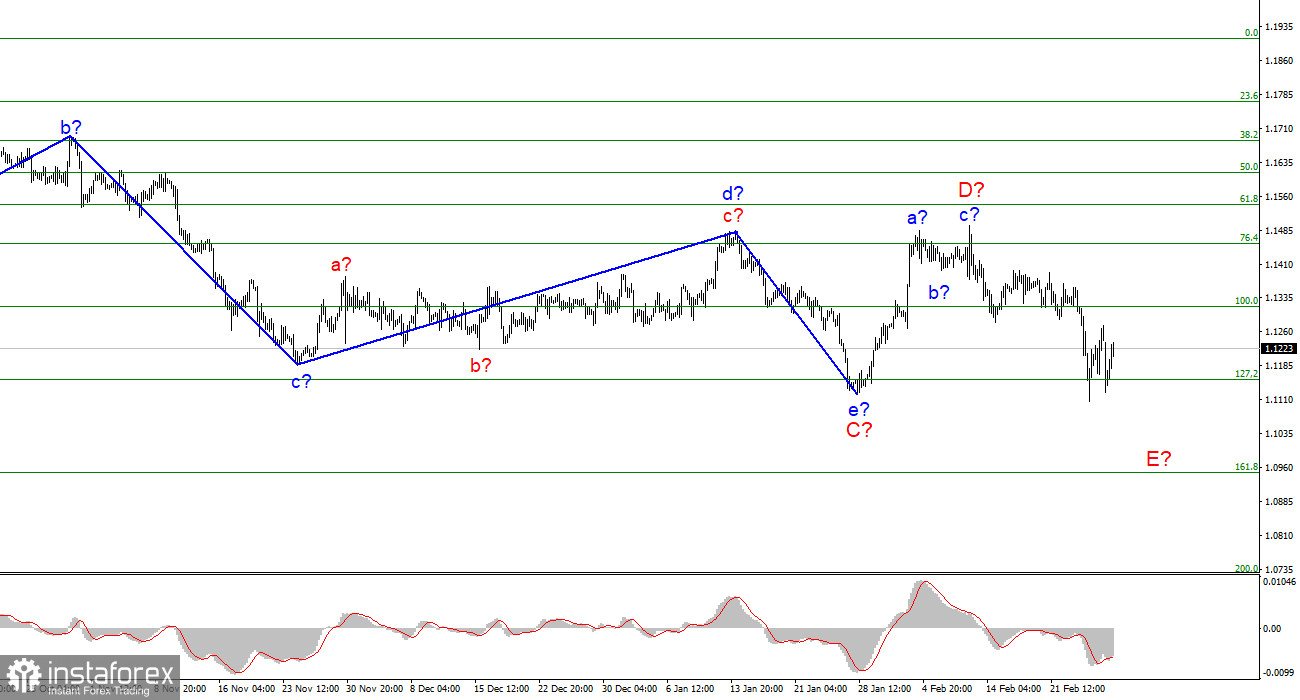

The wave layout on the 4-hour chart for EUR/USD has not changed lately. The European currency dropped last week in line with the current wave layout. On Friday and Monday, it was trying to regain ground. The current decline should be considered the wave E which can turn out to be very long and strong. At the moment, I believe that the D wave is over, and the news background fuels the demand for the US currency. Based on this, I think that there 80% probability that the pair has started to form a new descending wave. Another 20% probability is that the entire wave counting will require some adjustments. However, these days the market sentiment is largely shaped by the news background which is very unstable. Therefore, I believe that the decline will continue. Given the current situation with Ukraine, the whole wave structure can become very complicated.

Geopolitical conflict takes center stage

On Monday, the euro/dollar pair first fell by 150 pips and then advanced by 100 pips. There was no macroeconomic background on Monday apart from the speech by ECB President Christine Lagarde. Yet, markets did not get any new hints about the ECB policy. The regulator is now concerned about what is happening in Ukraine, as well as about high inflation, which can only increase if the geopolitical crisis is not resolved quickly. Energy prices are rising again, especially for gas. In the coming years, the gas shortage may become a very serious problem for the EU. At the moment, many European countries support the idea of a complete or partial refusal of gas imports from Russia. Thus, the EU will have to buy gas elsewhere. However, Europe could long have found new partners for gas imports but still preferred to buy Russian gas as it is much cheaper.

But at the moment, the Nord Stream 2 project has been frozen indefinitely and unprecedented sanctions have been imposed on Russia. This may push inflation even higher, and the European Union has no tools to fight it. The only solution is to raise the interest rate. But as Christine Lagarde has repeatedly stated, the bloc's economy is not in the best condition now. Therefore, the regulator is unlikely to raise the rate at least until the end of 2022. So, inflation will probably stay at the same high level. Although the coronavirus fears have slightly subsided, supply problems are still there as well as the imbalance of supply and demand in the market. Obviously, the geopolitical conflict in Ukraine will only exacerbate all these problems. At the moment, I see no factors that can help halt rising inflation.

Conclusions

Based on the current analysis, I can conclude that the formation of the D wave is completed. If so, now is a good time to sell the European currency with the target near 1.0949, which corresponds to 161.8% Fibonacci, following every sell signal of the MACD indicator. A successful attempt to break through 1.1154 will indicate that the market is ready to sell the instrument.

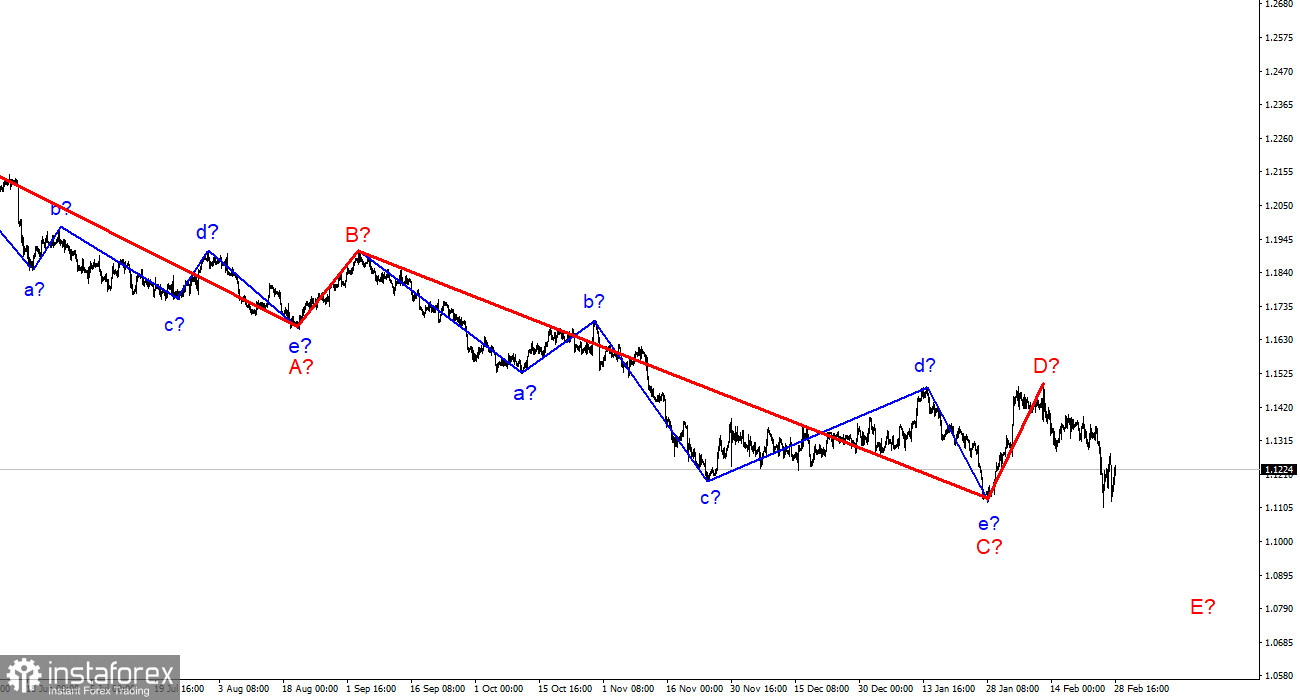

On a higher time frame, the supposed wave D has begun its formation. This wave may turn out to have a shortened or a three-wave form. Given that all previous waves were not too large and were similar in size, the same can be expected from the current wave. Everything indicates that the wave D has already been completed. The construction of the wave E has started.