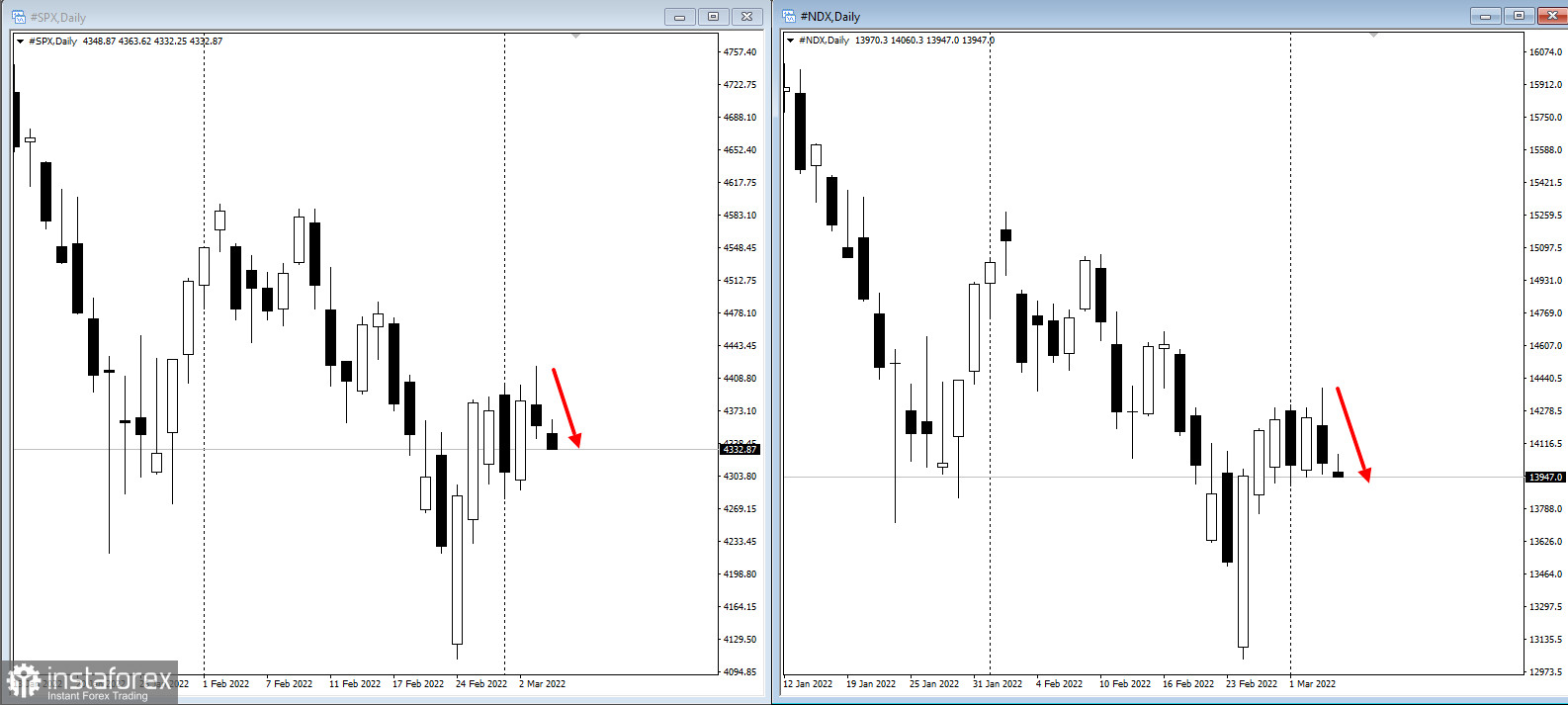

Tech stocks tumbled ahead of Friday's jobs report as traders weighed in on the economic impact of the war in Ukraine. The rally in oil also stalled, experiencing extraordinary volatility.

For much of the trading session, stocks struggled to find direction, with the S&P 500 slipping to the close amid sell-offs in megacaps like Tesla and Amazon. WTI also pulled back in price after topping $116. Industrial metals, on the other hand, extended their surge, with zinc hitting a high since 2007 and aluminum jumping to a new record.

Traders are awaiting the Department of Labor's employment report, which is currently forecast to show that the US added 423,000 jobs in February. This is one of the data closely monitored by the Fed as high labor costs are another thing the central bank must contend with. Fed Chairman Jerome Powell also noted that rising energy prices are likely to lead to higher inflation.

In terms of bonds, yields in the US rose over the past week, beating an investment class that is far more susceptible to rate hikes. Strategists expect debt to continue rising even if higher-rated bonds sell off.