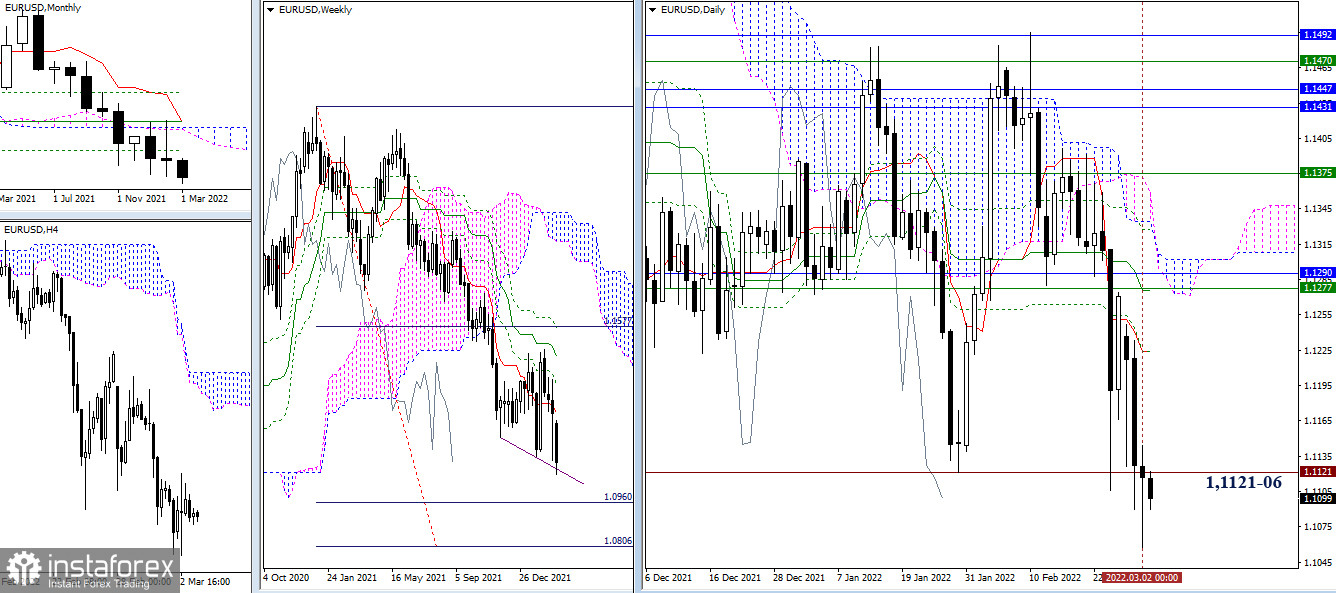

EUR/USD

There were no significant changes over the past day. The pair remains in the zone of attraction of the previous extreme (1.1121) and the low of last week (1.1106). Overcoming this zone will allow the bears to continue their decline to their nearest reference point in this area - the target for the breakdown of the weekly Ichimoku cloud (1.0960 - 1.0806). A reliable consolidation above 1.1106-21 will create conditions for the restoration of bullish positions. In this case, 1.1224 (daily levels) and 1.1276-90 (daily medium-term trend + weekly short-term trend + monthly Fibo Kijun) will serve as benchmarks for bulls.

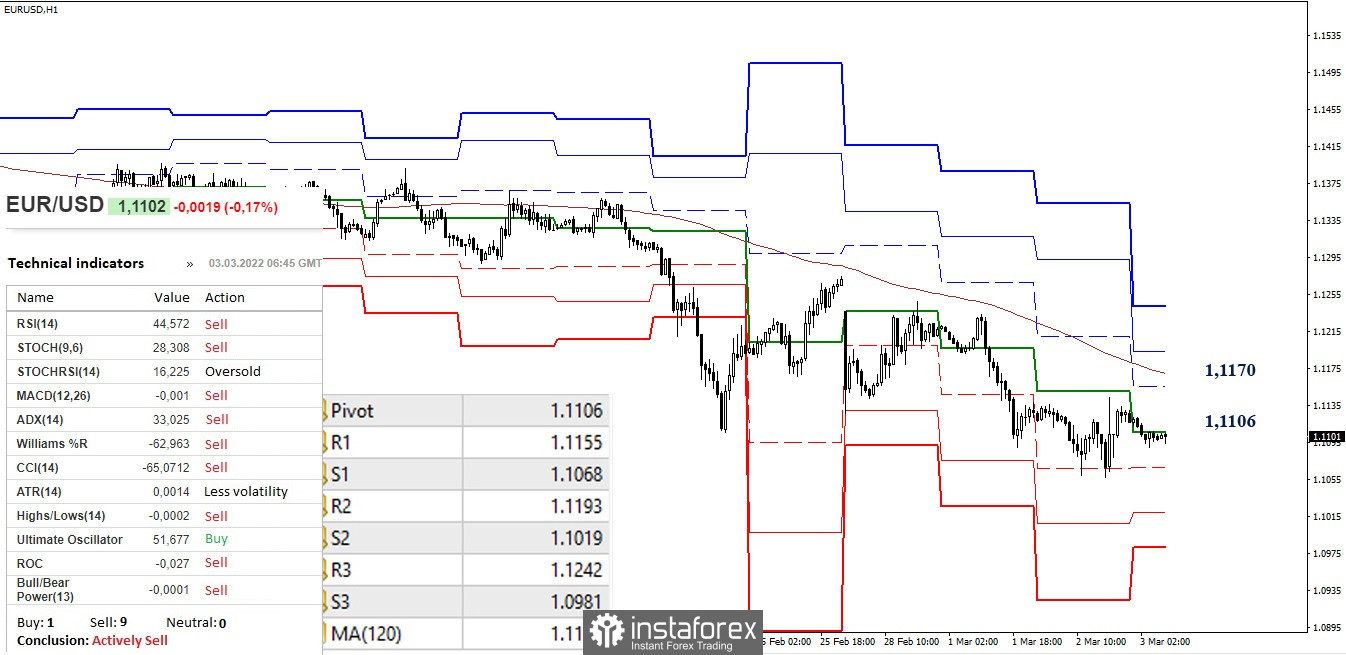

Since yesterday evening, the pair has been in the correction zone on the lower timeframes. At the moment, work is underway in the area of influence of the central pivot point of the day (1,1106). Consolidation higher will give preference to the development of an upward correction. The key benchmark on this path is the resistance of the weekly long-term trend (1.1170). A breakdown and reversal of the moving average can change the current balance of power in favor of further strengthening bullish sentiment. When leaving the correction zone (1.1057), the decline will continue, and the support of the classic pivot points of 1.1019 (S2) and 1.0981 (S3) will act as benchmarks within the day.

***

GBP/USD

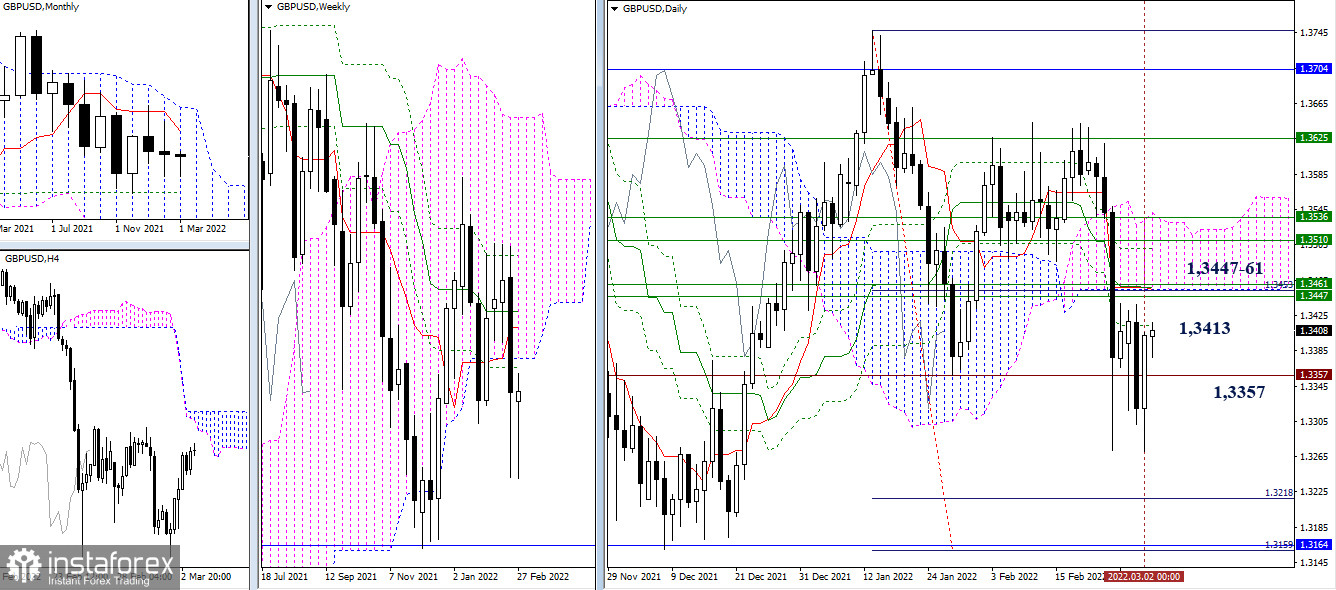

Yesterday, bears failed to consolidate under 1.3357, they again returned to the resistance of 1.3413 (daily Fibo Kijun), thus once again casting doubt on the implementation of the bearish scenario. In the event of a rise in the current situation, the accumulation of levels of higher timeframes in the area of 1.3447-61 and 1.3510-36 will be important.

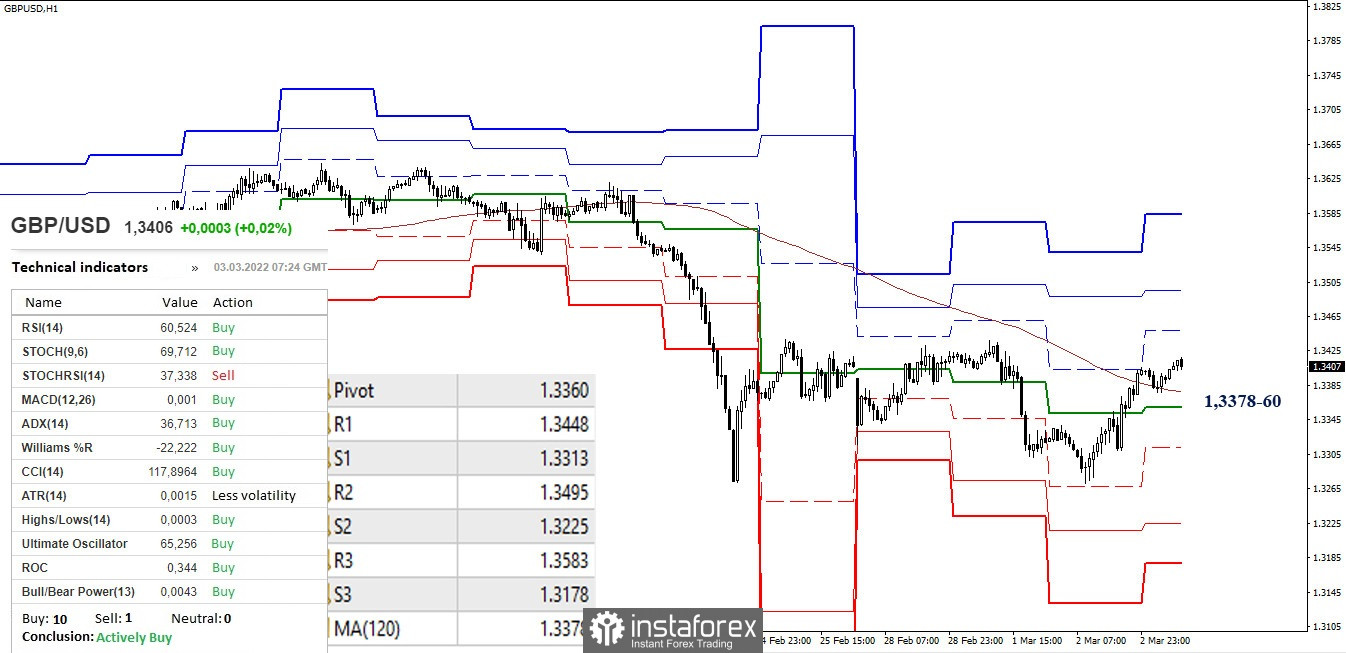

On the lower timeframes, bulls have now seized the advantage and support of all analyzed technical instruments. The pair has consolidated above the key levels, which today form the nearest support at 1.3378-60 (central pivot point + weekly long-term trend). Further, the reference points for the continuation of the rise within the day are the resistance of the classic pivot points (1.3448 - 1.3595 - 1.3583). With the loss of the main supports (1.3378-60), the support of the classic pivot points (1.3313 – 1.3225 – 1.3178) can start working on the lower timeframes today.

***

Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as Classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.