Gold prices are moving to a higher value at a pace that has not been seen for quite some time.

Analyzing prices from the beginning of 2022, from January 31 to February 4, gold prices rose by $194.90.

Gold is one of the most important safe-haven assets. It is both an excellent hedge against inflationary pressures and a quick response to geopolitical uncertainty and rising inflation. The recent rise in the price of gold is based on its sensitivity to both an inflation surge and a geopolitical crisis.

In this case, it is a combination of these two events occurring at the same time. This synergistic effect of both geopolitical uncertainty and existing inflationary pressures has simultaneously increased the impact of gold on the global economy.

Most worryingly, the geopolitical crisis in Ukraine has added another layer to inflationary pressures.

Just a few months ago, such a course of events was unimaginable. Prior to the outbreak of hostilities in Ukraine, inflation had already reached a 40-year high. According to the latest CPI (Consumer Price Index) data, the annual inflation rate reached 7.5%. This is the highest inflation rate since February 1982. Judging by recent events, it can be said with absolute certainty that inflation will reach even higher levels.

The main catalyst that will cause inflation to rise will be directly related to two main factors: first, the rise in the cost of crude oil, which is currently trading at $115 per barrel. Secondly, Ukraine's ability to produce agricultural products for export to Europe has been destroyed.

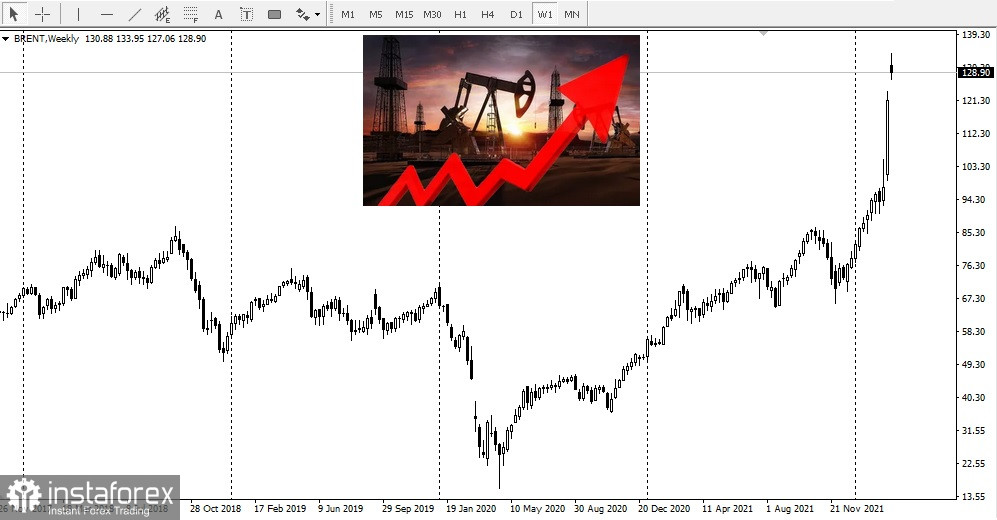

Recent oil surge:

In December 2021, crude oil futures traded at $62.51. By the first week of January 2022, crude oil futures rose to $74.58. By the end of February, oil rose to $90 per barrel.

From December to February, in a short span of three months, the cost of a barrel of crude oil rose another 43.97%. Even more troubling is that oil gained 19.60% in the first four trading days of this month. This equates to an average daily gain of 4.9%.

Rising food prices:

The recent rise in food prices is a fact that higher oil prices are drastically affecting the cost of growing and transporting food. These costs have increased dramatically due to the current conflict in Ukraine. Ukraine, in fact, was the main component supplying agricultural products to Europe. The current crisis has greatly affected Ukraine's ability to continue to supply agricultural goods to Europe.

Thus we conclude that the spiral inflation and prolonged hostilities in Ukraine will be devastating to the world economy.

The obvious conclusion is that the impact of the conflict in Ukraine on the current level of inflation is quite significant. This is a guarantee that inflationary pressures will continue to rise to higher levels, causing extreme hardship for the citizens of the world who need these commodities to survive.

For the reasons written above, gold has shown such brilliant results and a sharp rise in prices. The precious yellow metal does act as a safe-haven asset that should continue to gain value as a hedge against other investment classes in times of political uncertainty and high inflation. The sad truth is that the current conflict in Ukraine is unlikely to have a quick and peaceful resolution. It will take a long period of time for it to finish.

Assuming that the geopolitical crisis in Ukraine will not be resolved quickly and the current inflation rate will continue to skyrocket, it is easy to assume that soon gold will be able to overcome its all-time high of $2,088 and trade at a new all-time high price.