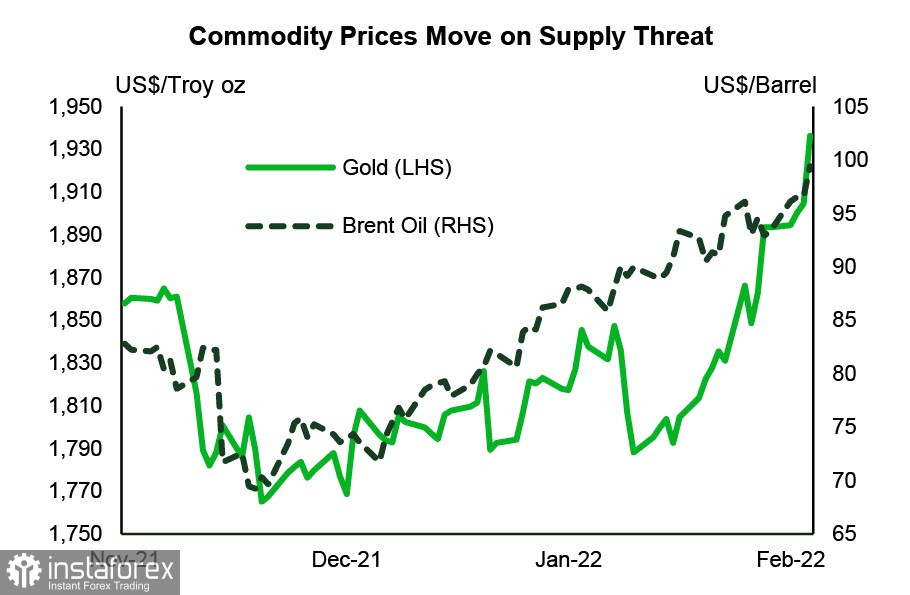

Markets are beginning to react to the conflict in Ukraine. May futures for Brent rose to $111/bbl, updating its 7-year record. Gas is also bullish even though it is lagging behind, while coal futures are up more than 50% in just a week. There is no doubt that if the current trend continues, the world will experience the worst energy crisis since 1979.

In terms of stocks, almost all world indices are trading in the red zone. The Euro Stoxx 50, for instance, lost more than 4% on Tuesday.

Yields also went down, which, among other things, means a revision of the plans of the central banks regarding stimulus programs and interest rates.

There is no clear catalyst for these sudden changes, so perhaps we are just seeing a delayed reaction of the markets. But there is no doubt that the sanctions imposed by the US and its allies will lead to a severe financial crisis that will affect all countries without exception.

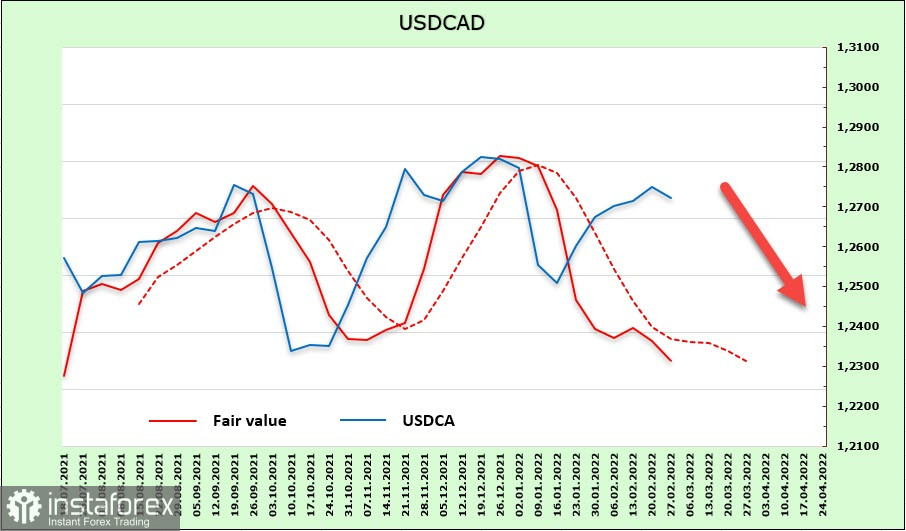

USD/CAD

Rising energy prices are by no means an absolute boon for Canada. On the one hand, higher prices are beneficial for manufacturers, but on the other hand, this growth hits consumers' wallets. Gas for example, has grown by 30% in six months, and this is not the limit.

Another risk that the Bank of Canada will consider is that Russia is the largest supplier of metals to world markets, in particular, nickel, lumber, agricultural products and potash fertilizers. If supplies are reduced, there will be a shortage that cannot be compensated, which, in turn, will cause serious damage to all dependent economies.

At the moment, it is assumed that the BoC will raise the rate by 0.25%. Geopolitical risks have undoubtedly grown, but the task of fighting inflation has not disappeared.

On a different note, the CFTC report for CAD is moderately negative. The weekly change is -232m, but the accumulated position is still bullish (+725m). The rise in oil prices gave an advantage to the Canadian stock market and demand for loonie, but the dynamics of yields is close to neutral and the settlement price is directed downwards.

The military actions in Ukraine contributed to the growth in demand for the dollar, which led to an attempt to get USD/CAD out of the converging triangle. The attempt was unsuccessful, so it is likely that the pair will dip lower. Perhaps it will go to 1.2550/70, and then consolidate below 1.2450.

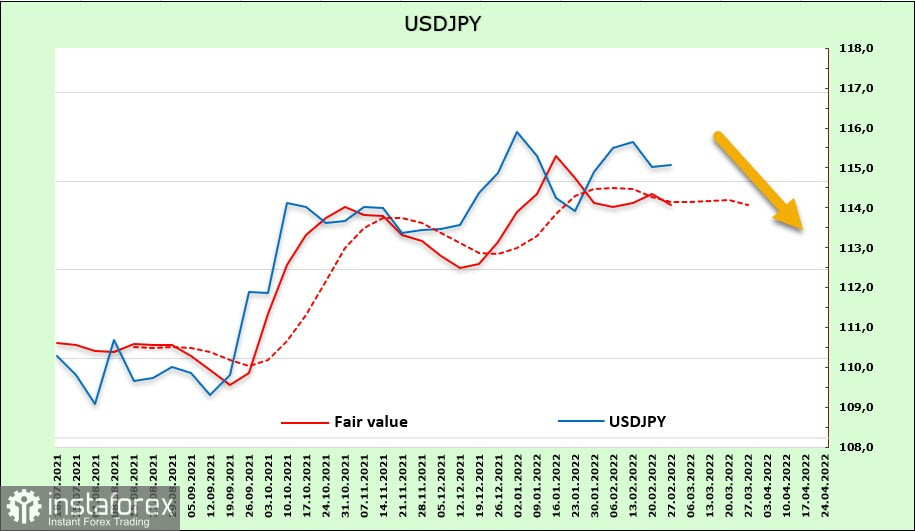

USD/JPY

Macroeconomic data from Japan is of no interest at the moment because a sharp rise in commodity and energy prices will have a much larger impact on the yen. Japan is a net importer of raw materials, so the pressure on the yen should increase.

The rise in prices is not a consequence of an increase in the demand for risk, but, on the contrary, is a response to increasing risks. This is why many expect the Bank of Japan to intervene at any moment to prevent the growth of volatility.

On a different note, the CFTC report for yen is weakly positive. The net short position is large (-6.86 billion), but its growth has stopped. Considering that risk appetite is decreasing sharply, it is likely that demand for yen will increase. The estimated price is near the long-term average, downward directeds.

A week earlier, it is expected that USD/JPY will grow, and there were objective prerequisites for it. But after February 25, the bullish factors lost their strength, and forecasts suggest that it will decline to 11350.