Today's review of the main currency pair of the Forex market will begin with the fact that the forecast made the day before and for the most part bullish, was not justified. It seems that now the market wants to sneeze at various kinds of reversal signals that will prevent purchases of the US dollar. The dollar is very much in the price of investors now. Let me remind you that the economy of the United States significantly exceeds the European one in terms of its degree of development, primarily related to the economic recovery from the COVID-19 pandemic. Given this factor, the monetary position of the US Federal Reserve System (FRS) differs significantly from the similar position of officials from the ECB in the direction of its much tougher bias. The full-scale war that began in Ukraine discourages the risk appetite of market participants and forces them to withdraw into protective assets, one of which is the US dollar.

As for the key interest rate, the first increase, and probably by 50 basis points at once, may take place already following the results of the Fed meeting, which will be held this month. So, anyway, all the trumps are up the sleeve of the US dollar. In addition, do not forget that the US dollar is still the main reserve currency of the world, and this factor in the current conditions also fuels the appetite for purchases of the "American". However, today is the first Friday of the new month, when data on the US labor market are traditionally published. These reports, which are important for traders, can further strengthen the position of the US dollar or, in case of weak data, send the US currency to adjust against all its main competitors. As they say: we'll wait and see. The US labor reports are scheduled for 13:30 London time, and we will analyze the labor market data in more detail, according to actual figures, on Monday. In the meantime, let's turn to the price charts of the EUR/USD currency pair.

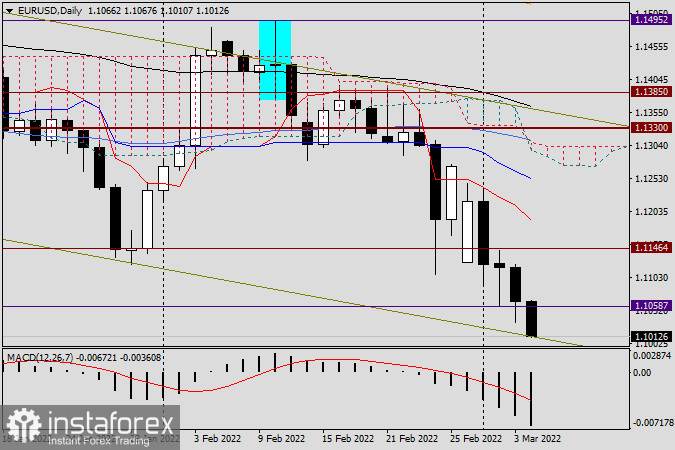

Daily

So, yesterday the market ignored the reversal candle for February 2 in its form and essence, and the trading ended under the dictation of the bears for the euro/dollar. Moreover, today, at the moment of completion of this article, the EUR/USD pair demonstrates a rather weak downward trend, trading already near 1.1018. If the nonfarm turns out to be strong, there is no doubt that the pair will fall below the 1.1000 mark and finish trading under this landmark psychological, historical, and technical level. Otherwise, we will see an increase in the quote, approximately in the price area of 1.1080-1.1100. As for trading ideas, I will immediately note that on such far from simple days as today, it is best for novice traders to remain sitting "on the fence", that is, to be outside the market. I recommend the rest to wait for the actual figures and only then enter (or not enter) the market.

H1

In my personal opinion, and purely by technique, sales look very reasonable and tempting after short-term rises in the price zone of 1.1075-1.1110. Well, how it will be, will become clear after the release of labor reports from the United States. We will meet on Monday, analyze non-farms and try to build the next trading plans.