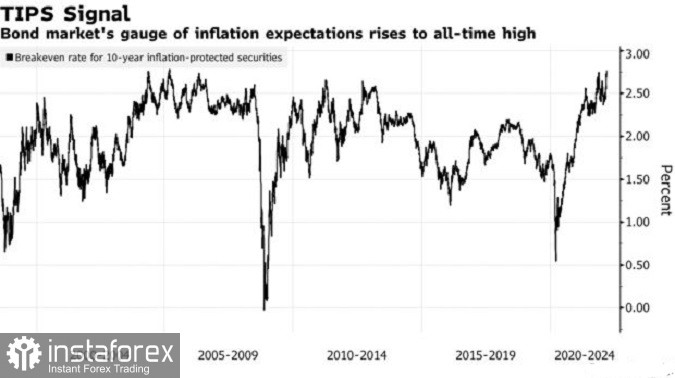

On Tuesday, stocks sank along with European and US futures on concerns that commodity prices will inflate inflation and stifle economic growth. Nickel briefly soared above $100,000 a ton.

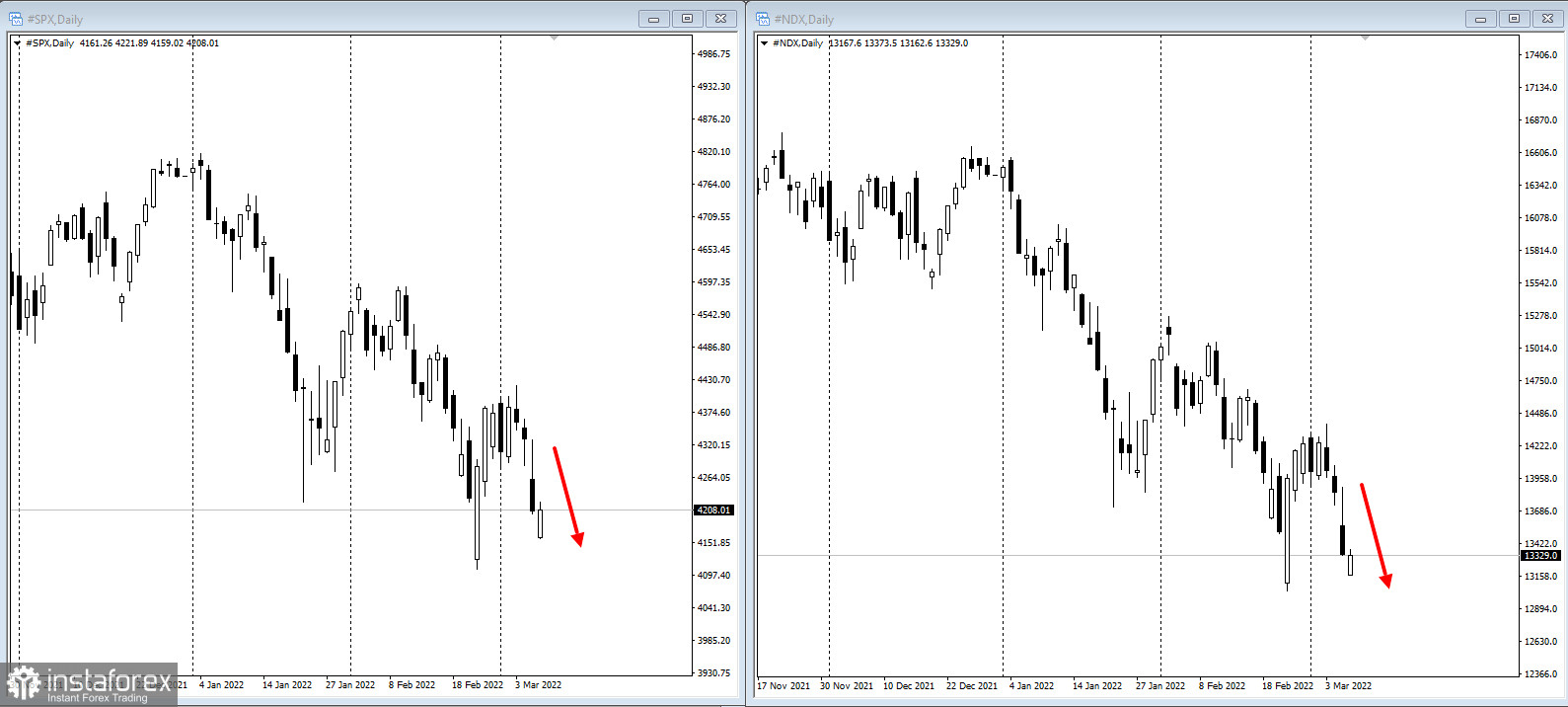

US futures declined, while the high-tech Nasdaq 100 futures lost less than 1% after falling 1.5%. The S&P 500 futures dropped about 0.6% after declining 3% on Monday, the worst such decline since 2020.

Nickel surged by 111% to $101,365 a ton on the London Metal Exchange. Russia's MMC Norilsk Nickel PJSC is the largest producer of the metal used to make stainless steel and car batteries.

The Stoxx 50 index has been declining for the fourth straight day. Moreover, all sectors are in the red, except energy. The European index has already lost 10,000 points since early 2022:

Crude oil topped $122 a barrel in New York on fears of disarray in commodity flows stemming from the war in Ukraine and sanctions on Russia. European gas futures jumped 32% after Russia threatened to cut natural gas supplies to Europe via the Nord Stream pipeline.

Treasury yields rose. Gold scaled $2,000 an ounce and the dollar rose in a sign that the turmoil in commodities is supporting demand for safe havens.

In the US, lawmakers are moving towards barring imports of Russian oil. Russia for its part threatened to cut natural gas supplies to Europe via the Nord Stream 1 pipeline. This underlines how the conflict and economic warfare against resource-rich Russia are dimming the global outlook.

Tightening monetary policy to curb inflation presents further challenges. The gap between two-year and 10-year Treasury yields is the narrowest since March 2020, a sign of expectations of slowing economic expansion.

"It's all about slowing growth and rising inflation," Alifia Doriwala, Rock Creek co-chief investment officer, said on Bloomberg Television. "With the sanctions on Russia intensifying, it's hitting all sectors. Then you are going to have some central bank action amidst uncertain economic growth."

Talks between Ukrainian and Russian officials have made limited progress so far on negotiating a cease-fire, but the discussions are expected to continue. Russian President Vladimir Putin said Kyiv must agree to his demands.

JPMorgan Chase & Co. said it would remove Russian bonds from all of its widely-tracked indices, further isolating the country's assets from global investors.

Here are some key events this week:

- Apple new product event, Tuesday

- EIA crude oil inventory report, Wednesday

- China aggregate financing, PPI, CPI, money supply, new yuan loans, Wednesday

- Reserve Bank of Australia Governor Philip Lowe speaks, Wednesday and Friday

- European Central Bank President Christine Lagarde briefing after policy meeting, Thursday

- US consumer price index, initial jobless claims, Thursday