Gold market is in turmoil. On the one hand, macroeconomic data is pushing the prices lower. On the other hand, the current geopolitical situation is boosting the metal price.

On Wednesday, gold prices were under significant pressure. Jerome Powell said that he would support the key interest rate hike of 25 basis points in March.

The Fed chair also pinpointed that the regulator may raise the benchmark rate faster than expected. Sanctions imposed by western countries against Russia will hardly affect the US economy. Nevertheless, the country may face the side effect that should be taken into account.

First of all, energy prices are expected to surge. This fact may accelerate the inflation growth. To cap inflation, the Fed will have to take more aggressive measures.

The hawkish comments made by the Fed's chair boosted the yield of the US bonds. The US stock market also showed a rise. In addition, demand for risky assets mounted despite the ongoing conflict in Ukraine.

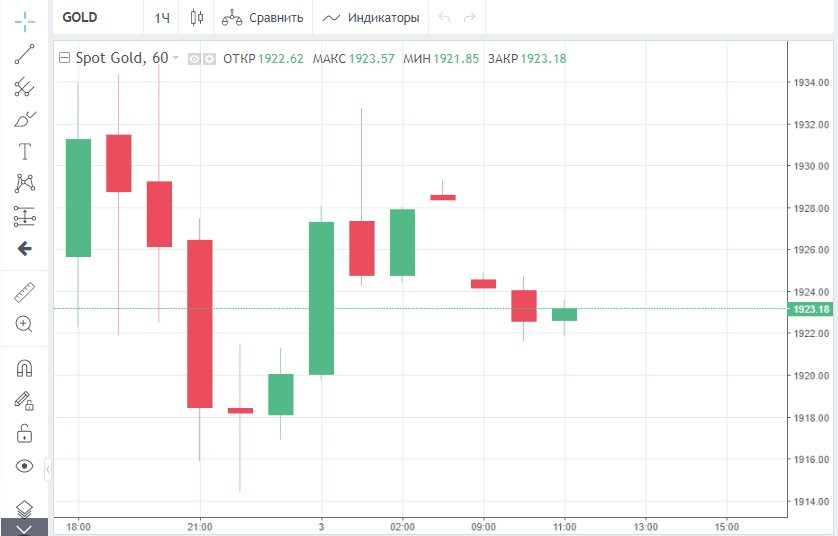

During Jerome Powell's speech, gold prices slumped by $30. Later, the metal recouped some of its losses, but closed the trading session with a drop.

On March 2, gold decreased by 1.1% or $21.50 to $1,922.30. Thus, gold slid from its 13-months high recorded during the previous trading session. Notably, on Tuesday, the asset appreciated by 2.3%.

Analysts emphasize that the Russia-Ukraine conflict is the main price-forming factor at the moment. The escalation caused a 6% jump.

That is why a tumble in gold prices amid Jerome Powell's comments is just a short-lived phenomenon. Once investors think over the information, they are likely to switch to the situation in Ukraine.

Meanwhile, today, Russia and Ukraine are planning to hold the second round of the negotiations. Expecting the meeting, which will hardly bear fruits, gold increased. Thus, at the moment of writing the article, gold futures rose by 0.4%.

The price is also supported by the news about a new package of sanctions approved by the US. The document prohibits the export of certain refining technologies, which will make it difficult to modernize Russian refineries.

At present, markets are not only assessing the influence of sanctions on the global economy. They are also preoccupied with the migrant crisis in Europe. According to the preliminary estimates, about 870 thousand people have already left Ukraine.

How the situation may develop?

Recently, Pierre Lassonde, a famous Canadian businessman, has shared his view on the geopolitical situation. He supposes that the conflict will hardly be settled soon. He expects that the tension will last much longer than planned.

He also warned that the longer the conflict would be, the more painful consequences the global economy might face. Thus, energy prices are likely to surge. If the conflict continues for the next several weeks, oil prices may approach $200.

The rally in oil prices will surely cause a boom in the whole commodity market. Pierre Lassonde foresees that gold prices will hit a new all-time high in the mid term. The metal will trade between $2,200 and $2,400.

The investor has also provided an optimistic forecast for gold in the long term. In the next five years, the metal may cost $10,000 if the correlation between the Dow Jones index, which lost 30%, and gold totals 2:1.