The situation in markets is similar now to the coronavirus crisis in 2020. In that period, gold soared because of the panic caused by the virus outbreak. Now, gold prices are also rising amid the escalation of the Russia-Ukraine conflict.

This week, exchange-traded funds (ETFs) that invest in gold and other precious metals have experienced seen a big inflow as traders rush to hedge themselves against the rising geopolitical tensions between Russia and Ukraine. So, on Monday, when speculators factored in tough sanctions against Russia, gold ETFs reported the highest investment inflows in 3 weeks.

At the same time, SPDR Gold Shares, the largest physically-backed gold exchange-traded fund (ETF) in the world, logged the biggest inflow. It rose by 1.3% to 1,042.38 tones, the highest indicator since July 2021.

The inflow of funds into gold ETFs is a clear sign that many investors are trying to shield themselves from market volatility, seeking shelter in safe-haven assets, market strategist Nicky Shiels said.

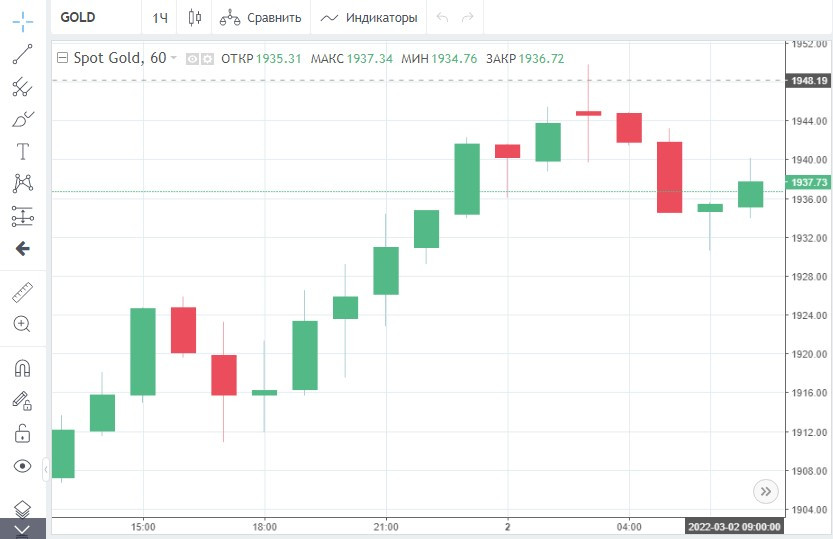

As of March 1, gold futures for April climbed by 2.3%, or $43.10 amid mounting demand. At the end of the day, gold was trading at $1,943.80, the highest since the beginning of 2021.

In late February, gold showed the biggest monthly increase since May last year. The quotes jumped by almost 6%, notching the best result for February since 2016.

In February, the escalation of the Russian-Ukrainian conflict became the main driver for gold. Currently, military operations in Eastern Europe still influence the gold market.

Yesterday, gold soared as Russian troops, faced with fierce resistance from Ukrainians, intensified bombing in an effort to take control of Kyiv.

Russian troops have been trying to enter the Ukrainian capital for the seventh day. As the number of attacks increases, Western countries have imposed tough sanctions in order to isolate Russia and thereby put pressure on the Russian President.

Now, analysts are warning about a sharp jump in prices for commodities with Russia being one of the main suppliers. Investors are also assessing how the bans on doing business with Moscow will affect Western companies and the global economy as a whole.

Investors are getting more worried as Western states introduce sanctions almost every day. Yesterday, Wall Street logged the steepest fall. In addition, the 10-year US government bond yields sharply decreased to 1.68%, whereas the day before it was 1.836%.

A drop in Treasures was also due to expectations of a less aggressive stance on monetary policy by the Fed. Now, when sanctions against Russia may also undermine the US economy, the probability of an increase in interest rates by 50 bps in March has dropped below 5%.

The likelihood of a slower rise in the interest rates is bullish for gold, especially in the current situation. Analysts expect that the escalation of geopolitical tensions will push inflation to a new all-time high. Gold is considered one of the best hedges against inflation.

Given a number of positive factors for gold, more and more analysts have recently been raising their forecasts for gold. For example, UK analysts at Capital Economics said that in the coming months, gold may show an explosive growth to $2,000.