After the collapse of equity markets, soaring prices for crude oil, gas and other commodities, investors mainly focused on the talks between Russia and Ukraine, causing a strong upward pullback of stock indices, as well as the fall in commodity and raw material prices.

The possible reason is that the market is deeply oversold amid the Russia-Ukraine conflict. Moreover, this problem is created by the market participants as this decline is not determined by economic reasons. Therefore, markets started to pay off as some relevant news emerged in mass media, causing unprecedented demand for shares and fixation of previous profits in commodity assets.

As for the foreign exchange market, the situation was also predictable. The growing demand for risk assets resulted in the significant local weakening of the US dollar. Consequently, yesterday the dollar fell from the local high of 99.08 basis points to the closing level of 97.95.

Moreover, the change of market sentiment is questioned after yesterday's trading.

However, it is unlikely so far. This situation occurred locally as the Russia-Ukraine conflict has not been resolved. Besides, negotiations between Moscow and Kyiv will not eliminate this problem. The situation may change at least after the conflict ends.

Currently, the outcome of the ECB monetary policy meeting is considered to be the key event of the day. According to the consensus forecast, the monetary policy will remain unchanged. Besides, the ECB will keep its main interest rate at zero.

However, this event will not affect the European stock market and the euro as a geopolitical factor, mainly the confrontation between Russia and the United States, exerts considerable pressure on the markets. This factor is the reason why investors sell off risky assets after they rebound upwards and buy safe haven assets such as gold, the dollar and government bonds of economically developed countries.

Daily outlook:

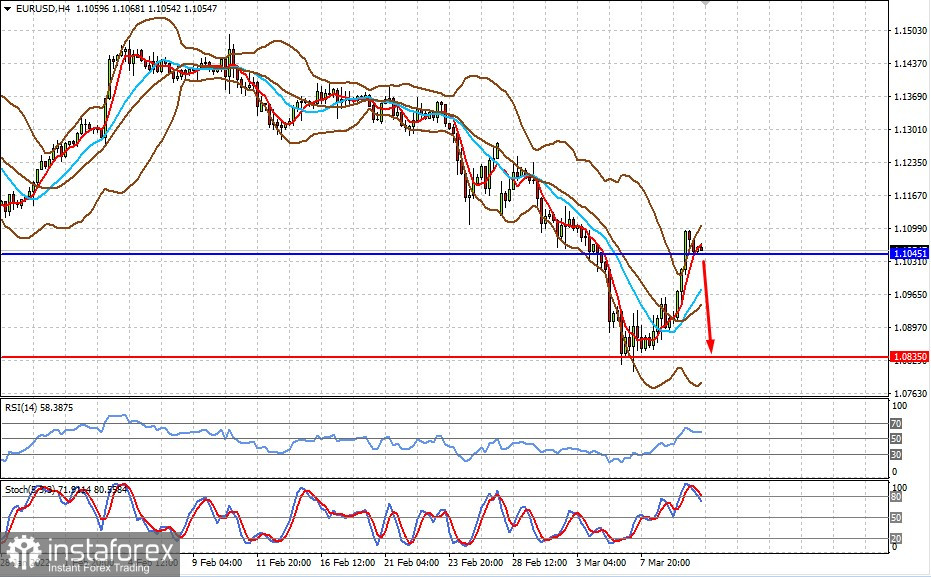

The EUR/USD pair is consolidating above 1.1045 in anticipation of the ECB monetary policy decision. If its policy remains unchanged, the pair may resume falling to 1.0835.

Spot gold found support at 1972.00. It could reverse upwards if the market negative sentiment resumes. If gold prices consolidate above this level, gold will hit the recent local high of 2066.00.