According to Bloomberg Intelligence, the geopolitical situation in Ukraine has the potential to trigger a global recession that will lead to a drop in oil prices.

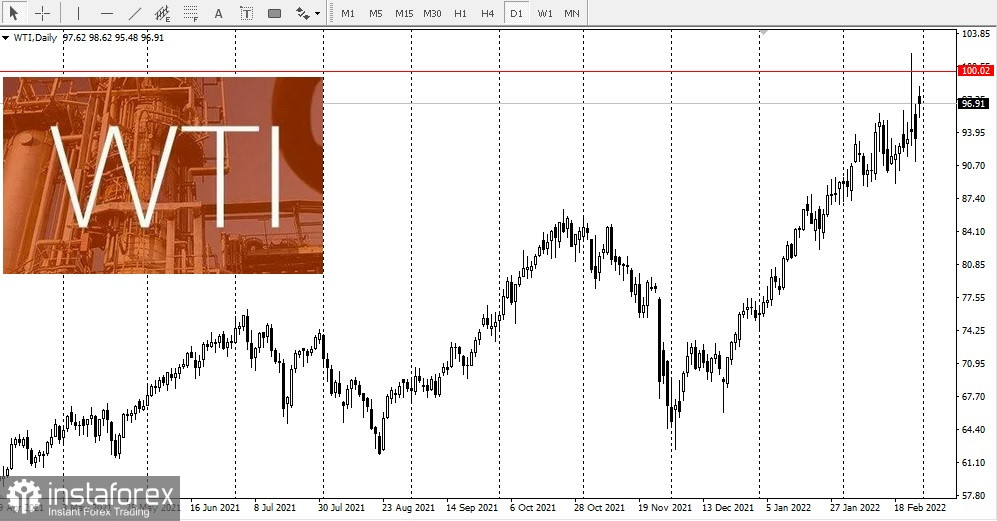

Recently, after the outbreak of hostilities in Ukraine, oil prices exceeded $100 per barrel. Therefore, with the same success, oil prices may fall by 80%.

After bouncing to multi-year highs amid the conflict in Ukraine, oil could be in danger of a reversal if a global recession is around the corner, according to Bloomberg Intelligence.

Mike McGlone, senior commodities strategist at Bloomberg Intelligence, said the war in Ukraine is a potential catalyst for a global recession and a spike in energy prices. And in 2008, the return of risk to assets was exacerbated by the sharp rise in the price of West Texas Intermediate crude oil to its peak.

If crude oil prices continue to rise, as they did 14 years ago, the world could be heading into a recession.

As a result, crude oil will collapse along with other risky assets. Most likely, the new world order will lead not to a reduction in supplies, but to a shift in the flow of liquid fuels from Russia to China.

Brent crude, at around $100 a barrel, hit an overbought zone, a sharp spike in energy prices in 2022, just like in 2008, just before the collapse, but with an unfavorable demand slope due to the war.

In addition, a surge in oil prices in response to geopolitics will accelerate the world's transition to renewable energy sources.