Analysis of Friday's deals:

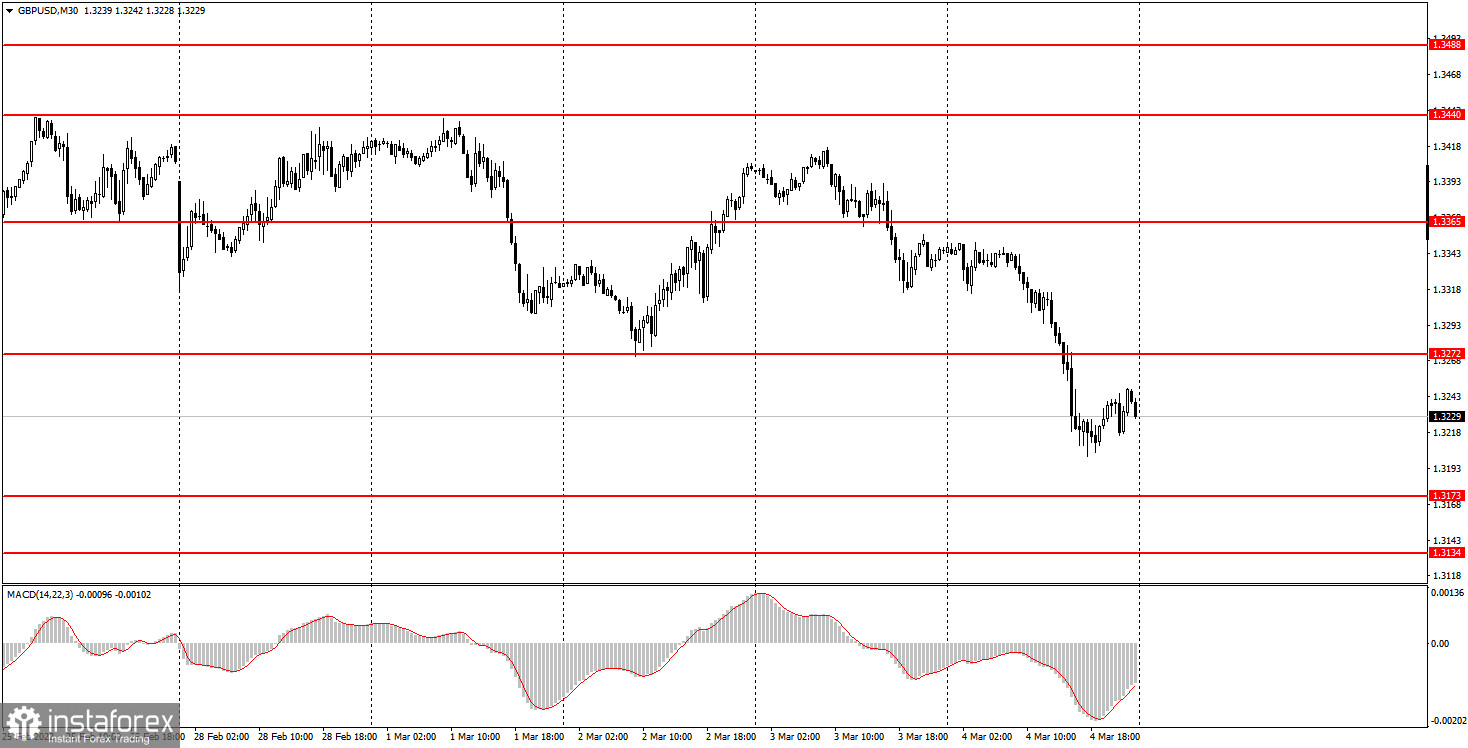

30M chart of the GBP/USD pair.

The GBP/USD pair also continued to fall on Friday and managed to overcome the important level of 1.3272. In total, the British pound fell by 120 points during the day, although the volatility of the pair was even higher. The same technical picture as for the EUR/USD pair. The fall of the pair was observed not only at a time when important Nonfarm Payrolls and unemployment reports were published in America. Thus, we conclude that not only American statistics helped the US dollar to grow on Friday. The matter, as usual in recent weeks, is in geopolitics. The situation with the military conflict in Ukraine, if it is not getting worse every day, then it is not getting better. The economic situation in Russia is getting worse every day under the yoke of Western sanctions. And considering that these sanctions are imposed almost every day, the Russian economy has a lot to fall. And investors have somewhere to run from Russian stocks and the Russian ruble. Therefore, it is not surprising that the dollar is now growing across the entire spectrum of the market, because shares of Russian companies on foreign stock exchanges are also sold for rubles.

5M chart of the GBP/USD pair.

On the 5-minute timeframe, the movement on Friday was quite good. And the trading signals were not bad either. Although this is natural, since most of the day the price moved only in one direction, and the trend is the best friend of traders. The first sell signal was formed when the price was fixed below the level of 1.3310, and literally, an hour later the price bounced from the same level from below. Therefore, novice traders could open a short position. In the future, the price dropped below the level of 1.3272, and then below the level of 1.3241. That is, two more strong sell signals were received, but at that time a short position was already open, so you just had to stay in it. The pair could not reach the level of 1.3172, so the deal should have been closed manually in the late afternoon. As a result, only one transaction was opened, profitable and it was possible to earn about 80 points on it. Excellent result.

How to trade on Monday:

On the 30-minute TF, the pair continues its downward movement, although not as fast as the EUR/USD pair. Theoretically, it is now possible to build a channel or a trend line, but now the downward trend is visible even without them. Much more important is the geopolitical factor, which will continue to push the pair down if the situation in Ukraine continues to deteriorate. On the 5-minute TF tomorrow, it is recommended to trade by levels 1.3134, 1.3172, 1.3241, 1.3272, 1.3310, 1.3365. When the price passes after opening a deal in the right direction, 20 points should be set to Stop Loss at breakeven. There are no major macroeconomic or fundamental events scheduled for tomorrow in the UK and the US. Therefore, if the geopolitical background does not deteriorate, the pair may begin an upward correction. However, if we see a powerful downward movement again, we should not be surprised either. The markets are still in a state of shock from what is happening.

Basic rules of the trading system:

1) The strength of the signal is calculated by the time it took to generate the signal (rebound or overcoming the level). The less time it took, the stronger the signal.

2) If two or more trades were opened near a certain level on false signals, then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade transactions are opened in the period between the beginning of the European session and the middle of the American session when all transactions must be closed manually.

5) On a 30-minute TF, signals from the MACD indicator can be traded only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as a support or resistance area.

What's on the chart:

Price support and resistance levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.

Red lines - channels or trend lines that display the current trend and show in which direction it is preferable to trade now.

MACD indicator(14,22,3) is a histogram and a signal line - an auxiliary indicator that can also be used as a signal source.

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp price reversal against the previous movement.

Beginners to trade in the forex market should remember that every transaction cannot be profitable. Developing a clear strategy and money management is the key to success in trading for a long period.