Hi, dear traders!

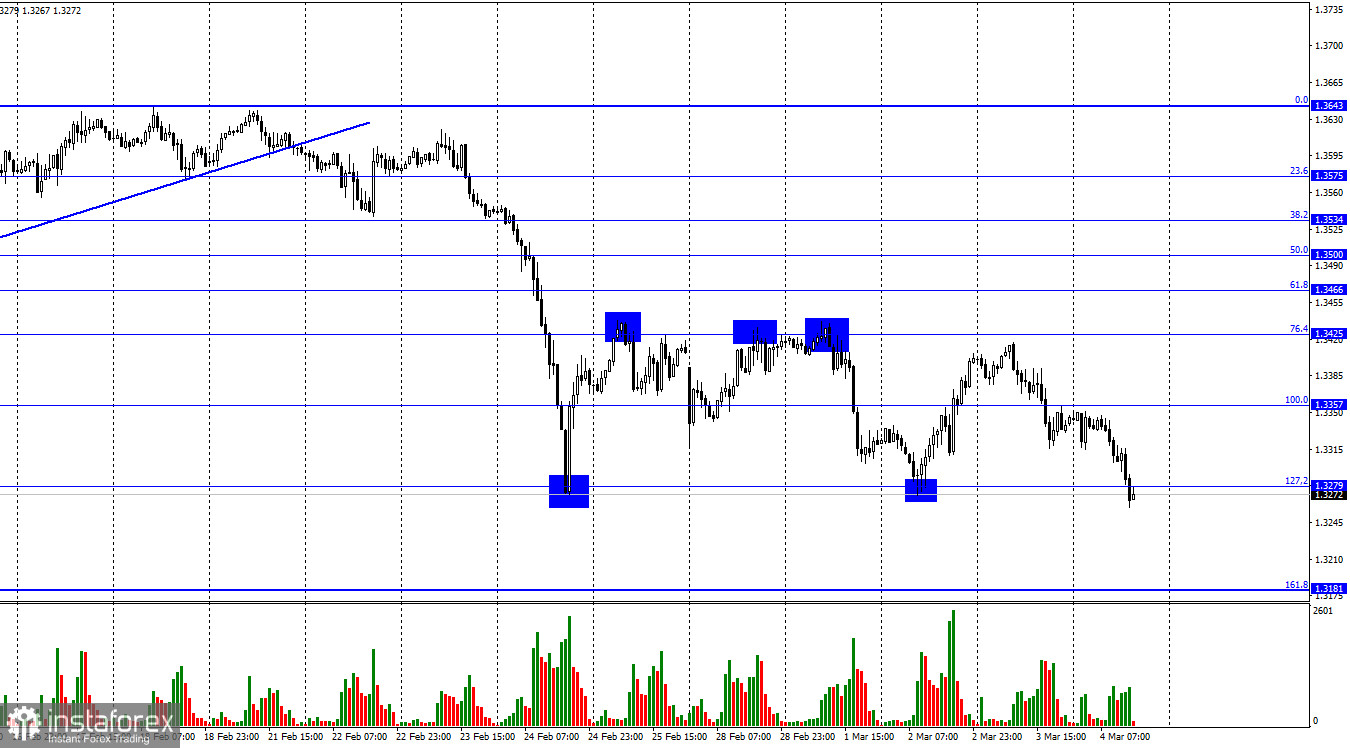

According to the H1 chart, GBP/USD continued to go down on Thursday without any upward corrections. The pair closed below the retracement levels of 100.0% (1.3357) and 127.2% (1.3279). At this point, it could decline toward the Fibonacci level of 161.8% (1.3181). Today, US non-farm payrolls were released. The data greatly exceeded market expectations – the US economy added 678,000 new jobs in February. Economists expected that only 350,000-400,000 new jobs would be created. The previous month's data was revised upwards to 481,000. Unemployment fell to 3.8% from 4%. Average hourly earnings did not match expectations, but they are not as important as non-farm payrolls. These strong data releases can send the pair into a slump and boost the US dollar. However, the initial reaction of traders to this batch of data was muted, as GBP was already sliding down throughout the day, while USD was going up.

The pair's further downward movement may be not as significant as it could have been before. The US dollar also found strong support in the ongoing international situation. The war between Russia and Ukraine shows no signs of stopping. The second round of negotiations between the two sides has failed to produce any results, just like the first one. The third round of negotiations is set to begin next week, with both Russia and Ukraine have drastically different positions. Some progress has been made – there are hopes that it would help stop the war and sanctions against Russia, as well as reverse the nosediving world markets upwards. However, de-escalation seems very unlikely, as new sanctions are being imposed on Moscow. Furthermore, the Kremlin could declare martial law in Russia in the near future.

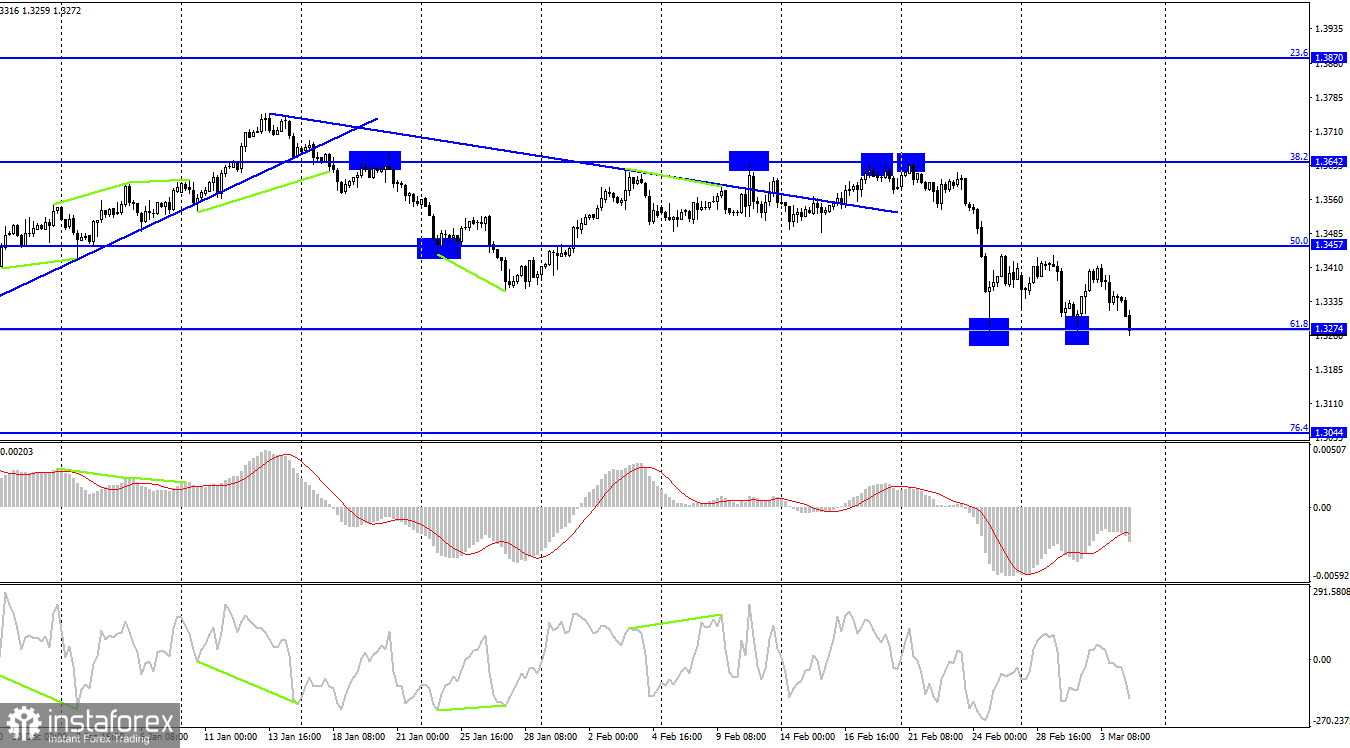

According to the H4 chart, the pair dived below the retracement level of 61.8% (1.3274). It could close below it tonight, which would open the way towards the next Fibo level of 76.4% (1.3044). There are no emerging divergences today. However, at this point, they are not as important to traders as geopolitical factors. If GBP/USD bounces off 1.3274, it would rise up slightly.

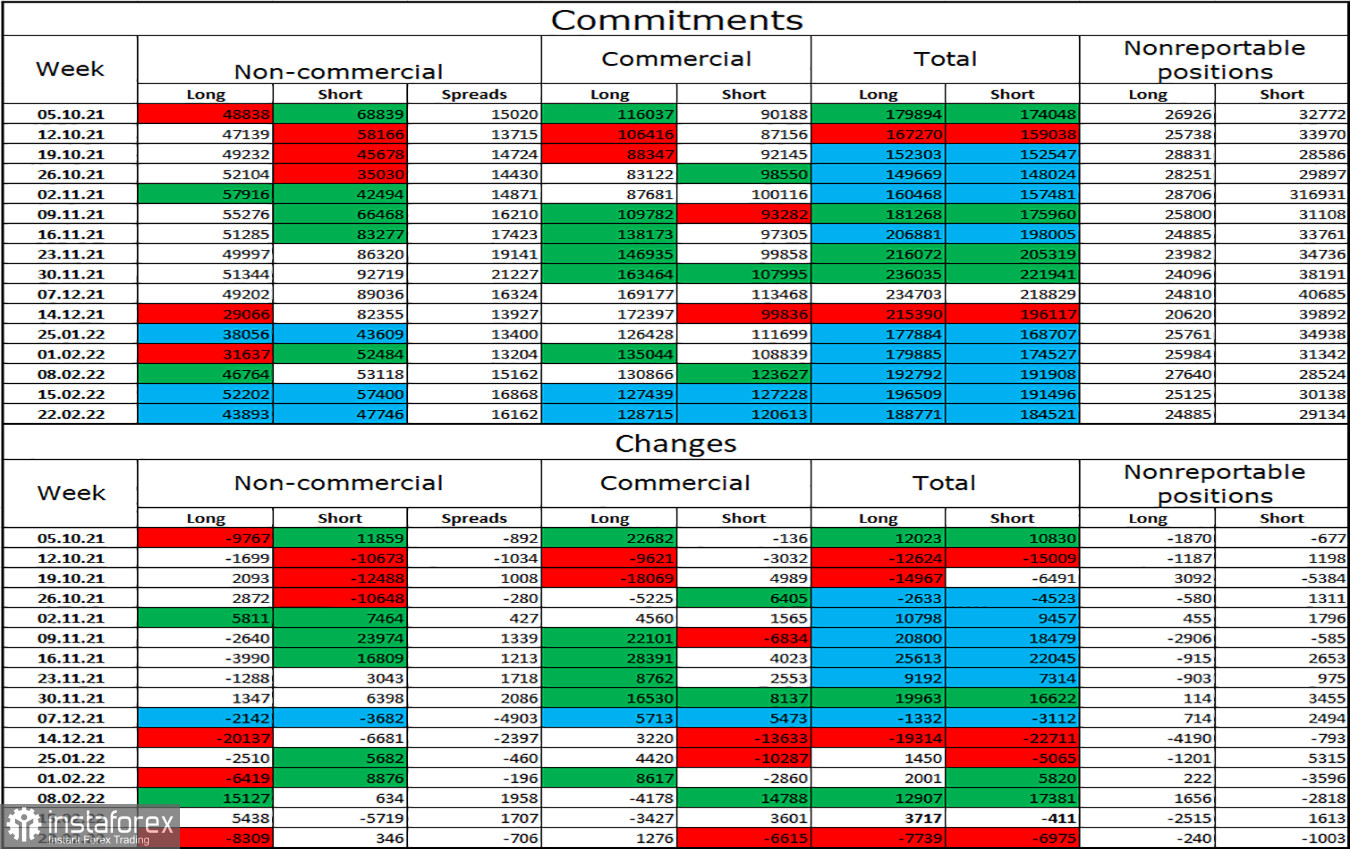

Commitments of Traders (COT) report:

The mood of "Non-commercial" traders changed sharply once again during the week covered by the report. 8,309 Long positions were closed, and 346 Short positions were opened, indicating an increasingly bearish sentiment among traders. However, the mood of traders could be called "neutral" – the total number of open Long and Short contracts is roughly the same among most categories of traders. At this point, the sentiment of traders can fluctuate rapidly due to geopolitical factors.

US and UK economic calendar:

UK – construction PMI (09-30 UTC).

US – unemployment data (13-30 UTC).

US – non-farm payrolls (13-30 UTC).

US - average hourly earnings (13-30 UTC).

Traders have ignored UK's construction PMI data. Strong data releases in the US are giving support to USD. However, the US dollar's upsurge could continue even without it.

Outlook for GBP/USD:

Traders are recommended to open short positions targeting 1.3181 – the pair has closed below 1.3279. Most factors favor the dollar – opening long positions is not recommended today.