Fed Chairman Jerome Powell backed a quarter-point rate hike this month to initiate policy tightening, but did not rule out a larger move at some point. Many bet that despite the conflict in Ukraine, the central bank will not slow down with a policy change as inflation is already out of control and energy prices continue to hit records.

"I am inclined to propose and support a 25 basis-point rate hike," Powell told the House Financial Services Committee on Wednesday. "To the extent that inflation comes in higher or is more persistently high than that, then we would be prepared to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings," he added.

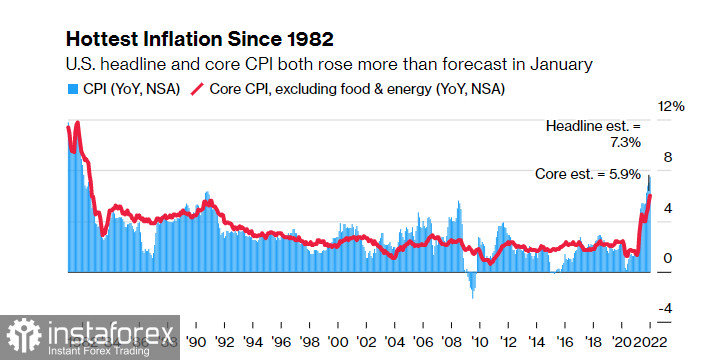

Fed officials are trying to cope with the fastest inflation in 40 years, and some of them have repeatedly stated the need to raise the rate by half a percentage point some time this year. Since the US will release the February data on consumer prices on March 10, it is likely that the Fed meeting on March 15 will be decisive.

In any case, while acknowledging the uncertainty caused by the attack on Ukraine, Powell noted that the need to support the economy in the wake of the coronavirus pandemic has not changed. "The bottom line is that we will proceed but we will proceed carefully as we learn more about the implications of the Ukraine war for the economy," he said.

Powell also mentioned that the labor market is "extremely tight", which is a signal to Congress that the central bank has reached its goal. "We know that the best thing we can do to support a strong labor market is to encourage its continued expansion,"he said. "This is possible only in conditions of price stability."

In terms of interest rates, Powell said it is not clear how high they should be in order to bring inflation under control. He said the Fed needs to be careful so as to not disturb the so-called "neutral" level, which does not accelerate or slow down economic activity. "We talk about getting to neutral, which is a neutral rate which would be somewhere between 2% and 2.5%. It may well be that we need to go higher than that. We just don't know," he said

Technical analysis EUR/USD

Bulls successfully defended 1.1108, returning demand for risky assets. But the tension in Ukraine limits the upside potential of EUR/USD, so do not expect a strong upward movement. Buyers need a consolidation above 1.1180 to see a jump to 1.1230 and 1.1310. A dip to 1.1100, on the other hand, will push the pair to 1.1060.

Technical analysis GBP/USD

A lot depends on 1.3400 because a breakdown will provoke a further rise to 1.3440 and 1.3510. However, upside potential is limited by the conflict in Ukraine, so do not expect very strong upward movements. A fall to 1.3310, on the other hand, risks a decline to 1.3270 and 1.3230.