The GBP/USD currency pair retraced yesterday towards the moving average line. Overall, as has been the case for the last 14 months, the pound sterling is showing more resistance in the pairing with the dollar. This means that it falls less willingly and rises more willingly. Now, with the European currency losing ground almost every day, the pound was limited to just one serious collapse and then traded in a range between the 2/8 and 4/8 Murray levels. However, the trend now is still downwards. The pound can't ignore geopolitics either. It remains a riskier currency compared to the dollar and therefore could continue to fall against the US currency. As with the euro, much now depends on geopolitics. Unfortunately, there is no positive news from Ukraine and Russia. There is a full-scale war going on in Ukraine, and negotiations between the Ukrainian and Russian delegations are not yielding any positive results. There can only be one positive outcome right now: a ceasefire and further negotiations on a ceasefire.

Unfortunately, the positions of the parties to the conflict remain directly opposite. It is unclear how Moscow and Kiev are going to come to a common solution to the problem. In the opinion of the overwhelming majority of neutral political analysts, there will be no progress in the negotiations at all. Thus, they are now more the creation of the illusion that the sides are trying to reach an agreement. Moreover, the longer the conflict drags on, the more the Russian economy suffers. The sanctions that have been approved by the European Union, the US and some other countries have either started or will start soon. Therefore, we cannot say that the worst for the Russian economy is over either. On the contrary, many sanctions have a long-lasting effect. That is, their effects will only start to manifest themselves after a few months, but will be visible over a very long period of time. So far, therefore, no one is benefiting from this war, and the markets may be in a panic, or at least very nervous, for a long time to come.

Britain is one of Russia's fiercest opponents these days. We have already said that it was Boris Johnson, delighted that all the media attention has shifted from his figure and "coronavirus parties" to Ukraine, who was one of the first in the world to talk about cutting off Russian banks from SWIFT, freezing Russian Central Bank assets, freezing assets of Russian oligarchs and businessmen in Britain, closing airspace to aircraft from Russia, denying Russian ships access to British ports, refusing all Europe from using Russian gas and oil. According to the latest information, this policy has already begun to bear fruit. For example, Roman Abramovich has announced that he is selling the Chelsea football club and will send all the money from its sale to the victims of the war in Ukraine.

As for the macroeconomic side, the only thing that matters in the UK now is the upcoming central bank meeting, which is due to take place this month. As we said before, all macroeconomic statistics are now simply ignored and the dollar as a whole continues to appreciate. If the Bank of England raises the interest rate again, it could provide strong support for the British currency. However, the Bank of England meeting is just one event in the month of March. After all, as we said before, any sanctions and restrictions are not a one-way road. The cut in economic ties means that there will be negative consequences for the UK economy as well. If it starts to slow down, will the Bank of England be able to turn its plans to bring the rate up to 1% into practice? That is now the big question. Many political scientists and economists even believe that the world is on the brink of a new economic crisis.

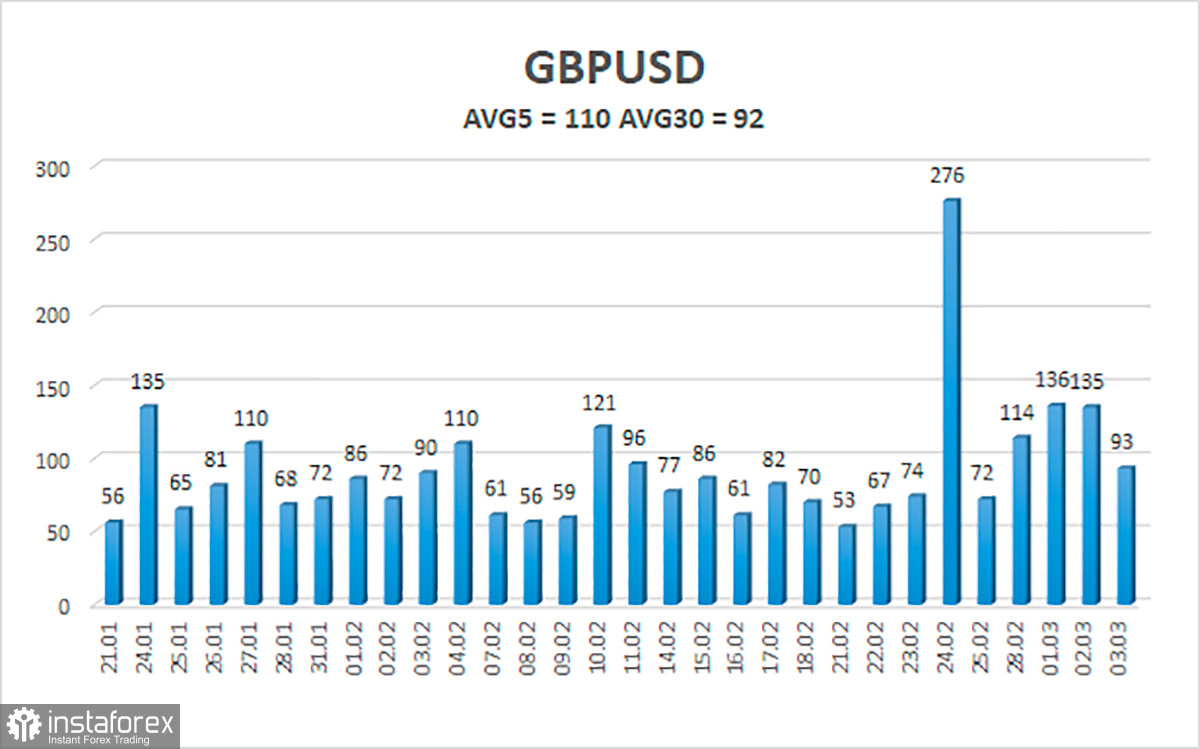

The average volatility of GBP/USD is currently 110 pips per day. This value is high for the GBP/USD pair. Therefore, on March 4, we expect a move inside the channel bounded by 1.3221 and 1.3441 levels. A reversal of the Haiken Ashi indicator upwards would signal a new round of a retracement move.

Nearest support levels:

S1 - 1,3306

S2 - 1,3245

S3 - 1,3184

Nearest levels of resistance:

R1 - 1,3367

R2 - 1,3428

R3 - 1,3489

Trading tips:

GBP/USD on the 4-hour timeframe has corrected to the moving and has resumed downward trend. Thus, at this time, short positions should be opened with the targets 1.3245 and 1.3221 until the Heiken Ashi indicator turns up. It will be possible to consider long positions not earlier than the price fixation above the moving target at 1.3441 and 1.3489.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.