On Tuesday, world markets advanced after Jerome Powell, chairman of the Federal Reserve, assessed the US economy and the labor market positively in the US Congress. The announced interest rate increase, which is set to occur in two weeks at the March meeting of the FOMC, did not influence traders. No comments were given about whether the Fed would hike the rate throughout the rest of the year or not.

Despite uncertainty caused by high geopolitical tensions, the imminent rate hike, and high energy prices, the stock market went up. What pushed it into an uptrend?

Severe tensions in developed regions are forcing investors, both in the US and other countries, to seek safer markets. This situation benefits the United States. The US will attract foreign capital inflow and will use them to resolve their economic issues. It happened during WW1 and WW2, and the US is likely to pull it off in 2022 as well.

As instability rocks Europe and the Asia-Pacific region, market players would be forced to move their investments to the US. Some investors would shift to Canada as well. This situation would boost demand for US stocks. Furthermore, geopolitical tensions would increase demand for US Treasury bonds. The Fed's interest rate increase would not be critical for investors fleeing from geopolitical risks.

Under these circumstances, the US dollar would remain strong. Rising demand for USD assets would give support to the American currency.

Today, market players will pay close attention to the ECB meeting minutes. Investors are trying to determine the European regulator's future policy amid the ongoing war in Ukraine and soaring inflation in Eurozone countries. Obviously, the meeting occurred before the invasion, but rising prices could lead to ECB reexamining its interest rate policy. A hawkish signal from the European central bank could give some support to EUR.

Overall, high volatility in the stock market and continuing demand for US Treasury bonds could give USD support in the longer term.

Today's outlook:

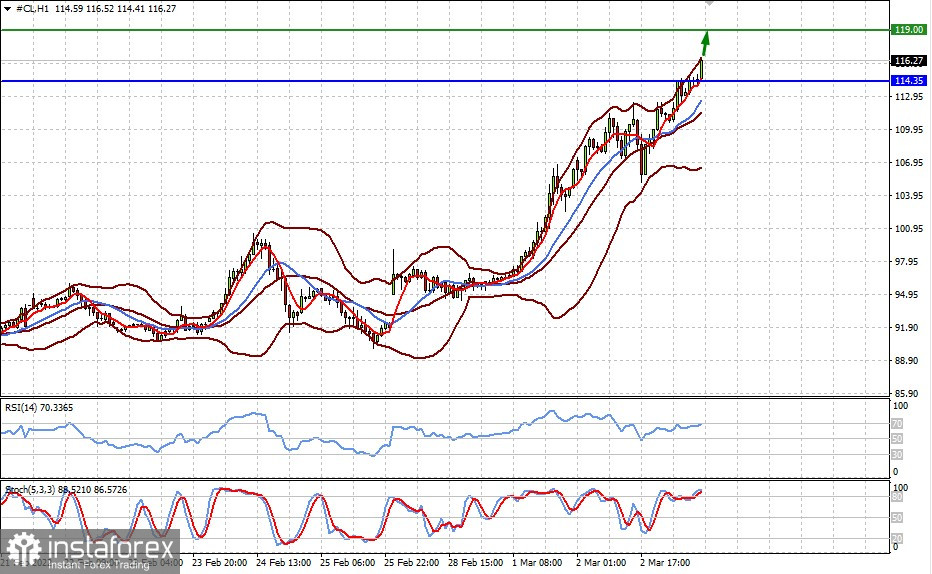

West Texas Intermediate is continuing its rally, propelled upwards by geopolitical tensions between Russia and the West. If tensions persist, WTI could reach $117.75 per barrel, which would open the way towards $135.00 per barrel.

USD/CAD fell below 1.2625 after the Canadian central bank increased interest rates yesterday. Rising oil prices also weighed down on the pair. If USD/CAD remains below this level, it could fall towards 1.2560.