Europe's refusal to impose a ban on the import of Russian oil and gas somewhat calmed the energy market. This led to a significant drop in oil prices. Along with it, a fairly noticeable correction took place in the foreign exchange market. In particular, the single European currency was able to demonstrate impressive growth. Of course, it fades against the background of the previous fall, but still, it is growth. However, there can be no question of any completion of the trend for the strengthening of the dollar. What happened yesterday is just a temporary respite. Moreover, a local rebound was already suggesting itself. There just wasn't a good reason. The information background for the pound was, and still is, extremely negative.

War continues in Ukraine, which in itself provokes the flight of capital from the European continent. The sanctions confrontation between Russia and the West seems to cause the greatest damage to Western Europe, which only reinforces this trend. And by and large, the situation has not changed in any way so far, so yesterday's growth of the single European currency is really just a local rebound that does not change the overall picture. Just as today's meeting of the European Central Bank's Governing Council will not change it. And it's not just that the European regulator does not intend to change anything in its monetary policy. Even if they decide to unexpectedly raise the refinancing rate, this will only give a temporary effect. The events taking place are so large-scale, and the consequences are really unpredictable, that the level of interest rates does not matter now.

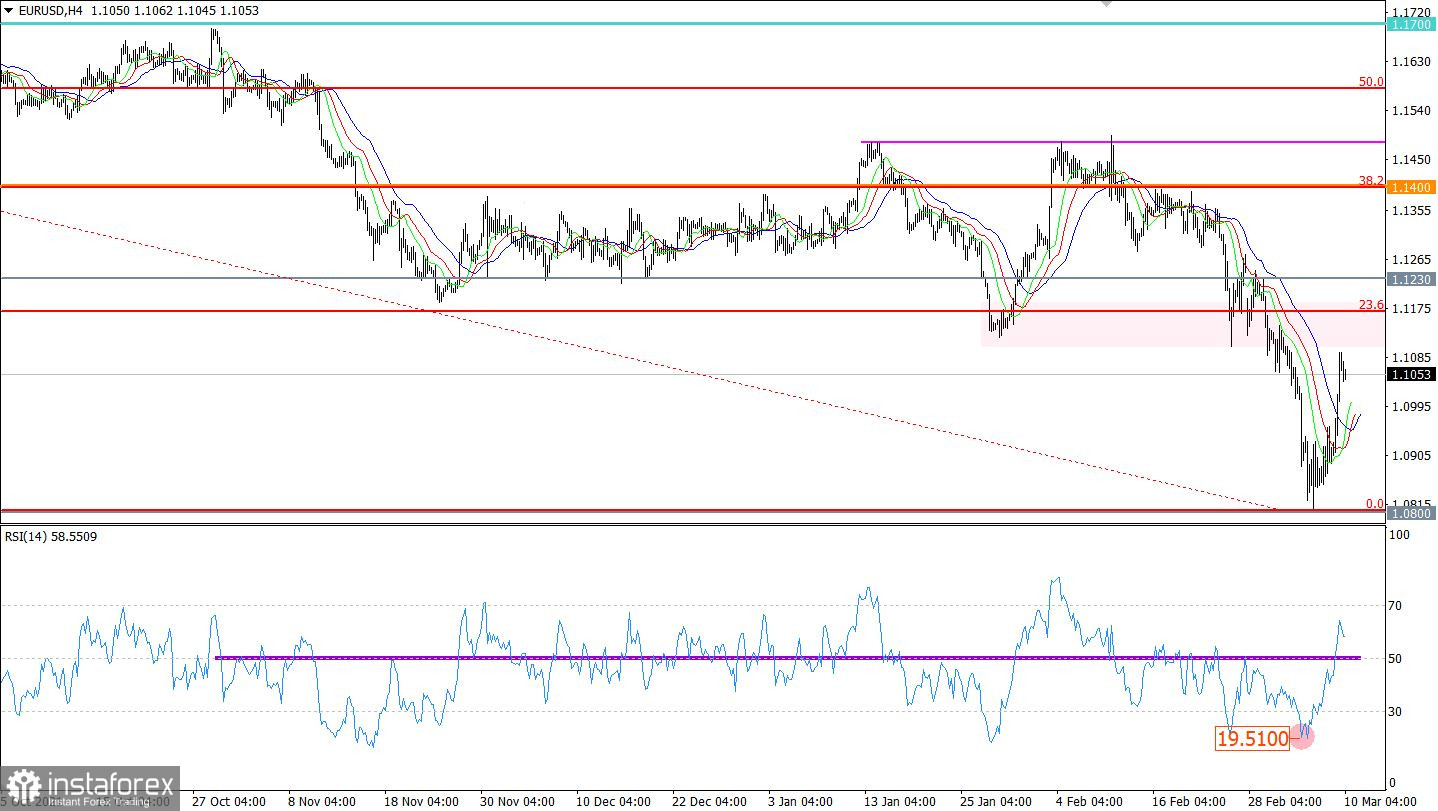

The technical correction from the support level of 1.0800 managed to return the EURUSD quote above 1.1050. This movement has led to a fairly strong strengthening of the euro in recent days, which removed the oversold status.

Now the RSI technical instrument is moving in the upper area of the 50/70 indicator in a four-hour period. This signals that the correction has a full-size view.

The Alligator H4 indicator has a crossover between the MA lines, which confirms the stage of correction and signals a slowdown in the downward trend. Alligator D1 indicates a downward trend. There are no intersections between MA lines.

Expectations and prospects:

It can be assumed that the corrective move has already reached the desired scale and soon the market will again see an increase in the volume of short positions. This move will lead to the recovery of the U.S. dollar, followed by an update of the local minimum. Traders consider the price area 1.1120/1.1180 as resistance on the way to correction.

Comprehensive indicator analysis gives a signal to buy in the short term due to a correction. Indicators in the intraday and medium-term periods give a sell signal due to a downward trend.