The British pound has fallen against the U.S. dollar to its lowest levels since the end of the Brexit saga. High demand for safe-haven assets against the backdrop of the war in Ukraine, American exceptionalism, and doubts about the aggressive tightening of the monetary policy of the Bank of England are pushing the GBPUSD quotes down. The pair has approached the target at 1.312 indicated in the previous article, and it seems that this is not the limit yet.

An increase in U.S. non-farm payrolls employment of 678,000 in February, an upward revision of December and January data, a drop in unemployment to 3.8%, and the fact that the average salary has grown by 5% or more for the fourth month in a row, allow talk not only about a strong labor market, but also about a strong economy. Fiscal stimulus by 25% of GDP inflated domestic demand and accelerated inflation to 7.9%, Bloomberg experts predict. The Fed can afford to tighten monetary policy at every meeting. The Bank of England is in a different position.

Despite the acceleration of inflation to 5.5%, which is the highest level in 30 years, and the forecast for its further growth above 7%, the increase in consumer prices in the U.K. is based on other factors than in the U.S. Europe in general and Britain, in particular, are highly dependent on oil and gas supplies from Russia, so a significant increase in the cost of energy goods hurts consumers' pockets and contributes to the acceleration of CPI. According to research by the Office for National Statistics, the share of respondents who reported an increase in the cost of living jumped from 62% in November to 81%. One in five Britons spends their savings.

At the same time, local businesses predict that inflation will continue to grow at the fastest pace in the last five years. Chief financial officers expect to see it at 4.8% by the end of 2022. The January survey showed a figure of 4.5%.

Dynamics of inflation expectations of British business

Thus, the Bank of England faces a daunting task - how not to go too far with the tightening of monetary policy and not aggravate the already not very good situation of British households against the backdrop of rapidly accelerating consumer prices. It is not surprising that even such an MPC hawk as Michael Saunders, who voted in February to raise the repo rate by 50 basis points at once, is now talking about the dangers of high CPI for income and expenses and argues that it is too early to say how the war in Ukraine will affect inflation.

Due to the proximity of Britain to Eastern Europe, its economy will most likely face greater difficulties than the U.S., and the Bank of England will be slow to tighten monetary policy, which suggests the stability of the "bearish" trend in sterling against the U.S. dollar.

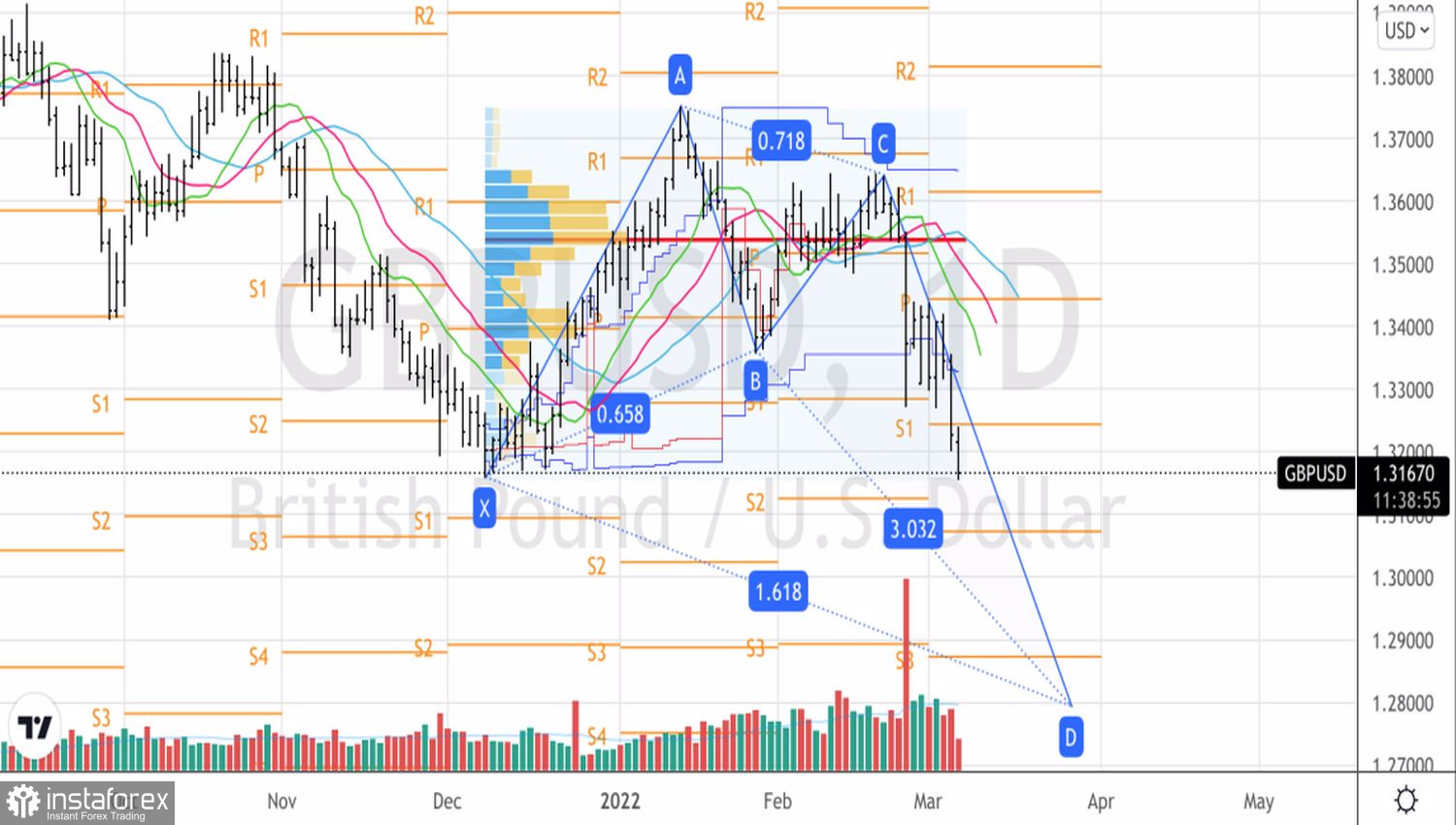

Technically, the potential of the downward movement of the GBPUSD is far from being exhausted. Judging by the Crab pattern, the pair is quite capable of falling to 1.28. In this regard, I recommend holding the previously formed shorts and periodically increasing them on pullbacks.

GBPUSD, Daily chart