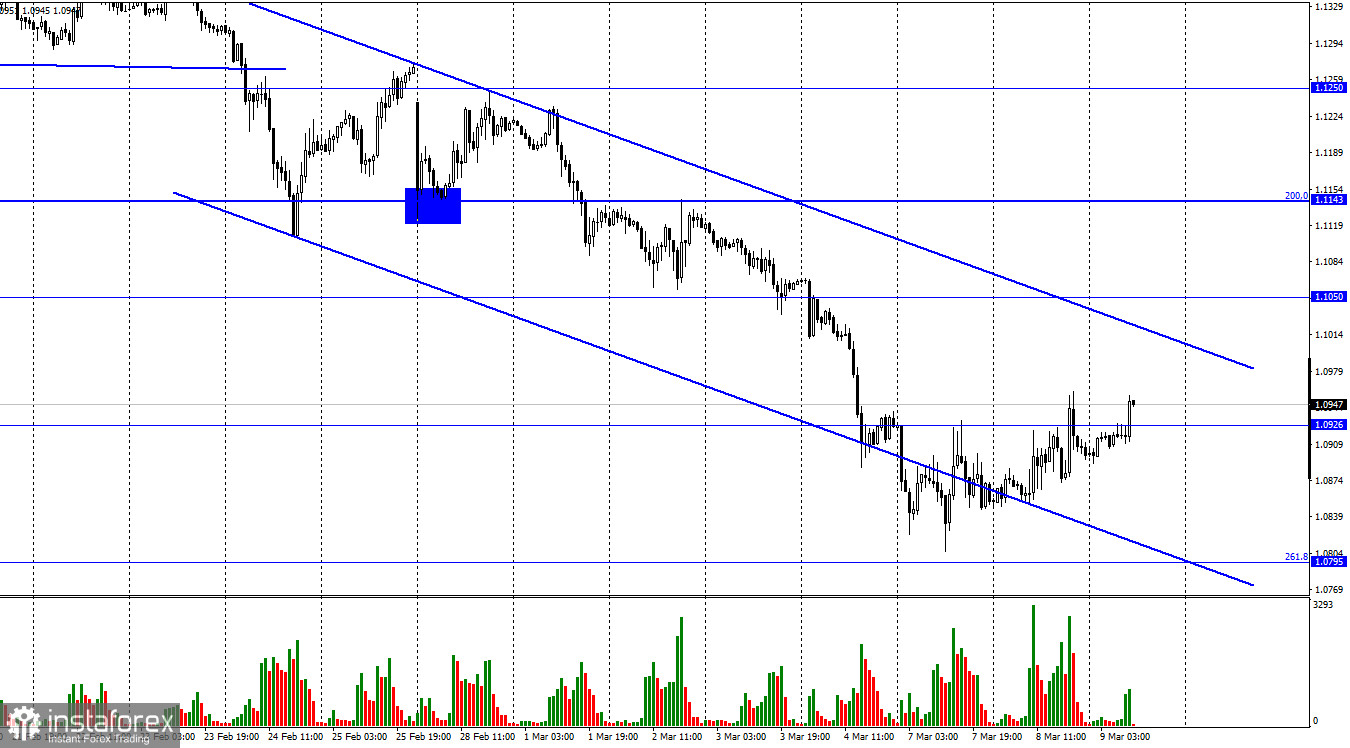

The EUR/USD pair continued its weak growth process towards the upper boundary of the downward trend corridor on Tuesday. The pair's quotes have secured above the level of 1.0926, but this consolidation does not open up any special prospects for the bulls. It will be possible to count on a stronger growth of the euro currency only after consolidation over the descending corridor. In this case, the euro may continue to grow towards the levels of 1.1050 and 1.1143. However, the current information background does not allow us to assume a strong growth of the euro currency. Over the past day, there was no information background, which explains the attempt of traders to roll the pair up a little and the drop in activity. However, the lack of information background from the USA and the EU concerns only economic news and the calendar. Yesterday, it became known that Joe Biden, together with Congress, decided to abandon purchases of Russian oil, gas, and coal. The share of imports of these energy carriers from Russia to the United States is small, but this is an additional blow to the Russian economy, which is already going through its bad times.

In addition, the central bank of the Russian Federation has banned the sale of foreign currency to Russians, as well as the withdrawal of more than certain amounts abroad. World rating agencies have lowered Russia's credit rating to "pre-default". In general, the situation is not improving, and world markets continue to be in a state of shock. While we have a small pause, the European currency may rise, but tomorrow this pause will end. A very important consumer price index in the US will be released on Thursday, and the results of the ECB meeting will also be announced. Although it is not necessary to expect much from the European Regulator now, information concerning the impact of the Ukrainian-Russian crisis on the European economy may sound from the lips of Christine Lagarde. That is, the EU Central Bank may adjust its monetary policy, which did not imply an interest rate increase in 2022. Inflation in the EU is likely to continue to grow, as the price of oil and gas, which are actively used in the European Union, is growing very much.

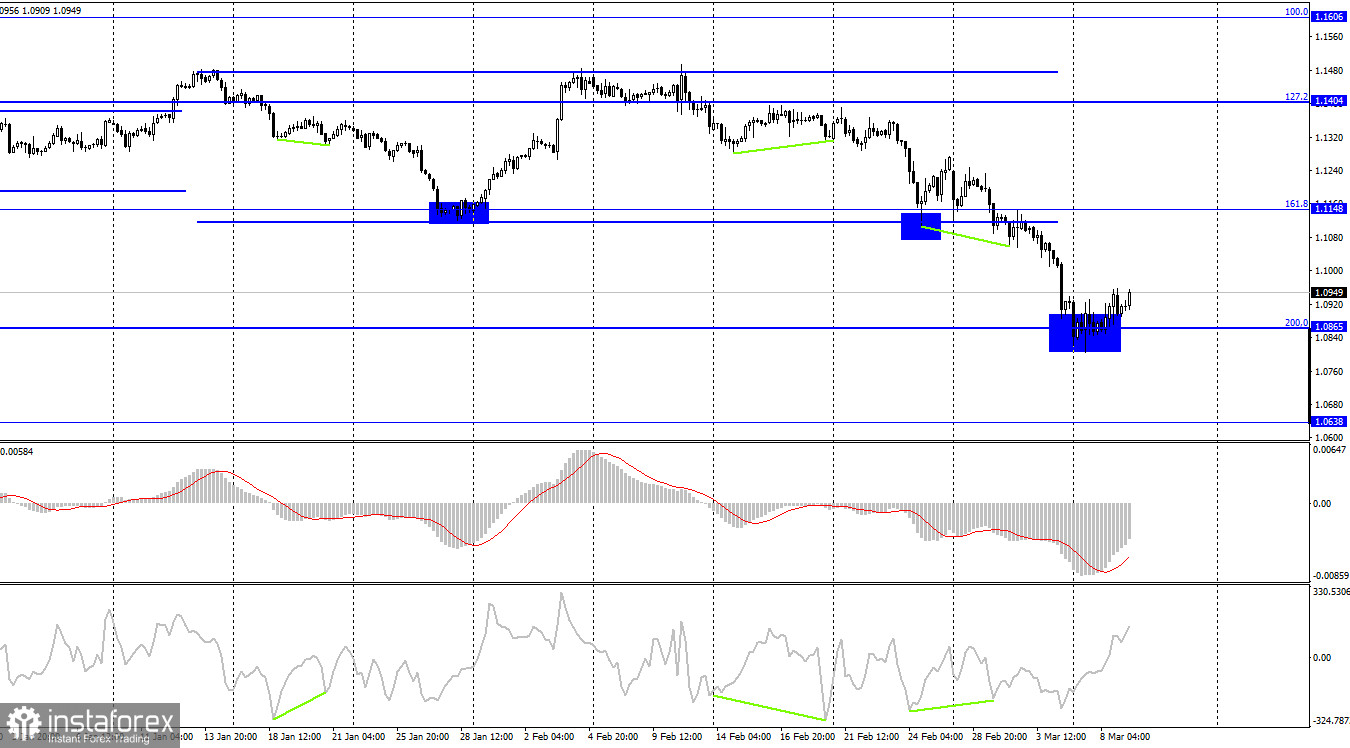

On the 4-hour chart, the pair performed a drop to the corrective level of 200.0% (1.0865) and rebound from it, which allows traders to count on a reversal in favor of the EU currency and some growth of the pair in the direction of the corrective level of 161.8% (1.1148). Closing at 1.0865 will work in favor of the US currency and increase the likelihood of further decline towards the next level of 1.0638.

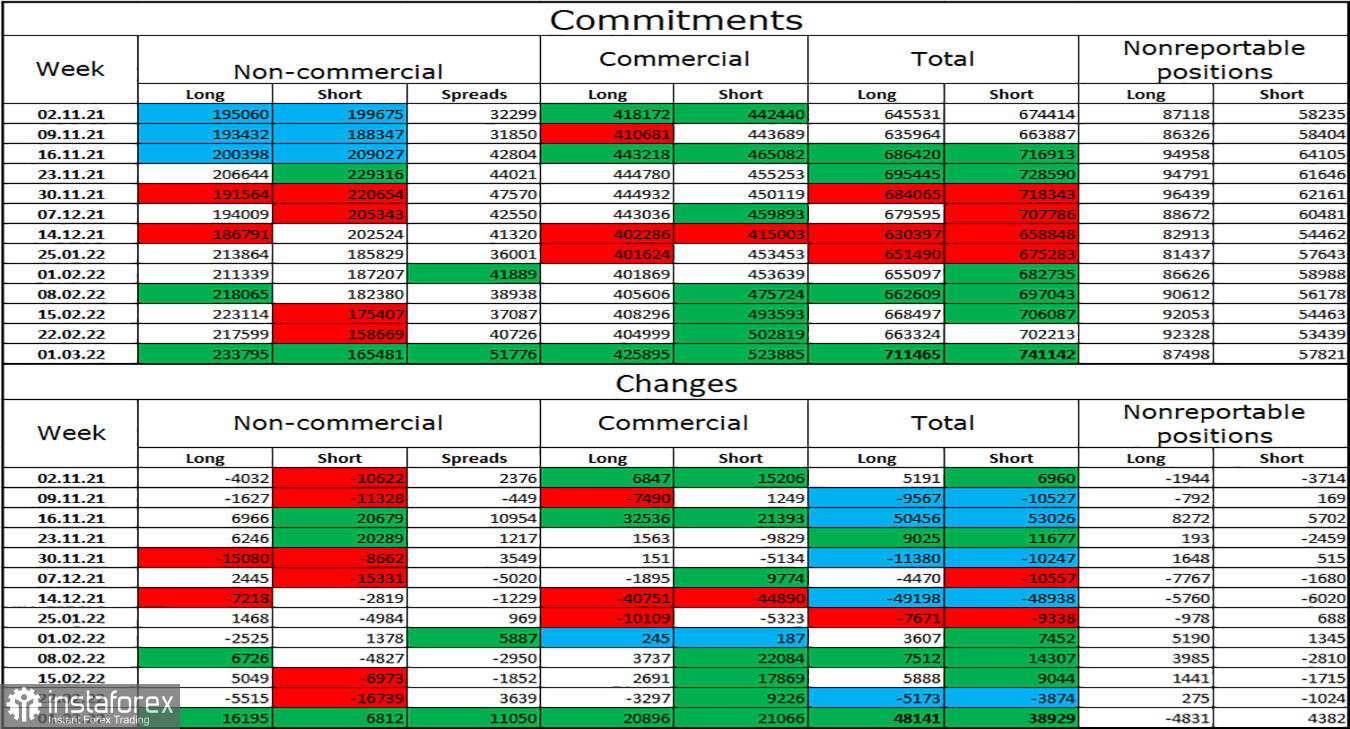

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 16,195 long contracts and 6,812 short contracts. This means that the bullish mood has intensified. The total number of long contracts concentrated on their hands now amounts to 233 thousand, and short contracts - 165 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is also characterized as "bullish". This would allow the European currency to count on growth, if not for the information background, which now supports only the American currency. We are now witnessing a paradoxical situation: the bullish mood of major players is increasing, while the currency itself is falling. And it falls very much. Thus, only geopolitics matters now.

News calendar for the US and the European Union:

On March 9, the calendar of economic events of the European Union and the United States does not contain a single interesting entry. Thus, the influence of the information background on the mood of traders today will be absent. I don't expect any geopolitical news today either.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when rebounding from the upper limit of the descending corridor on the hourly chart with a target of 1.0795. It is also possible to sell the pair when closing below the level of 1.0865 on the 4-hour chart. I do not recommend buying a pair, as the probability of a new fall in the euro currency is too high.