Analysis of GBP/USD and trading tips

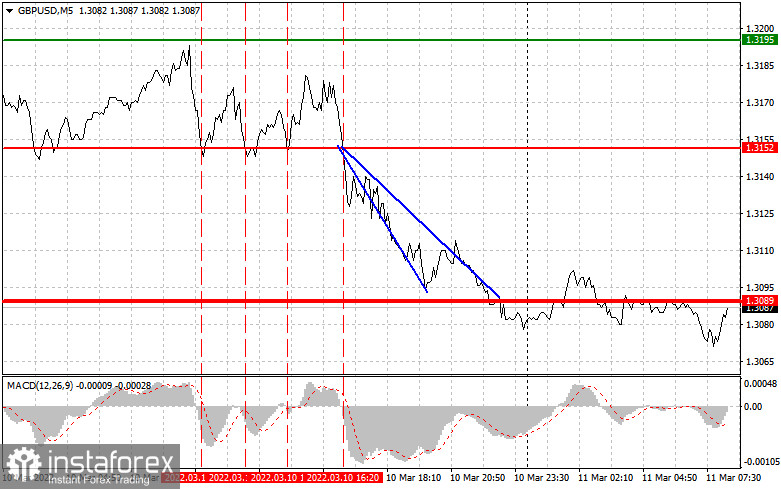

Yesterday, the pair tested the level of 1.3152 many times. The first two tests of the level took place at the beginning of the European session, when the MACD indicator was far from the zero level, thus limiting the downward momentum. At that time, traders did not receive any sell signals. The third test of the mentioned level occurred when the MACD indicator began sliding. However, this sell signal led to losses. Only the last test provided traders with a good sell opportunity. The pair lost 60 pips.

Data on the US inflation met forecasts and negatively affected the British pound. The US inflation rate climbed to 7.8% in February on a yearly basis. The indicator is likely to go on rising in March.

Early today, the UK will disclose a lot of macroeconomic reports, including the GDP data for January, industrial and manufacturing production reports, and data on the index of services. The reports may influence the future movement of the pound sterling that is still trading near its yearly lows. Weak reports are likely to cause a new wave of depreciation. That is why I recommend following scenario 1 and selling the asset. During the US trade, the UoM consumer sentiment data and the UoM inflation expectations report are slated for release. A decline in any indicator may put pressure on the US dollar. However, traders will hardly avoid trading the greenback amid the current geopolitical situation and expectations of the key interest rate hike by the Fed.

Signals to buy GBP/USD

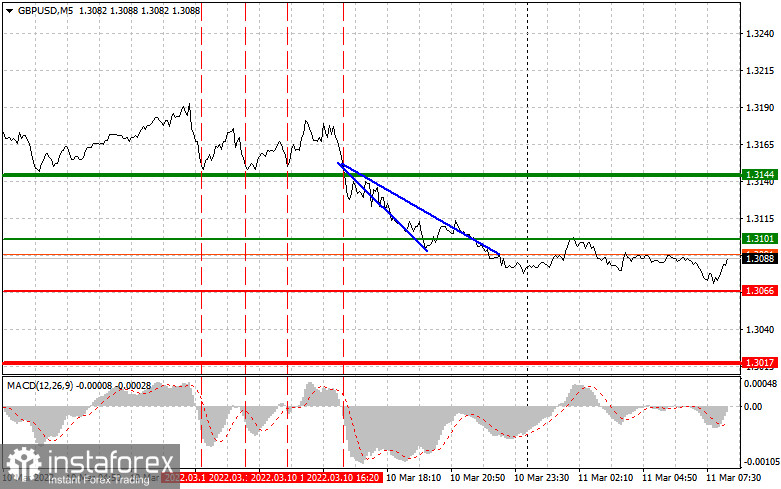

Scenario 1: Today, it is possible to buy the pound sterling when the price hits the level of 1.3101 (a green line) with the target at 1.3144 (a thicker green line). At the level of 1.3144, it is better to close buy orders and open the sell ones, expecting a drop of 1520 pips. In the first part of the day, the British pound may gain in value only thanks to strong macroeconomic data from the UK. A break of 1.3101 may force speculators to close their short positions, thus leading to a jump in the pound sterling. Importantly, before buying the asset, make sure that the MACD indicator is above the zero level and is starting its rise from it.

Scenario 2: today, it is wise to buy the British pound if the price touches 1.3066. The MACD indicator should be in the oversold area. This will limit the downward momentum and cause the price reversal. The pair may climb to 1.3101 and 1.3144.

Signals to sell GBP/USD

Scenario 1: today, traders may sell the pound sterling only after the price tests 1.3066 (a red line). This will lead to a rapid drop in the pair. The key target is located at 1.3017, where it is recommended to close sell orders and open buy positions, expecting a rise of 15-20 pips. Pressure on the pound sterling may revive at any moment. A lot depends on the UK macroeconomic reports. Under the current conditions, it will be wise to follow scenario 2. Importantly, before selling the asset, make sure that the MACD indicator is below the zero line and is starting to slide from it.

Scenario 2: traders may also sell the British currency when the price hits 1.3101. The MACD indicator should be in the overbought zone, thus capping the upward potential of the pair and causing the price reversal. The pair may decline to 1.3066 and 1.3017.

What we see on the trading charts:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.

A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Beginning traders should be very cautious when making decisions to enter the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to enter the market amid the news release, place stop orders to minimize losses. Otherwise, you may lose all your funds, especially if you do not use money management and trade big volumes.

Please remember that successful trading requires an accurate trading plan similar to the one described above. Knee-jerk decisions made amid the current market situation is a losing strategy of an intraday trader.