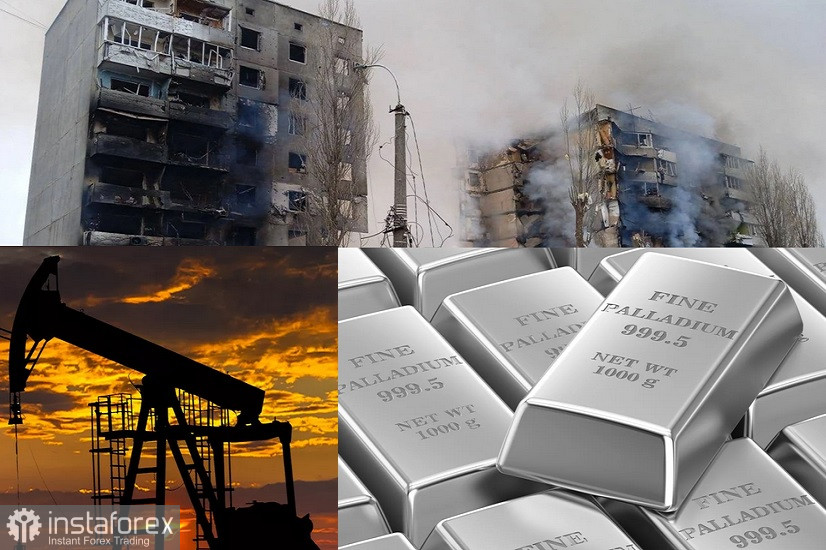

The Russia-Ukraine war has repeatedly wreaked havoc in Ukraine. Vladimir Putin's actions were strongly criticized by many countries throughout the world. They made attempts to stop further Ukraine's invasion, imposing economic sanctions on Russia.

The consequences of this war have deeply affected the world's financial markets. Inflation has surged globally, amounting to 7.5% in the United States.

The two major commodities exposed mostly to additional inflationary pressures are energy and agricultural products. This fact adds fuel to the fire. Besides, the situation has been getting out of control. Crude oil prices hit their all-time highs. However, Ukraine's geopolitical crisis was the reason why oil prices have surged even higher.

Crude oil hit its record high in April 2008. It cost $147 a barrel then.

That price was temporary. Moreover, the following month crude oil prices dropped to $100 a barrel. Later, they declined to $43 a barrel in October 2008.

That price was temporary. Moreover, the following month crude oil prices dropped to $100 a barrel. Later, they declined to $43 a barrel in October 2008.

Agricultural commodities were also a major factor in inflation's rapid rise before the war. However, crude oil's exponential growth created more inflationary pressures. Besides, Ukraine accounted for EU supply of agricultural products. These products became even more expensive due to the Russia-Ukraine war.

The global stock market has also suffered considerably. Apart from defense companies, major US corporations experienced significant declines in the value of their companies. Therefore, Russia's invasion of Ukraine has caused turmoil in financial markets, as well as more devastating and far-reaching consequences.

Precious metals and the US dollar became safe haven assets. Previously, precious metals rose as inflationary pressure did not hit such an unprecedented level since 1982. The military actions in Ukraine have increased market sentiment as investors make attempts to move their capital into a safe haven asset.

The upward trend continues in the precious metal segment. Palladium has made the biggest gains. As Russia accounts for 40% of its world's production, palladium is reaching its all-time high of $3,000.

It is possible to illustrate the rate of growth in palladium prices. Let's assume that palladium was trading at $1,531 on December 21, 2021. Today, palladium futures rose by $112 or 4.21%.