Global financial markets continue to experience problems from the ongoing confrontation between the West and Russia in Ukraine. The stock market in America, which has consolidated over the past week, could not resist on Monday and collapsed under the pressure of geopolitical tensions after another upward surge in prices for crude oil, gas, and other commodity assets.

The decision of the U.S. authorities not to buy Russian oil has led to a new round of rising prices, which are likely to continue to rise in the wake of the destruction of the world trading system, which was launched by the West in a mad desire to subjugate Russia. The understanding that the Ukraine crisis is likely to drag on for a long time, meaning its military phase, due to the unwillingness of the Russian side to carry out large-scale military operations that will lead to large casualties of the civilian population, will pull global stock indices further and further down.

In the foreign exchange market, the dollar is expected to receive support, fulfilling its previously fairly forgotten global function of a safe-haven currency. The ICE index has closely approached the 100-point mark, but so far has not been able to overcome it.

As indicated earlier this week, the focus will be on the publication of U.S. consumer inflation data. It is assumed that both monthly and annual values will show growth. And these are just February numbers, what will we see in April after the release of March values, which will be fully negatively affected by geopolitical events in Eastern Europe, which led to a rise in prices for crude oil and gas, as well as other commodity assets. Under these conditions, will Europe itself and the Western world as a whole, accustomed to living in comfort over the past 40 years, survive? We believe not. It's not yet clear when this realization will come.

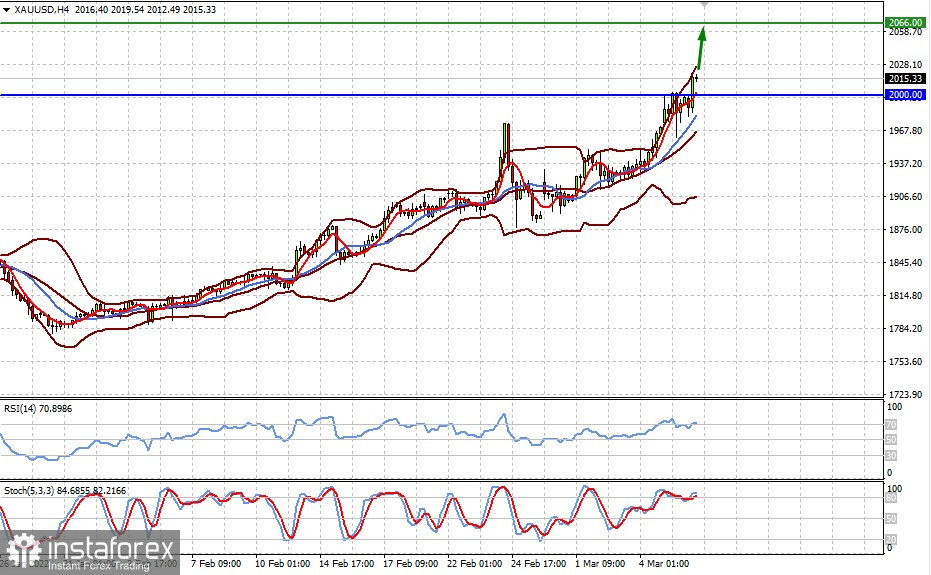

On this wave of confrontation, gold broke through the psychological barrier of $2,000 per ounce this morning, which may serve to further increase the price. Oil and gas prices are also flying vertically upwards.

The market is completely focused on the Ukraine crisis, but next week the Fed meeting will take place, which, with its expected decision to raise interest rates, can only exacerbate the problem. So, the financial markets in the near future, at least, are waiting for hard times, which, perhaps, not everyone will survive.

Forecast:

The GBPUSD pair fell below 1.3100, consolidating below which will lead to its further fall on the wave of geopolitical tensions between the West and Russia.

Spot gold broke the $2,000.00 mark. Consolidation above this level may stimulate further price growth towards 2066.00 while the geopolitical factor plays a major role.