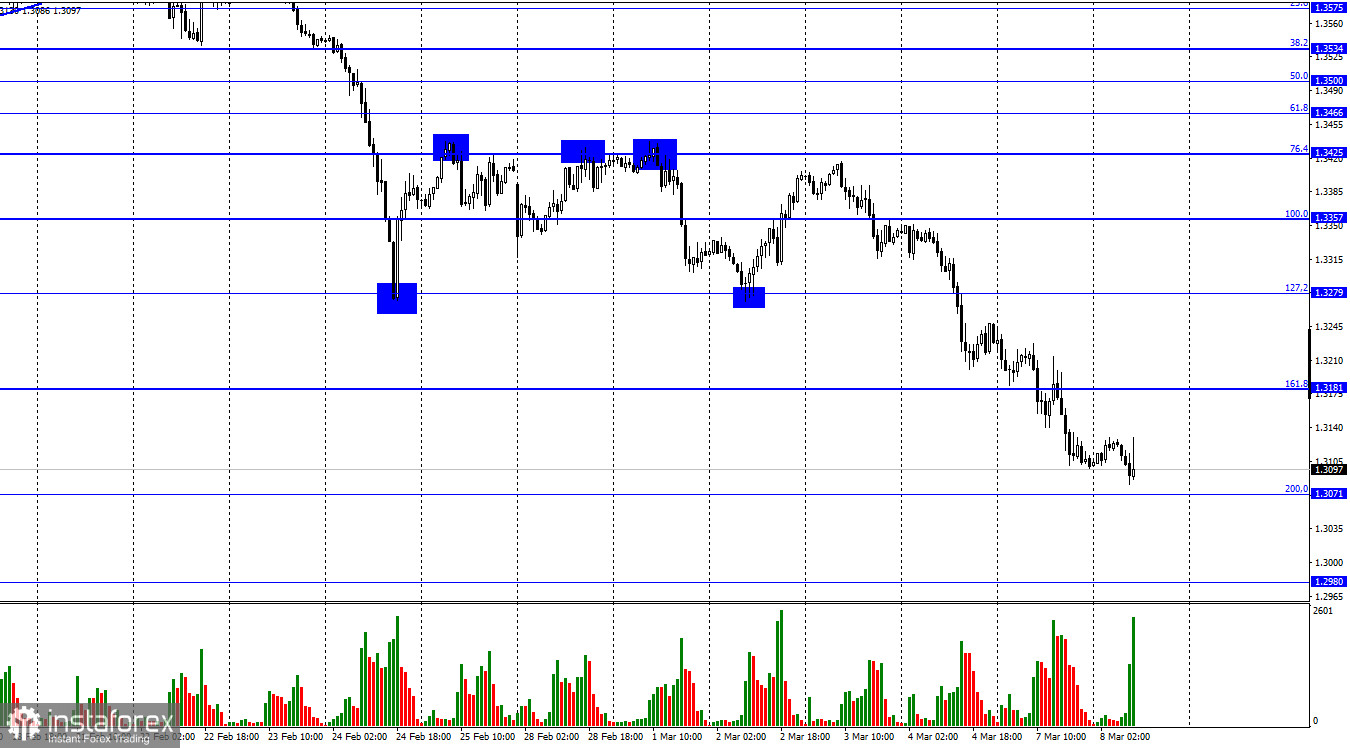

According to the hourly chart, the GBP/USD pair continued the process of falling on Monday and secured under the corrective level of 161.8% (1.3181). Thus, the fall in quotes continues in the direction of the Fibo level of 200.0% (1.3071). The rebound of the pair's rate from this level will allow us to count on a reversal in favor of the British and some growth in the direction of 1.3181. Closing at 1.3071 will increase the probability of continuing the fall towards the next level of 1.2980. The pound has become more receptive to geopolitical news in the last few days. If earlier the European currency fell more willingly, now it is the British pound. This, of course, has nothing to do with the British or European economies. And in general with economies. Last Friday, the US dollar rose thanks to Nonfarm Payrolls, but this is now just an isolated case, an exception to the rule. There won't be a whole lot of events in the UK this week. In the US, there is only an inflation report that can have the effect of an exploding bomb a week before the Fed meeting.

Let me remind you that traders have been constantly changing their forecasts for a rate hike in recent months, and Jerome Powell said last week that he would support an increase of only 0.25%. However, inflation is growing at the same time and will continue to grow. Just look at oil and gas prices. Thus, the Fed can move to tougher measures to stop the insane rise in prices. In this case, the bid will have to be raised much stronger and faster. And this, in turn, can lead to even greater growth of the US currency, which is now actively growing without the help of the Fed. The Bank of England, by the way, may also decide to raise its interest rate more strongly. It is already 0.5%, and the British regulator does not plan to raise it higher than 1% in 2022. I didn't plan it before. But who knew that there would be a war in Europe? Who knew that a new energy crisis could begin?

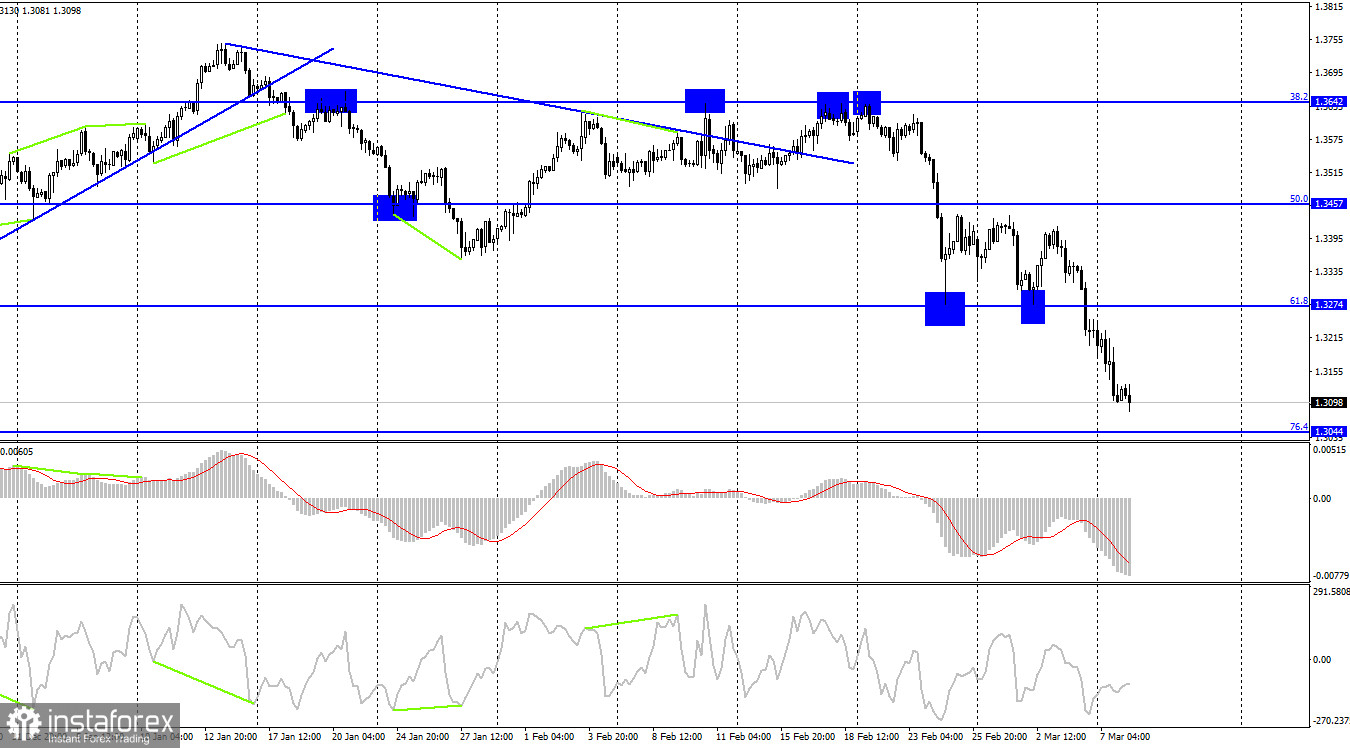

On the 4-hour chart, the pair closed under the corrective level of 61.8% (1.3274). Thus, the fall in quotes continues now in the direction of the next Fibo level of 76.4% (1.3044). The rebound of quotes from this level will allow the pound to grow slightly, and closing below it will increase the chances of a new fall in the direction of the corrective level of 100.0% (1.2674). There are no brewing divergences today, and it is very difficult to count on any growth of the British now.

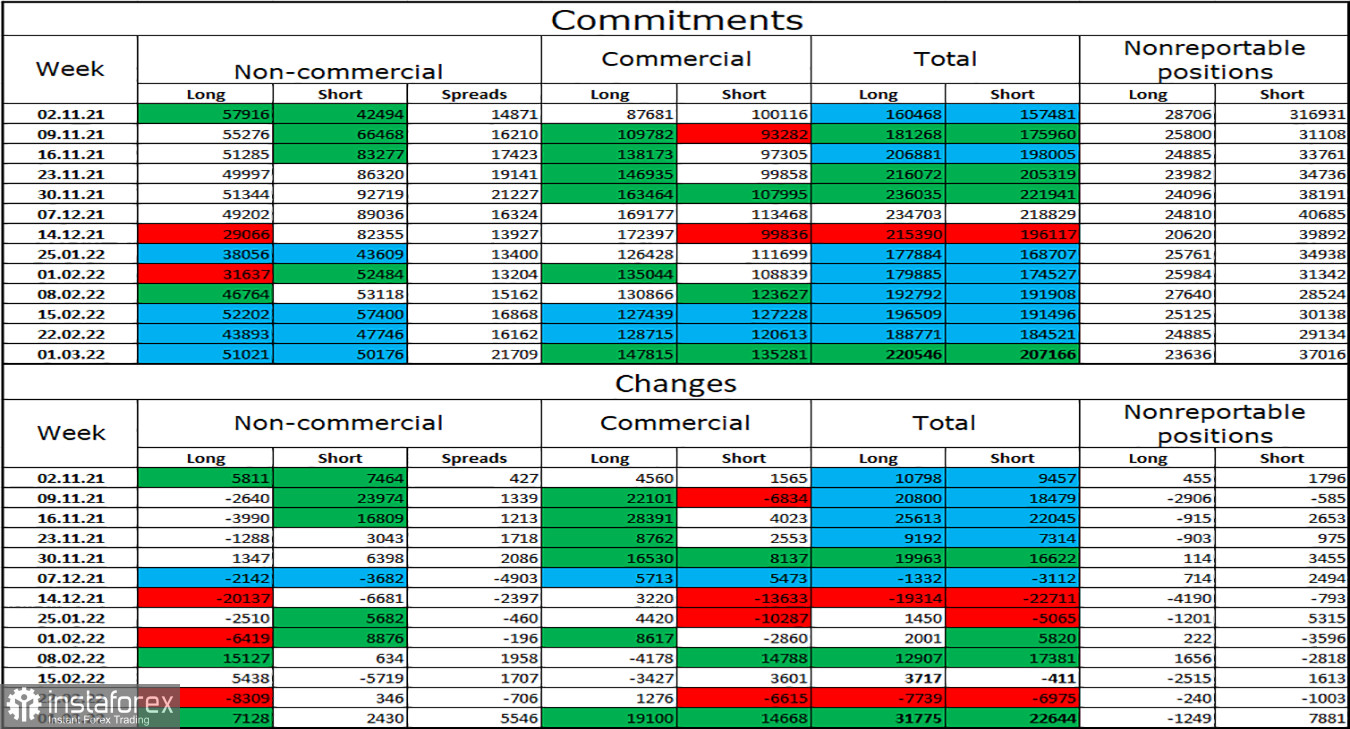

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts increased in the hands of speculators by 7,128, and the number of short contracts increased by 2,046. Thus, the general mood of the major players has become more "bullish", but at the same time, in the category of speculators, there is now equality in the number of long and short contracts. Thus, I conclude that the mood is now more neutral than "bearish" or "bullish". But even this does not matter much, since geopolitical factors can continue to have a very big impact on the British rate. Now it turns out that the mood is "neutral", and the pound is falling.

News calendar for the USA and the UK:

On Tuesday, the calendars of economic events in the UK and the US are empty. Nevertheless, the decline of the British continues without an informational background.

GBP/USD forecast and recommendations to traders:

At this time, I would recommend selling the British dollar with targets of 1.3071 and 1.3044, as the closing was made under the level of 1.3181. New sales - at the close under 1.3044. I do not recommend buying a pound today, since all factors remain in favor of the dollar.