The events related to the military actions of the Russian Federation in Ukraine leave investors no choice but to go into protective assets, in particular the US dollar. The situation is quite tense and at the same time ambiguous. On the one hand, the leaders of Western countries, at the instigation of the United States of America, impose all possible sanctions and restrictions against Russia. On the other hand, right here and now, that is, in an instant, it is not possible to abandon the use of Russian gas and oil. This is exactly what British Cabinet Minister Boris Johnson said at yesterday's briefing held with Canadian Prime Minister Trudeau and Dutch Prime Minister Rutte. The fact is that the so-called energy sanctions will also hit European energy suppliers, and they will hurt. And therefore, before abandoning Russian gas and oil, it is necessary to find an alternative, because due to the COVID-19 pandemic, the supply chain has been disrupted, which creates an imbalance between supply and demand, which is the main cause of high inflation in almost all developed economies. And then there is the withdrawal from the Russian market, which will not bring anything good either to those leaving or to those who will remain in isolation. However, Russia has some alternatives associated with turning its gaze to the East. They do not so aggressively and unequivocally negatively assess the actions of the Russian Federation in Ukraine. Simply put, they don't care, just to get relatively cheap Russian energy resources. In general, the situation is complicated and makes everyone think. Although, under the patronage of the Americans, there is little doubt that sanctions on Russia will fall like an avalanche, and the Russian Federation will try to isolate as much as possible economically and politically.

If you look at today's economic calendar and look at the releases that can affect the price dynamics of the GBP/USD currency pair, then, perhaps, you can only highlight data on the US trade balance, which will be presented to the market participants at 13:30 London time. There are no macroeconomic reports scheduled from the UK for today at all. Therefore, it is logical to assume that the pound/dollar will be under the influence of market sentiment and move following the technical picture, which we are going to consider right now.

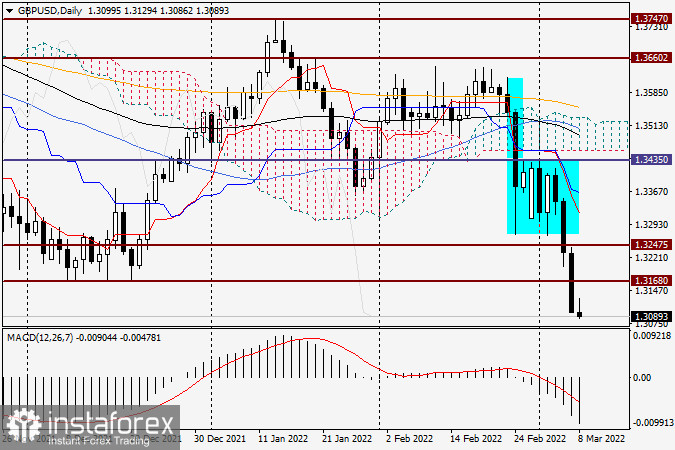

Daily

As can be seen on the daily chart, the market seized on the figure of the continuation of the technical analysis "Inverted Flag", and at yesterday's auction continued to work it out. Thus, both the technique and the external background are on the side of the US dollar. Admittedly, and this is visible on the daily timeframe, on March 7, the GBP/USD pair sank significantly, closing the session at 1.3099. At the same time, I will note two important points. First of all, yesterday's trading closed, albeit quite a bit, but below the strong technical level of 1.3100. Second, the candle for March 7 has no lower shadow at all, which indicates strong selling pressure and the current weakness of bulls in the pound. However, the upper shadow is quite insignificant, which also confirms the full control of the bears over the GBP/USD pair.

For trading recommendations, let's go to the hourly chart, where I stretched the grid of the Fibonacci instrument to a decrease of 1.3416-1.3098. In my personal opinion, the main trading idea looks like sales, which are better to look for not at the very bottom of the market, but after at least small corrective pullbacks up. I don't think they will be significant, so I suggest considering opening short positions after a pullback to the broken support level of 1.3168, just above which the first pullback level of 23.6 Fibo passes from the downward movement of 1.3416-1.3098. Usually, with such strong and confident movements (in this case downwards), the adjustment is limited to the first Fibo level. Above, you can look at the opening of deals for sale after the pair rises to 50 simple moving average, which is now at another significant level of 1.3200. I recommend that you refrain from purchasing in the current situation.