Hi, dear traders!

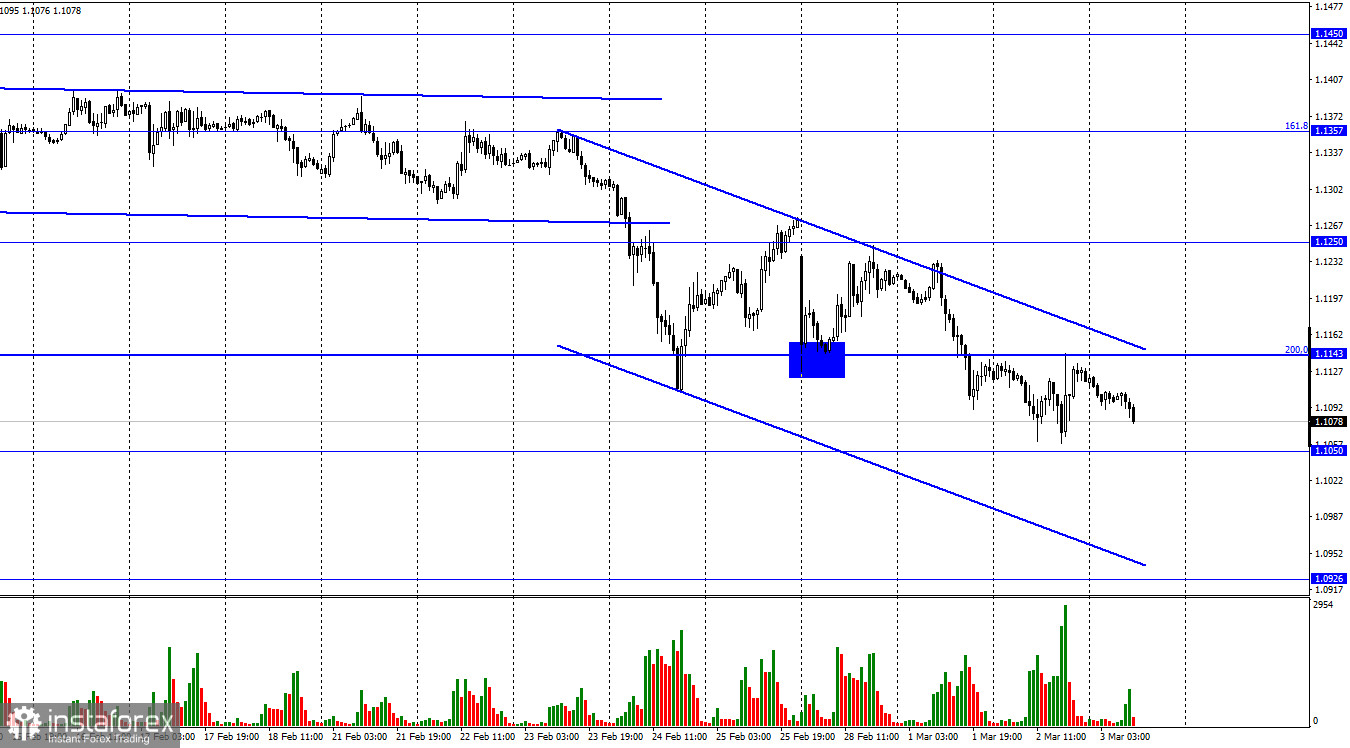

On Wednesday, EUR/USD tried to reverse upwards twice. However, the descending channel indicates that traders remain bearish. The quote has failed to even close above the retracement level 200,0% (1.1143). The pair bounced off this level downwards and is now falling towards 1.1050. EUR/USD is likely to test this level today. However, the pair could close below 1.1050 – it could fall towards 1.0926 afterwards. The market's reaction to the latest news remains mixed. Yesterday, EU CPI data was released – inflation in the Eurozone rose to 5.8% year-over-year. In the US, the latest ADP payroll data exceeded expectations. However, traders ignored both data releases. Yesterday, Fed chairman Jerome Powell made statements in the US Congress – he once again took a "neutral" position.

Although traders remain highly concerned by the current level of inflation in the US, Powell said he would recommend raising the interest rate by only 0.25%. Furthermore, Powell stated the regulator would be ready to enact more hawkish monetary policies if inflation continued to rise. It is unclear what would be the trigger for such a policy shift. The US CPI is already approaching 8% - the highest level in 40 years. Geopolitical tensions, as well as rising oil and gas prices, would push inflation up even further. Traders expected the Fed to raise interest rates by 0.5%, but Powell does not think it is necessary. As a result, USD went down yesterday. However, geopolitical factors reversed the US dollar upwards – the Fed chairman's rhetoric only briefly halted the uptrend.

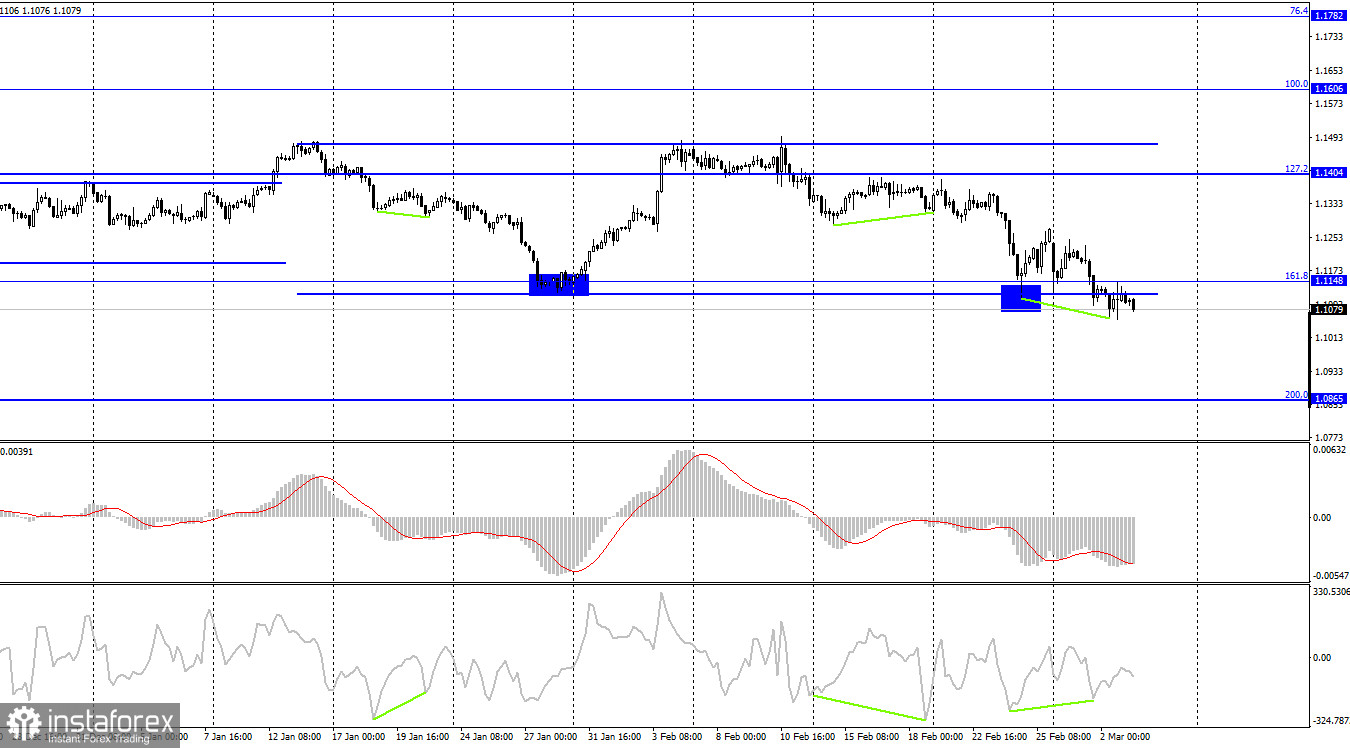

According to the H4 chart, the pair settled below the sideways channel. It could fall towards the next retracement level of 200.0% (1.0865). Yesterday's bullish divergence only managed to stop the pair's plunge for a few hours. It is uncertain what would make EUR/USD rally.

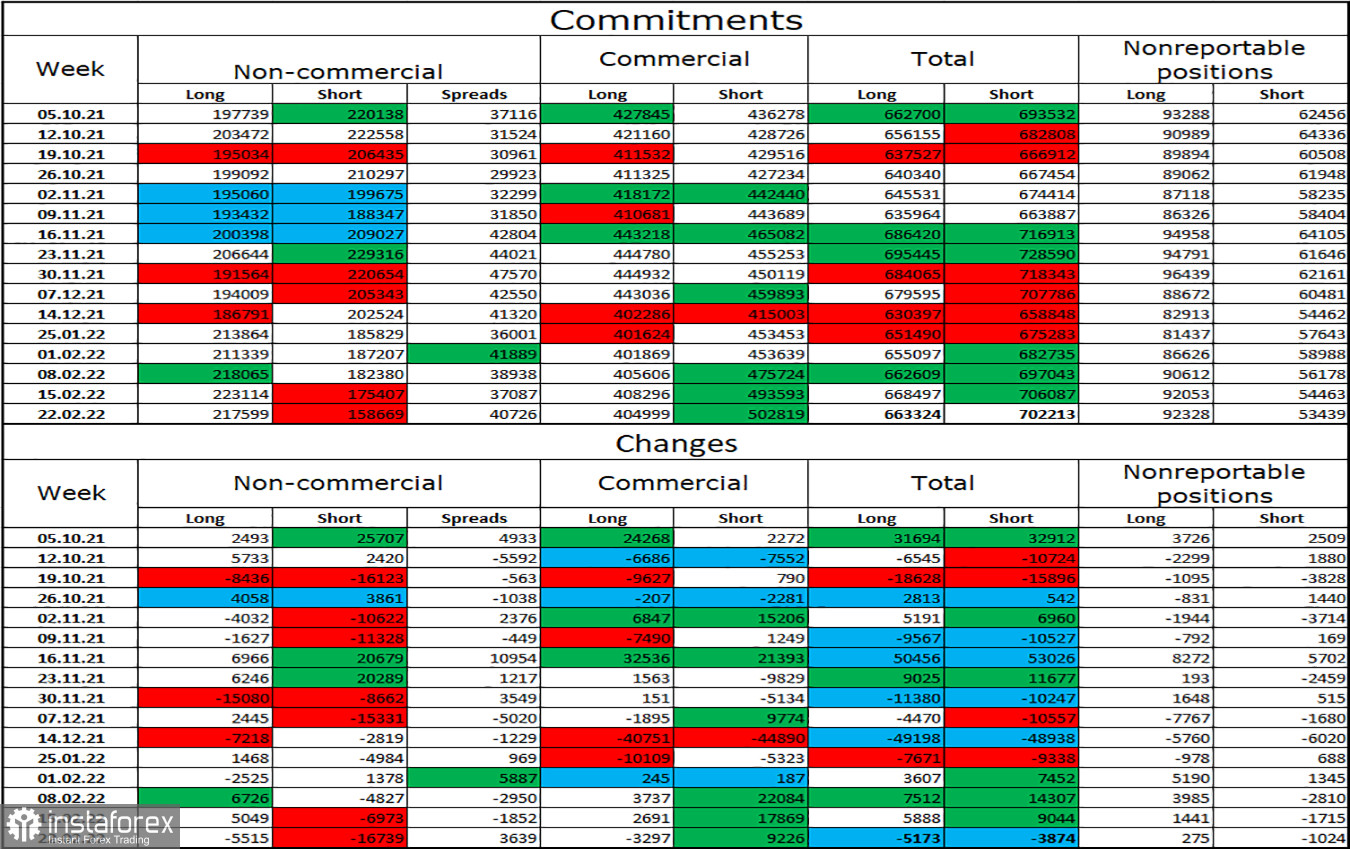

Commitments of Traders (COT) report:

During the week covered by the report, traders closed 5,515 Long positions and 16,739 Short positions, indicating an increasingly bullish sentiment among traders. The total number of open Long positions is now 217,000. 158,000 Short positions are currently opened. Overall, the mood of Non-commercial traders is bullish. The euro could go up, but the ongoing events favor the US dollar. At this point, COT reports could be ignored – the sentiment of market players can change very quickly due to the tense international situation.

US and EU economic calendar:

EU – services PMI (09-00 UTC).

EU – unemployment data (10-00 UTC).

EU – ECB meeting minutes (12-30 UTC).

US – Initial and continuing jobless claims data (13-30 UTC).

US – ISM services PMI (15-00 UTC).

US – speech by Jerome Powell, chairman of the Federal Reserve (15-00 UTC)

Today's economic calendar is full of events. Jerome Powell's speech is the most important event of the day. The data releases are unlikely to influence traders significantly.

Outlook for EUR/USD:

Earlier, traders were recommended to open new short positions if the pair closes below the sideways channel on the H4 chart, with 1.0926 and 1.0850 being targets. These positions can be kept open. New long positions could be opened if EUR/USD close above the descending price channel on the H1 chart, with 1.1250 being the target.