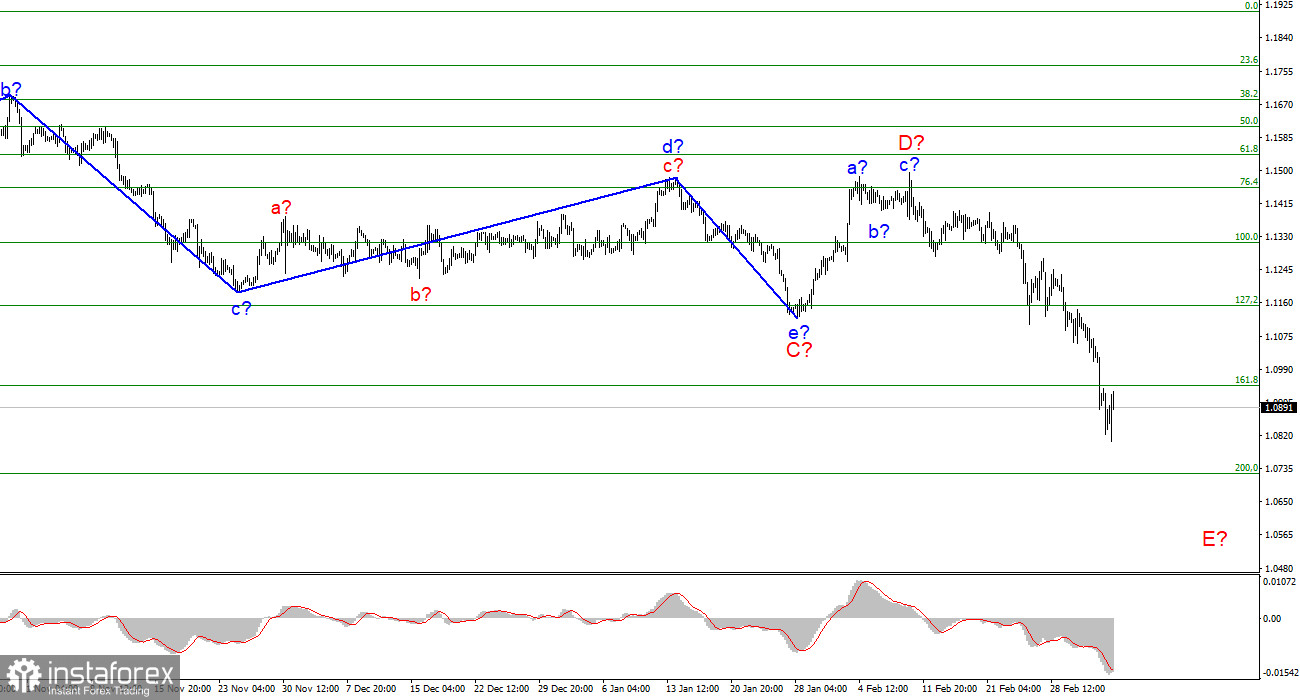

The wave marking of the 4-hour chart for the euro/dollar instrument still does not change and looks quite convincing. It has not changed for several weeks, because all this time the European currency has been doing nothing but declining. Therefore, at this time, the descending wave simply continues its construction, which fully corresponds to the current wave marking. Last week, there were weak attempts to keep from a new decline, but they very quickly came to naught. The current decline in quotes is interpreted as wave E, and this wave can turn out to be very long and strong. The news background openly supports the increase in demand for the US currency, and this applies to both geopolitics and the economy. Based on this, I think that the probability that the instrument will continue to build a downward wave is 80 percent. The situation in Ukraine now is such that much other news, reports, and events simply do not matter. Wave E can be any in size. A successful attempt to break through the 1.0947 mark indicates readiness for further sales of the instrument.

What will Christine Lagarde report on Thursday?

The euro/dollar instrument fell by another 50 basis points on Monday, and this is still very little, since during the day the quotes were much lower than the 1.0880 mark, almost coming close to the 8th figure. However, the news background was almost completely absent today. If we talk about the economic news background. There is also little news on geopolitics. A new stage of negotiations between Ukraine and the Russian Federation has begun in Belarus, but its results are still unknown. All the previous stages took at least 4-5 hours, so we will be able to get information only late in the evening or even at night. Nevertheless, the market did not stand still today, and the amplitude of the instrument was about 65 points. This suggests that the market is still in a panic state, once on Monday, in the absence of news, the instrument passes about 130 basis points from low to the peak.

This week, a very important event will take place for the European currency - the ECB meeting. Practically no one is waiting for action from the European regulator now, but all Lagarde's past statements have not yet taken into account the strong fall of the European currency. And they also did not take into account the possible even stronger fall in the European currency. After all, no one expects that the decline of the instrument will end today? Thus, the ECB may face the issue of saving the euro currency from further decline. However, it is still very difficult to imagine what exactly the ECB can do to stop the depreciation? Complete all incentive programs as soon as possible? Christine Lagarde's words will be of great importance here. What issues, apart from geopolitical tensions in Ukraine, will she be concerned about? Will she say something about the change in the PEPP and the weak euro? It is statements on these topics that can give the markets a signal about which way the ECB intends to move in the near future and what issues it is interested in at all.

General conclusions

Based on the analysis, I conclude that the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". A successful attempt to break 1.0945 indicates that the market is ready for new sales of the instrument.

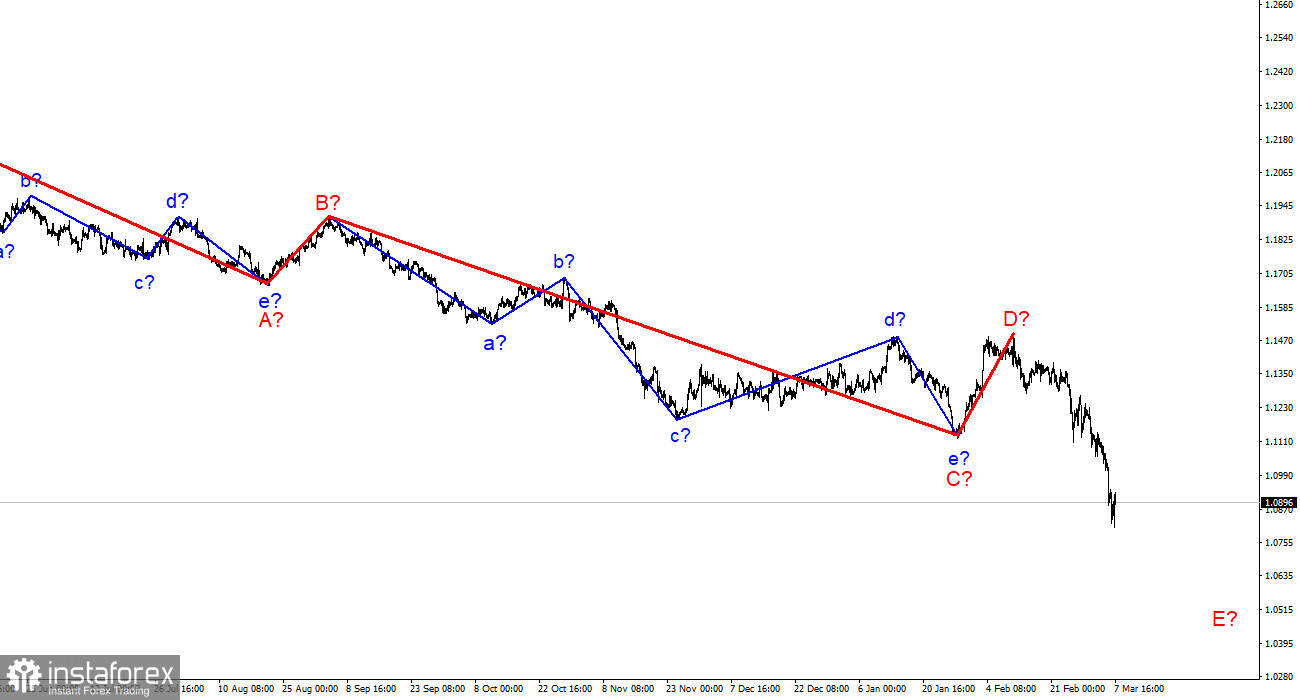

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has already updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built now, which may turn out to be as long as wave C. If this assumption is correct, the European currency will decline for a long time, although a couple of weeks ago many expected to build a new, upward trend section.