As expected, following the results of its regular meeting, the European Central Bank (ECB) did not make any changes to its monetary policy. The interest rate on the main refinancing operations and the interest rates on the margin credit line and deposit line remained unchanged at 0.00%, 0.25%, and minus 0.50%, respectively. However, the market did not count on this. There were some expectations that the ECB would tighten its rhetoric and give at least some signal about the beginning of a rate hike. However, we didn't hear that either. Against this background, Christine Lagarde's press conference somehow dissolved. Investors knew before that the program of purchasing net assets under the PEPP program, launched in connection with the COVID-19 pandemic, would end at the end of this month. As for bank financing, the ECB will continue to keep an eye on it, and the TLTRO III program, specially launched for this purpose, will end in June this year. As for inflation, the ECB's position, frankly speaking, continues to be wait-and-see. However, if high inflation persists - more than the regulator's medium-term forecast provides, the European Central Bank is ready to change its schedule for the purchase of net assets, namely, to adjust their size and (or) duration.

Among the main risks, quite predictably, the geopolitical conflict in Ukraine and the same too high inflation were noted. And, of course, it was not without the standard and traditional wording that the ECB is taking and will take all necessary actions within its mandate. Meanwhile, yesterday's American statistics came out in the following form. Initial applications for unemployment benefits rose above the forecast value of 216 thousand and were at the level of 227 thousand. But consumer prices, including their base value, fully coincided with economists' expectations.

Daily

Following the results of yesterday's trading, the main currency pair of the Forex EUR/USD market declined, which was facilitated by the soft rhetoric of the ECB. As can be seen on the daily chart, the pair returned under the red Tenkan line of the Ichimoku indicator and closed Thursday's trading below the most important psychological and strategic level of 1.1000. The trading of the current five-day period ends today, and the weekly candle at the time of writing retains a small bullish body and equidistant rather long shadows. Thus, it can be assumed that today will be decisive in many ways. If the pair shows growth and closes Friday's session above Tenkan, and even more so above another important technical mark of 1.1100, it will be just right to expect a further strengthening of the quote. The bearish scenario will regain its real shape if a black candle appears with a closing price below the previously broken resistance level of 1.0958.

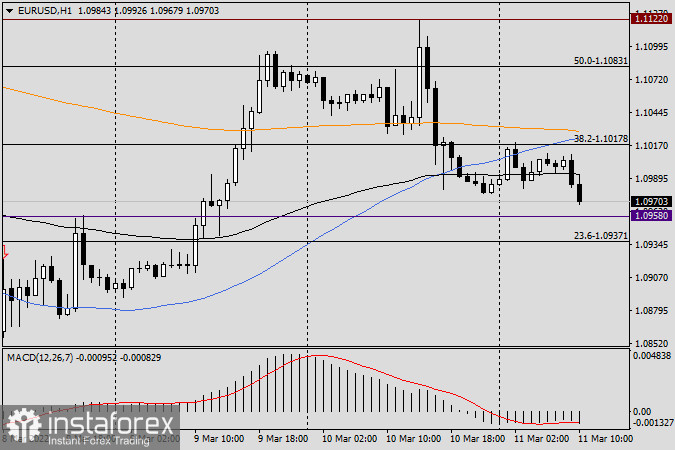

H1

On the hourly chart, we see that the euro/dollar is trading in a cluster of moving averages used: 89-EMA (black), 50-MA (light blue), and 200-EMA (orange). For trading recommendations and opening positions on EUR/USD, I suggest focusing on the designated moves. In the event of a breakdown of the black 89-exponent and fixing three consecutive hourly candles under it, on a rollback to the 89-EMA, you can try selling. The signal for possible purchases will be the breakdown of the orange 200-EMA with the mandatory fixing above. In this case, we adhere to the same tactics - we are waiting for the consolidation of three consecutive hourly candles over the 200th exponent, and on the rollback to the 200th EMA we try to buy a pair. Once again, I would like to remind you that Friday is not the best day to open new positions. On the contrary, on the last day of weekly trading, many traders close previously opened deals, and against the background of profit-taking, various and far from pleasant surprises are possible in the price movement of a particular trading instrument. In particular, adjustments and (or) multidirectional movements of the exchange rate are likely.