What is needed to open long positions on EUR/USD

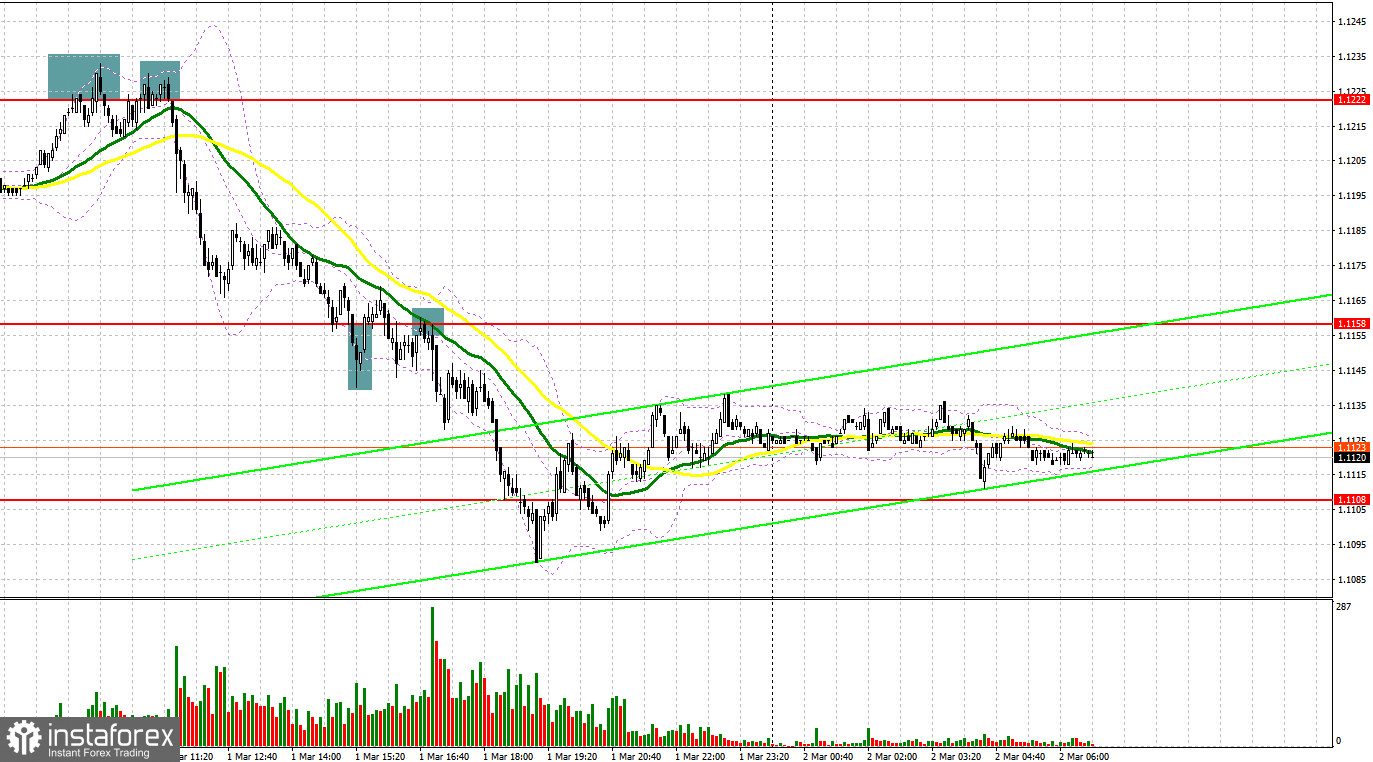

Yesterday, EUR/USD made a few excellent sell signals. Now let's have a look at the 5-minute chart and try to figure out what actually happened. The geopolitical tensions didn't improve to the slightest degree. On the contrary, Russia is poised to step up its aggression. So, several risky assets went into a downward spiral yesterday with the US dollar's advance in parallel. In my morning review, I turned your attention to 1.1222 and recommended taking decisions on the market entry with this level in focus. A downbeat manufacturing PMI for the Eurozone didn't allow the EUR buyers to climb above 1.1222. The currency pair has no fundamentals for its growth as the situation in Ukraine is getting worse. A few false breakouts that I marked on the chart generated excellent signals to sell EUR. As a result, the pair slumped by more than 60 pips. In the second half of the day, the bulls were eager to defend 1.1158 and even enabled a false breakout there. That triggered a buy signal. However, EUR/USD wasn't able to grow. After the second breakout with a test of 1.1158 upwards, the price created a signal to buy EUR. Later on, the pair dropped another 60 pips.

Today, the market doesn't expect any positive changes. Thus, EUR is set to trade under growing pressure. The rumors about the next round of the talks between Russia and Ukraine haven't been confirmed yet. The new talks haven't been settled yet, though the first round ended in nothing. It would be better not to rush buying the pair for a while. The economic calendar contains some statistics on Germany and the Eurozone in the first half of the day. The economic data might be bearish for the euro.

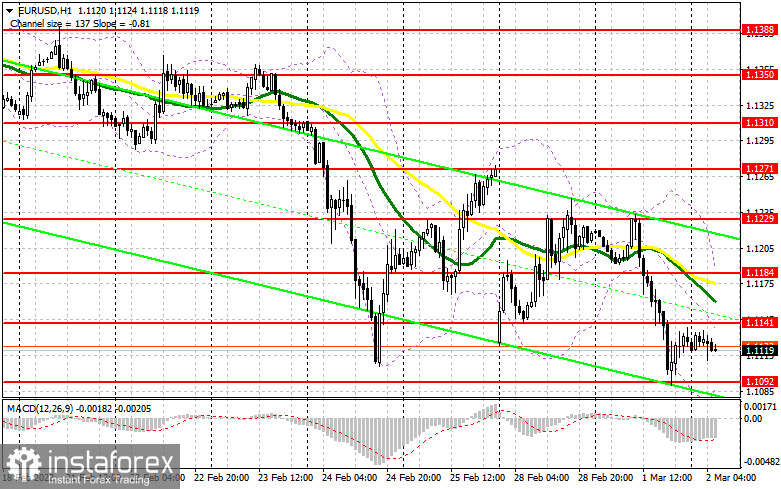

The major task for the bulls in the first half of the day is to defend support of 1.1092, a new low this week. Only a false breakout at this level will create the first market entry point for long positions, bearing in mind EUR's recovery to 1.1141. The thing is that the pair needs more robust actions from the bulls to rely on further growth. The bulls have to break this resistance. If the unemployment rate in Germany declines and inflation shows sharp acceleration in the EU, these factors could ensure EUR's growth above 1.1141 in the first half of the day. However, I wouldn't predict notable activity of the bulls.

A breakout and test of this level downwards will produce a buy signal that will set the stage for the pair's recovery to 1.1184 where moving averages are passing. By the way, they are playing in the buyers' favor. A breakout of this level will halt the bearish trend and open the door to the highs of 1.1229 and 1.1271 where I recommend profit taking. At the same time, if the geopolitical crisis gets worse, the US dollar will enjoy buoyant demand. I wouldn't be surprised to see no buyers at 1.1092. In this case, the reasonable scenario for long positions will be a false breakout at 1.1062. So, we could open long positions immediately at a bounce off the lows at 1.1029 and 1.0994, reckoning an upward 20-25-pips intraday correction.

What is needed to open short positions on EUR/USD

As expected, any negative news instantly invited EUR sellers back to the market. Further market sentiment will depend on developments in the Russia – Ukraine conflict that could involve other countries. Today, to reinforce the bearish trend, EUR/USD needs weak data on the Eurozone, including Germany's labor market. Besides, the bears have to protect resistance at 1.1141. A false breakout at this level backed by the escalation of the hostilities in Ukraine and retaliation from the US and the EU will send a message to sell EUR/USD during the bearish trend. EUR could weaken to the interim target at 1.1092. A breakout and a test of this level upwards could happen soon. If so, this will give an extra signal to open short positions with the target at a low of 1.1062. The door will be open towards 1.1029 and 1.0994 where I recommend profit taking.

In case EUR rises and the bears lack activity at 1.1141, it would be better not to rush opening short positions. I don't rule out that sharp inflation acceleration in the EU will raise expectations of a rate hike by the ECB. Such prospects will reinforce EUR. Therefore, the reasonable scenario will be short positions during a false breakout at 1.1184. We could sell EUR/USD immediately at a drop off 1.1229 or higher from 1.1271, bearing in mind a 15-20-pips correction. As I mentioned above, no fundamental data or remarks by ECB policymakers will overshadow the geopolitical events. So, I would recommend that you give priority to technical analysis when making trading decisions.

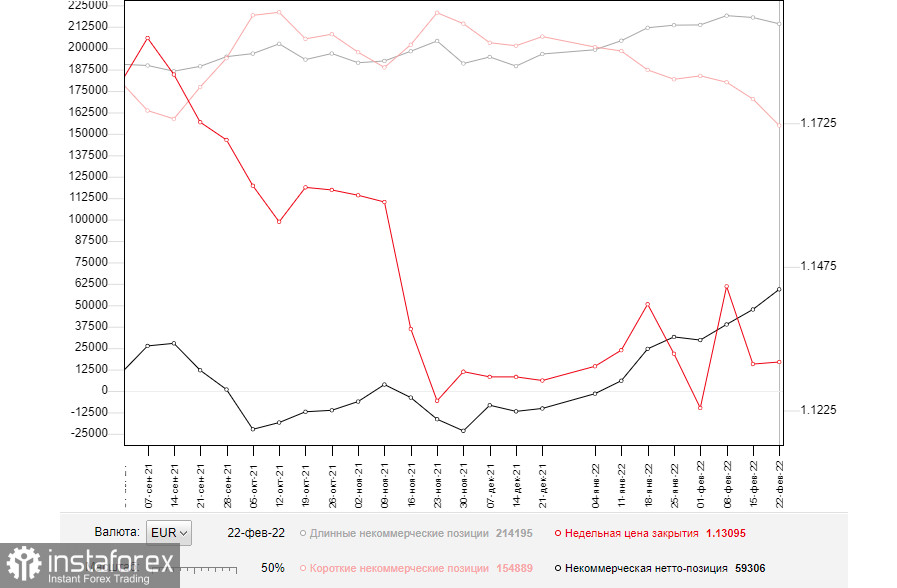

The COT report from February 22 again logs contraction of both long and short positions that increased a positive delta. Notably, short positions were much fewer. On the back of the severe geopolitical conflict that affected the whole world it doesn't make sense to speculate on further policy moves of the ECB or the Federal Reserve. Indeed, if geopolitical tensions get worse, monetary policy moves will be of no importance. Now Russia and Ukraine are holding the talks. So, market sentiment will entirely depend on the outcome. Markets are anticipating a few rounds of the talks. Under such conditions, COT reports are taking the back seat. They are commonly of secondary importance for traders. I would strongly advise you to trade risky assets cautiously for the time being. It would be better to buy EUR at some signs of easing tensions among Russia, Ukraine, the US, and the EU. Any new sanctions towards Russia would entail grave economic consequences that will put a strain on financial markets and hurt not only the ruble but the single European currency. EUR could be bruised by the Kremlin's retaliatory measures that will be strongly disliked by the EU. So, it will be another headwind for EUR.

According to the COT report, long non-commercial positions slipped from 217,899 to 214,195 whereas short non-commercial positions fell from 170,318 to 155,889. It means that fewer traders are willing to sell EUR but the buyers are not getting more numerous. It seems traders prefer to sit back during the political turbulence. All in all, the overall non-commercial net positions grew to 59,306 last week against 47,581 a week ago. EUR/USD closed nearly flat last week at 1.1309 against 1.1305 on the previous week.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages. It indicates the ongoing bearish trend.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD grows, the indicator's middle line at 1.1141 will serve as resistance. Alternatively, if EUR weakens, the indicators' lower border at 1.1092 will serve as support. Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.