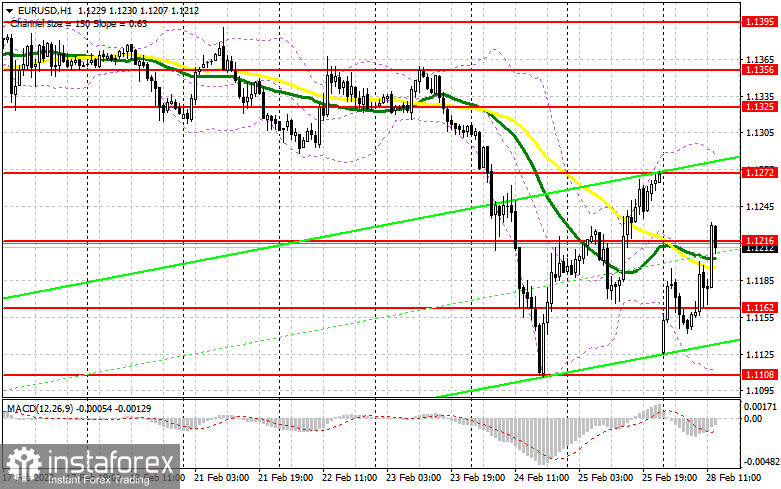

The actions of Russian troops on the territory of Ukraine continue to put serious pressure on the euro, but the good news about the start of negotiations, of course, will warm up the markets. In the afternoon, although several fundamental statistics on the American economy are released, including reports on the balance of foreign trade in goods and changes in the volume of stocks in wholesale warehouses in the United States, however, all attention will be tied to the results of the meeting, which is not known when it will end and how it will end. For this reason, I do not recommend rushing with long positions, especially at current highs. An important task of the bulls for the second half of the day will be to protect the nearest support of 1.1162, which was the focus during the European session. Only the formation of a false breakdown will give the first entry point into long positions in the expectation of another correction of the pair. It is possible to count on a larger recovery of EUR/USD only after the smoothing of military tensions and active actions of buyers in the area of 1.1216. A breakthrough and a test of this range from top to bottom during the release of weak US data will lead to a buy signal and open up the possibility of recovery to the area of 1.1272, where I recommend taking the profits. However, as I noted above, geopolitical tensions will affect the euro. With the further aggravation of the military conflict, the demand for the US dollar will only increase. If there is no activity at 1.1162, traders will start closing long positions, which will only increase the pressure on the pair. Therefore, it is best to postpone purchases until a false breakdown near the minimum of 1.1108, but it is possible to gain long positions on the euro immediately for a rebound from the level of 1.1070, or even lower - around 1.1034 with the aim of an upward correction of 20-25 points within a day.

To open short positions on EURUSD, you need:

Sellers keep the market under control, but they also have some problems. High volatility allows speculative traders to benefit from what is happening. In addition to the US data, Christine Lagarde, President of the European Central Bank, will also speak this afternoon, but her speech is unlikely to have serious consequences for the foreign exchange market. Until the moment when trading is conducted below 1.1216, you can count on a return of pressure on the pair. The important task of the bears in the afternoon will be the protection of this resistance. The formation of a false breakdown at this level, as well as negative news related to Russia and Ukraine - all this will be a signal to open short positions to reduce EUR/USD to the area of 1.1162. A breakdown of this area and a reverse test from the bottom up will give an additional signal to open short positions already with the prospect of falling to a minimum of 1.1108, and there you can reach 1.1070, where I recommend fixing the profits. In the case of strong fundamental statistics for the United States, you can count on the 1.1034 test with the prospect of updating 1.0994. If the euro rises during the American session and there are no bears at 1.1216, and as the practice of last Friday shows, anything can happen, it is best not to rush with sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1272. You can sell EUR/USD immediately on a rebound from 1.1325, or even higher - around 1.1356 with the aim of a downward correction of 15-20 points.

The COT report (Commitment of Traders) for February 15 recorded a reduction in both long and short positions, which led to an increase in the positive delta, as there were much fewer short positions. The uncertain policy of the European Central Bank, together with its president Christine Lagarde, who recently said that it is necessary to act more aggressively in the event of an acceleration of inflationary pressure, and last week completely changed her position, leads traders to a dead end. But even despite the growth of the positive delta, the euro sank very much at the end of the reporting period. This is happening against the background of the risk of a military conflict between Russia and Ukraine. More recently, the Russian authorities recognized the independence of the LDPR, which only exacerbated geopolitical tensions around the world. Another weighty argument for the observed downward movement of the EUR/USD pair is the actions of the Federal Reserve System in relation to interest rates. According to the Fed minutes from the February meeting, it is expected that the central bank may resort to more aggressive actions and raise rates immediately by 0.5% in March this year, and not by 0.25%, as originally planned. This is a kind of bullish signal for the US dollar. The COT report indicates that long non-commercial positions decreased very slightly from the level of 218,973 to the level of 217,899, while short non-commercial positions decreased from the level of 180,131 to the level of 170,318. This suggests that although fewer people are willing to sell euros, there are no more buyers from this. It seems that traders prefer to sit on the sidelines of those events that are now rapidly gaining momentum. At the end of the week, the total non-commercial net position increased slightly and amounted to 47,581 against 38,842. The weekly closing price collapsed and amounted to 1.1305 against 1.1441 a week earlier.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates a slight market confusion with the direction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator around 1.1290 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.