Analysis of Tuesday's deals:

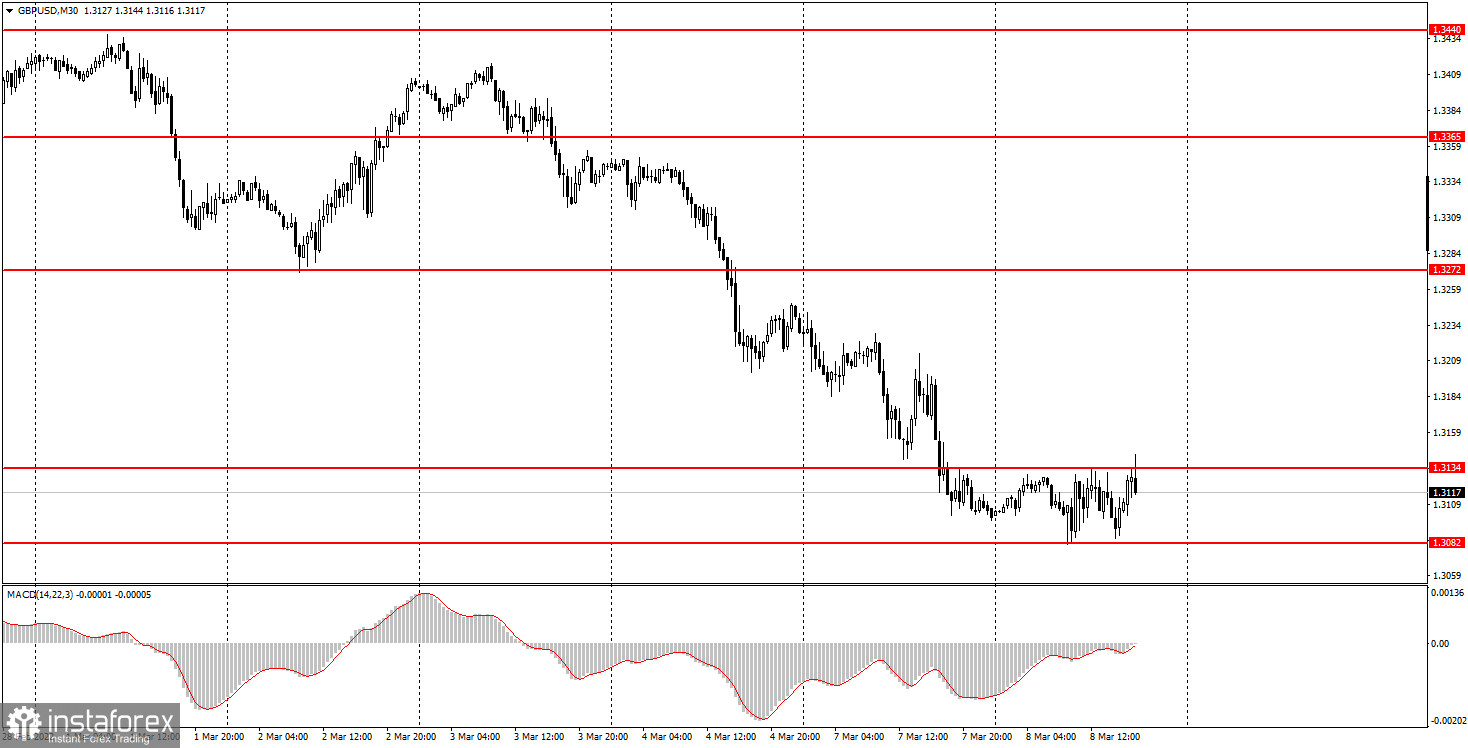

30M chart of the GBP/USD pair.

The GBP/USD pair was in a total flat on Tuesday. Although the levels of 1.3082 and 1.3134 are "old" levels that were formed more than a year ago, the price showed that it is ready to "respect" them and spent the entire Tuesday exactly between them. Thus, now we are talking about a flat and a side-channel. However, this channel is unlikely to keep the pair inside for a long time. First, geopolitics remains very complicated, so a new fall in the pound may follow. Second, the channel is very narrow and it will be physically difficult for the price to stay inside it. Third, an upward correction is now expected, albeit not strong. No important macroeconomic statistics were published on Tuesday either in America or the UK. Therefore, in part, the market worked out this day quite logically. However, we recall that there was no important news on Monday either, but the pair showed volatility of 130 points during the day. The downward trend continues.

5M chart of the GBP/USD pair.

On a 5-minute timeframe, the movement looks very eloquent and does not even need explanations. From a technical point of view, the pair moved almost perfectly, because, despite the side channel, it worked out each of the borders in turn, thus forming trading signals. Let's look at them. The first two buy signals were formed when they rebound from the level of 1.3082. Novice traders could work them out and make a profit, as prices subsequently rose to the level of 1.3134 and worked out this level with minimal error. This was followed by a sell signal in the form of a rebound from 1.3134, after which the price dropped back to 1.3082 and also bounced off it with minimal error, forming another buy signal. This signal also turned out to be profitable, as the price rose again to the level of 1.3134 and bounced off it once again, forming another sell signal. As a result, today we have 4 trading signals, all profitable, each one could earn about 25 points. It is clear that 25 points on each trade in the flat are an ideal option, but in total, you could still earn at least 70 points. The movement was lateral, but if there are good signals, you can even earn money on it.

How to trade on Wednesday:

On the 30-minute TF, the pair continued its downward movement and on Monday it only intensified. It is very difficult to predict how the pair will move further now since there are very few levels now and there were no more of them on Tuesday since the price perfectly worked out the existing levels. On the 5-minute TF tomorrow, it is recommended to trade at the levels of 1.3082, 1.3134, 1.3241. When the price passes after opening a deal in the right direction, 20 points should be set to Stop Loss at breakeven. There are no major macroeconomic or fundamental events scheduled for tomorrow in the UK and the US. Therefore, all attention is again on the geopolitical background, if there is one, of course. Although, as Monday showed, even its absence does not mean that the pair will stand in one place. On Tuesday, the market may take a little break, and on Wednesday it may get down to business with renewed vigor.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to generate the signal (rebound or overcoming the level). The less time it took, the stronger the signal.

2) If two or more trades were opened near a certain level on false signals, then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade transactions are opened in the period between the beginning of the European session and the middle of the American session when all transactions must be closed manually.

5) On a 30-minute TF, signals from the MACD indicator can be traded only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as a support or resistance area.

What's on the chart:

Price support and resistance levels - the levels that are the targets when opening purchases or sales. Take Profit levels can be placed near them.

Red lines - channels or trend lines that display the current trend and show in which direction it is preferable to trade now.

MACD indicator (14, 22, 3) - a histogram and a signal line. An auxiliary indicator that can also be used as a signal source.

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp price reversal against the previous movement.

Beginners to trade in the forex market should remember that every transaction cannot be profitable. Developing a clear strategy and money management is the key to success in trading for a long period.