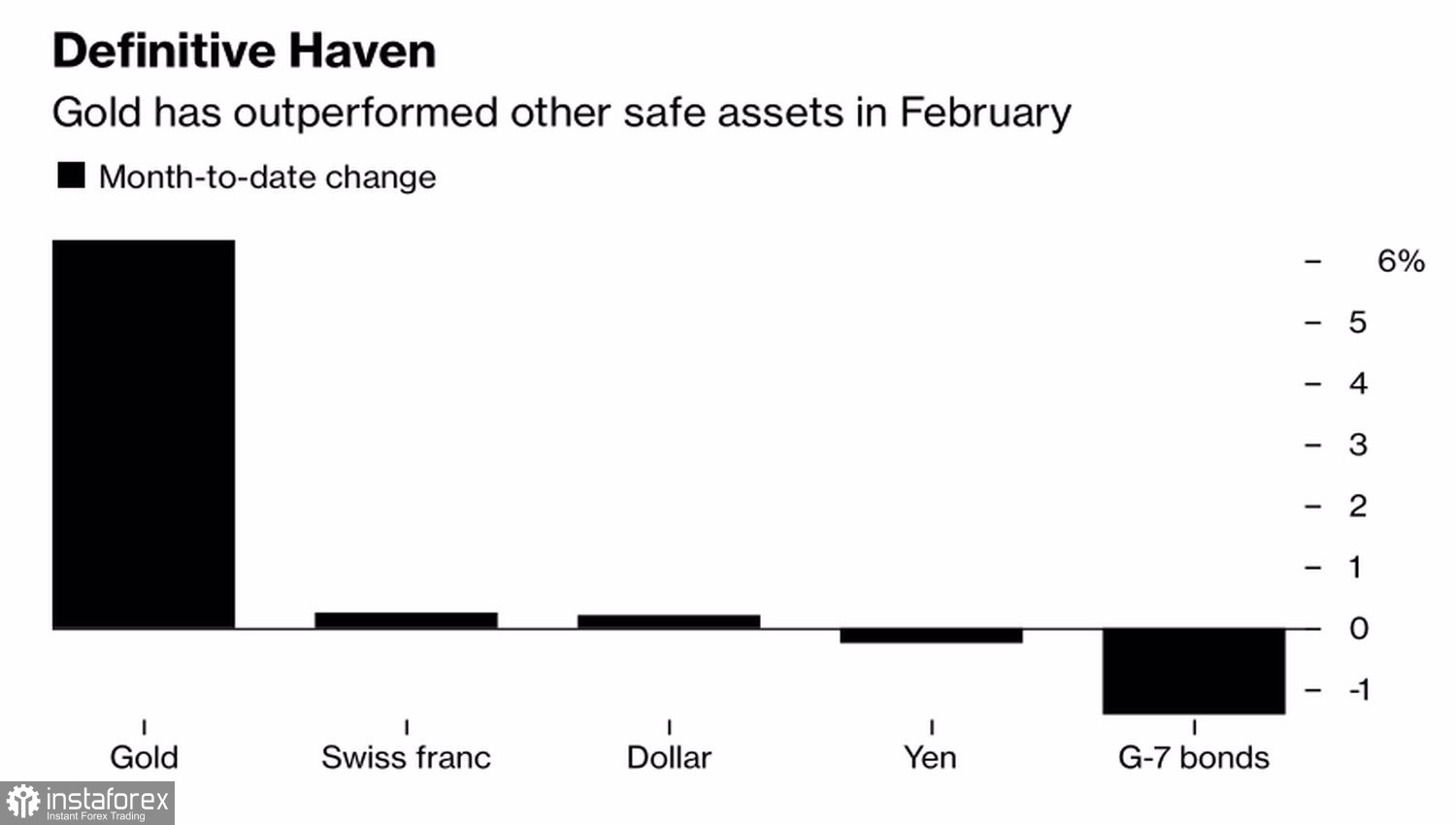

February was the best for gold since 2016. The precious metal managed to outshine other safe-haven assets in the form of the U.S. dollar, Japanese yen, Swiss franc, and U.S. Treasury bonds amid the war in Ukraine. Investors are seriously concerned that the sanctions imposed by the West against Russia will significantly slow down the growth of the global economy and lead some countries and regions into recession. And in such conditions, currencies lose to gold.

Dynamics of safe-haven assets

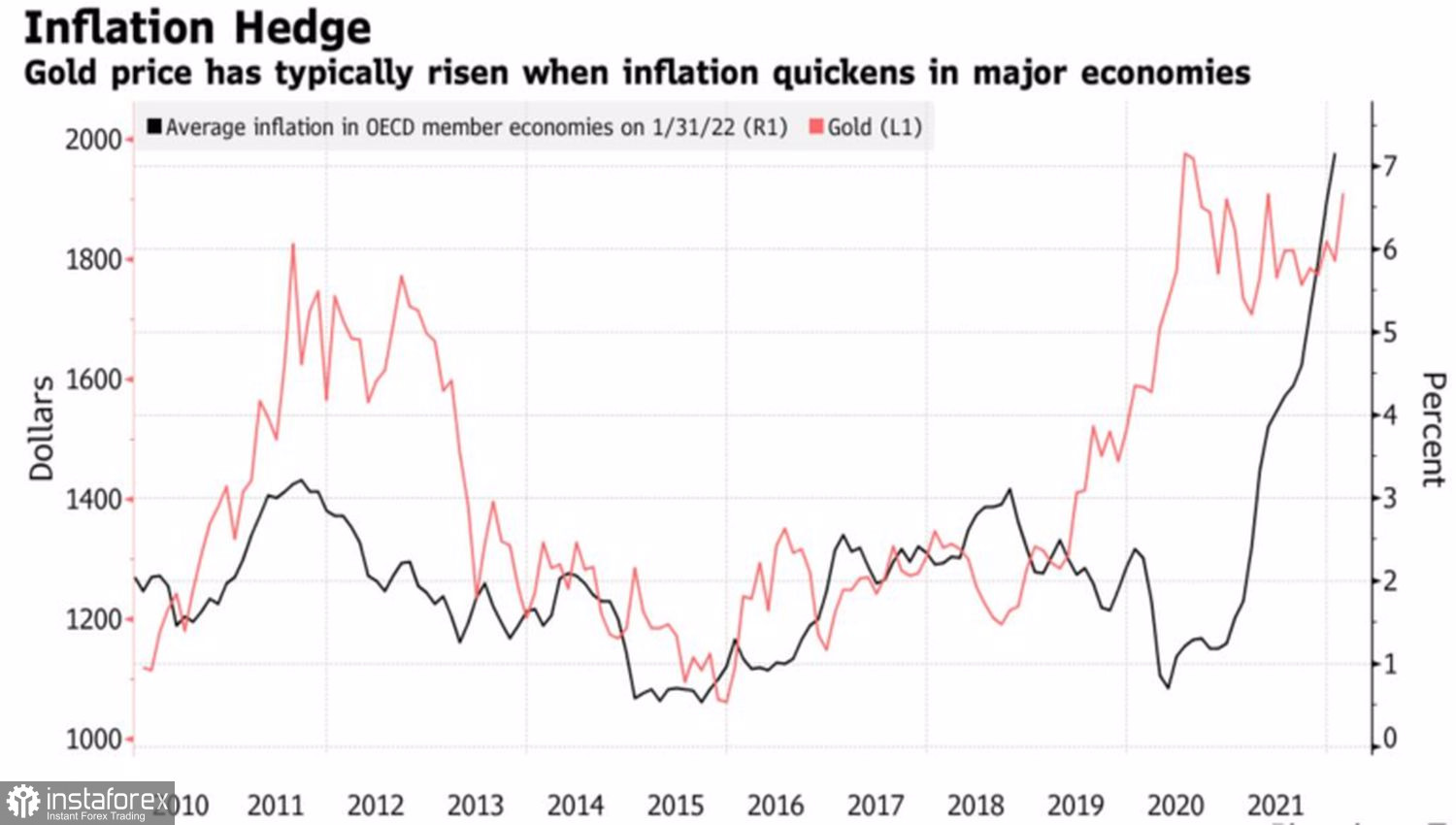

The Bloomberg Commodity Spot Index reached its highest level since 2009 due to fears that the military conflict in Eastern Europe is exacerbating problems with the supply of raw materials. Prices are rising, and inflation is likely to rise behind them. Good news for the precious metal, which is traditionally used as a hedge against inflationary risks. In conditions when central banks turn a blind eye to this, XAUUSD quotes, as a rule, go up. This was also the case in the summer of 2020, when gold reached an all-time high against the backdrop of the Fed's patience policy and the likelihood of inflation accelerating by leaps and bounds.

At the turn of winter and summer, a similar situation developed. The war in Ukraine is causing global inflation to accelerate, but central banks, led by the Fed, have little ability to influence the supply shock. Their aggressive monetary restriction could trigger a recession, so Jerome Powell and his colleagues should think twice before cutting.

Dynamics of gold and global inflation

The signs of a change in the worldview of central banks and financial markets are well felt. CME derivatives are no longer waiting for the federal funds rate to rise by 50 basis points in March. They predict not 6, but 5 acts of monetary restriction in 2022. The yield of U.S. Treasury bonds is falling in the face of increased demand for safe-haven assets, which leads to a decrease in real rates of the debt market, to which gold has historically shown increased sensitivity. As a rule, an increase in yields on U.S. debt obligations is a bad sign for the precious metal, which is unable to compete with income-generating assets. Conversely, its decline is a reason to buy XAUUSD.

Gold is supported by information on the growth of stocks of specialized exchange-traded funds for the second month in a row and on the resumption of its purchases by the Bank of Russia. Due to the Western sanctions imposed on it, the regulator is unable to support the ruble. The acquisition of the precious metal with its subsequent sale is a good opportunity to get the necessary liquidity for this. The Central Bank of the Russian Federation is the fifth-largest holder of gold, whose share in the structure of gold and foreign exchange reserves is about 20%.

In the short term, the fate of gold may be affected by Jerome Powell's speeches before Congress and the release of data on the labor market. Strong employment statistics and hawkish rhetoric of the Fed chairman is a reason for XAUUSD to pull back.

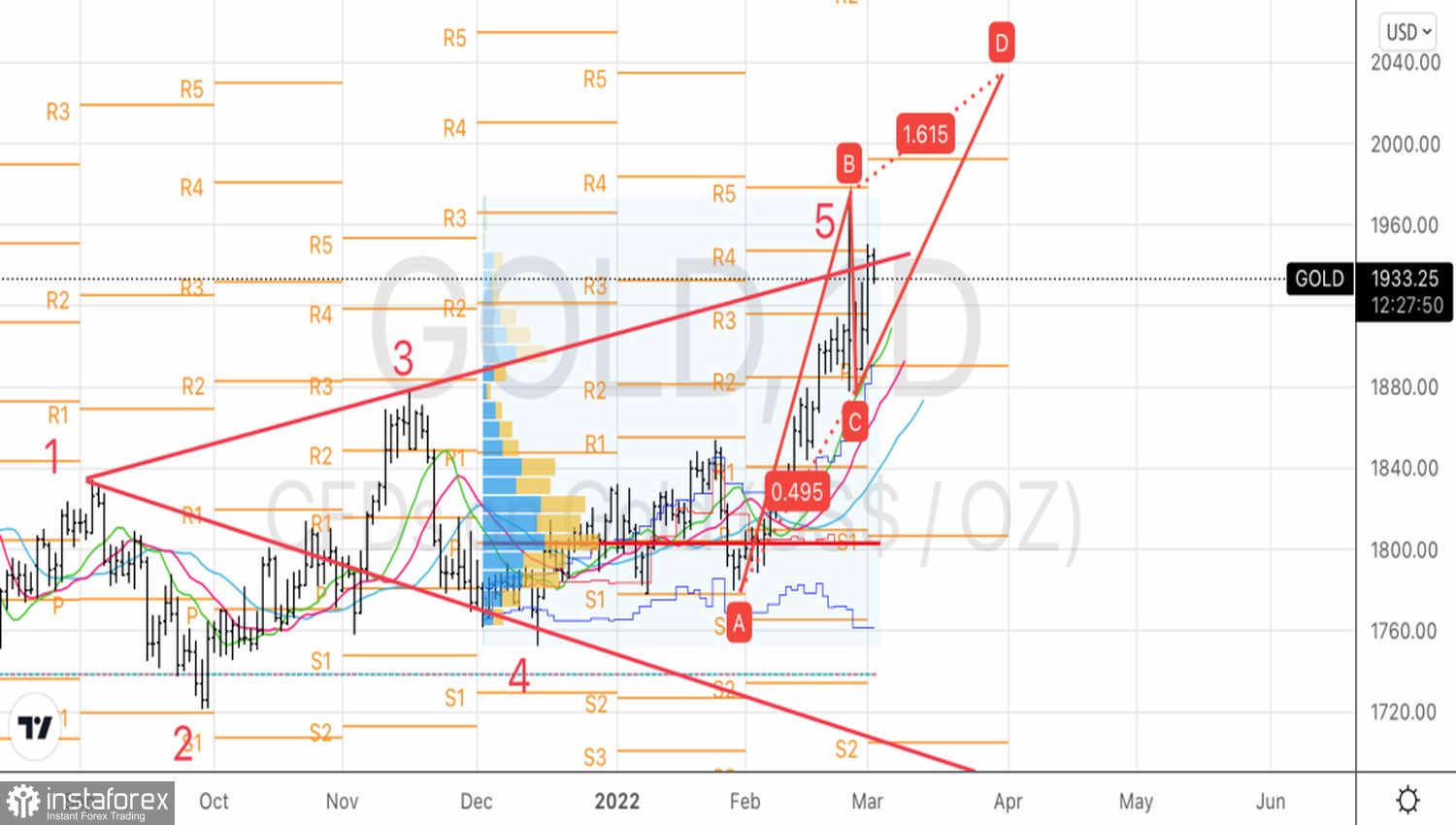

Technically, the rebound from the supports at $1930 and $1915 per ounce should be used to form longs in the direction of the target at 161.8% according to the AB=CD pattern. It is located near the $2020 mark.

Gold, Daily chart