At the beginning of the trading week, the euro was trying to remain stable. However, yesterday, it started losing value. The slump was mainly caused by the energy market situation. The fact is that the Swiss-based company behind the Nord Stream 2 pipeline has filed for bankruptcy. In addition, more and more European and US companies are leaving Russia's oil and gas projects.

As a result, prices of both gas and oil skyrocketed. Against this background, many countries may face a grave energy deficit. Although the heating period in Europe is almost over, the local storage facilities are practically empty. In other words, Europe does not have any energy reserves to provide heating, support industry, and produce electricity. Since countries have just started imposing sanctions against each other, there is no doubt that the euro will continue falling, though at a slower pace.

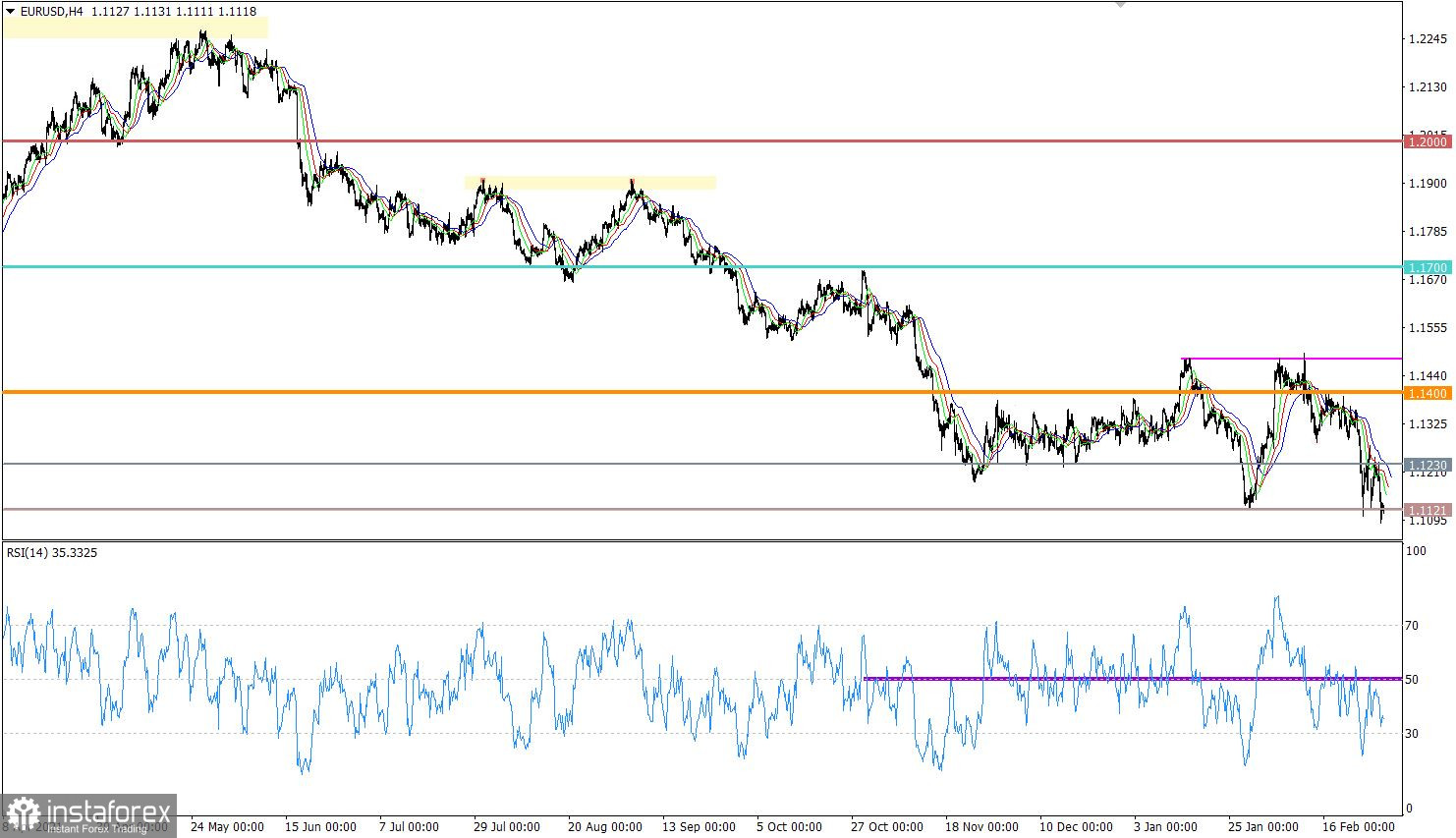

The euro/dollar pair once again hit a new local low of the downtrend. As a result, the pair settled below the control level of 1.1121 on the four-hour chart. This, in turn, proves that traders are highly interested in short positions.

Although the euro is dropping faster than earlier, the RSI technical indicator on the four-hour and daily charts does not provide signals about oversold conditions in the euro. The indicator is moving in the lower area of 30/50. This proves traders' interest in short positions.

Meanwhile, the Alligator's moving averages on the four-hour and daily charts point to a downtrend. Moving averages are not intersecting each other.

On the daily chart, we see that the mid-term downtrend became longer.

Outlook

Now, the US dollar positions are much more attractive than others. That is why the price fixation below 1.1121 is likely to lead to a slump to the psychological level of 1.1000.

In terms of the complex indicator analysis, we see that technical indicators are signaling short opportunities on the short-term, intraday, and mid-term periods amid a rapid downward movement.