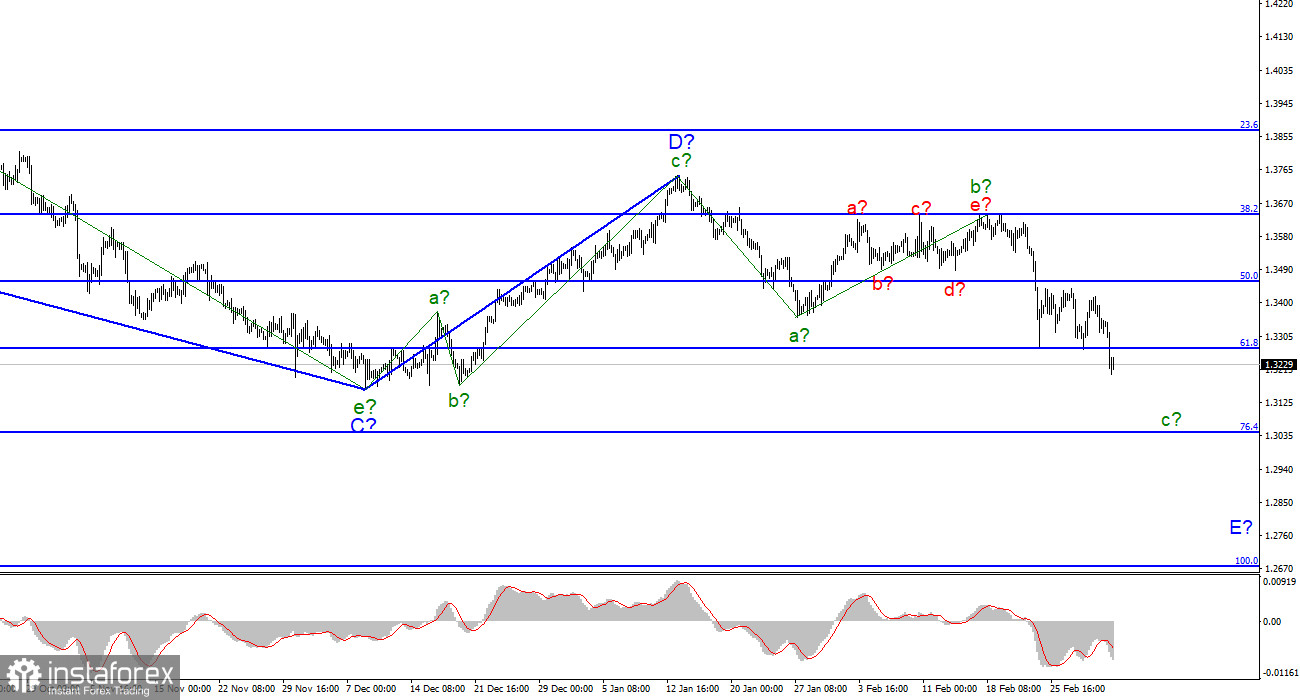

For the pound/dollar instrument, the wave markup continues to look very convincing, although it is quite difficult. The supposed wave b-E of the downward trend segment became much more complicated, but after several unsuccessful attempts to break through the 1.3642 mark, it still ended. The decline in quotes in the last week indicates a transition to the construction of wave c, which can also turn out to be very long. At the moment, the low of the expected wave a has been broken, so the construction of the downward trend section continues for sure. And necessarily within the framework of wave E. Thus, the entire downward section of the trend has acquired a five-wave form, and its intended wave E should also acquire a five-wave form. Hence, adopt a rather extended structure. A successful attempt to break through the 1.3275 mark indicated that the market was ready for new sales. Wave c-E does not look completed yet - it is too short, and the current news background continues to increase demand for the dollar.

And again, geopolitics.

The exchange rate of the pound/dollar instrument decreased by 125 basis points during March 4. In my review of the euro/dollar, I touched on the topic of economic statistics from America only in passing, but the statistics turned out to be very important, so we will analyze it in more detail. Let's start with the British report on business activity in the construction sector. It rose to 59.1 at the end of February, but the British did not show a single bullish candle during Friday. That is, the market did not pay any attention to this report. The next in line was data from America. The most important Nonfarm Payrolls report turned out to be significantly better than market expectations, accounting for 678 thousand new jobs outside agriculture. The unemployment rate dropped from 4% to 3.8%. These two reports were already enough to make the demand for the US currency grow even stronger. Therefore, Friday became a "black" day for the euro and the pound, and instead of an upward pullback on Friday evening (which often happens), we saw a new decline.

At the same time, geopolitics does not leave the minds of market participants. The situation in Ukraine, if it has not escalated in recent days, then it is not improving. Thus, the market is still in a very nervous state, and the direction of movement of both instruments that I am observing perfectly shows what the mood of the market is now. From my point of view, there are simply no alternative options for the development of the situation. For the first time in a very long time, almost all factors say an unambiguous "down". Judge for yourself. The wave pattern implies the construction of another descending wave, which can take a very extended form. Geopolitics puts pressure on the euro and the pound in the first place, while the US dollar is just in demand. The geopolitical conflict in Ukraine may persist for many months. Already on March 15-16, the Fed may raise the interest rate and begin a course to bring it to 2-2.5%. At the same time, the Bank of England does not plan to raise the rate higher than 1% in 2022. All the trumps are in the hands of the Americans.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. The instrument made two unsuccessful attempts to break the 1.3645 mark, but the third was successful. Therefore, I continue to advise selling the instrument with targets located around the 1.3046 mark, which corresponds to 76.4% Fibonacci, according to the MACD signals "down", since the wave c-E does not look complete yet.

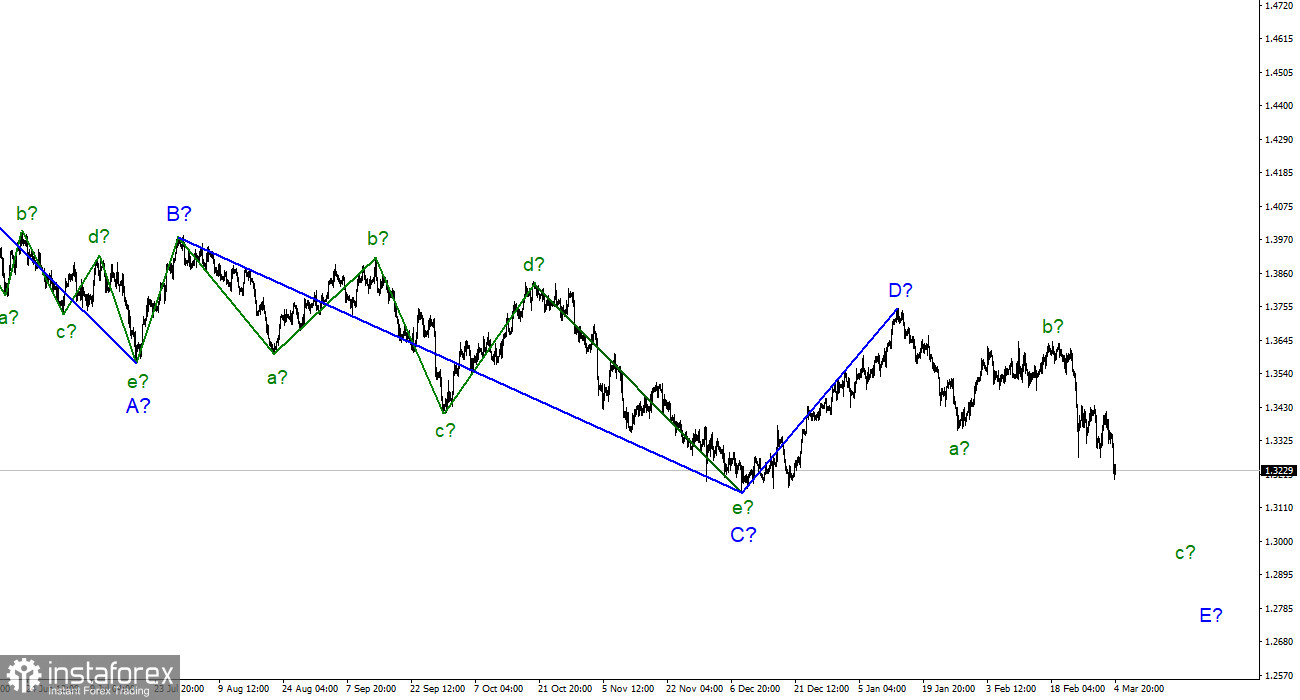

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect the instrument to continue to decline with targets below the low of wave C. Wave D turned out to be a three-wave one, so I cannot interpret it as wave 1 of a new upward trend segment.