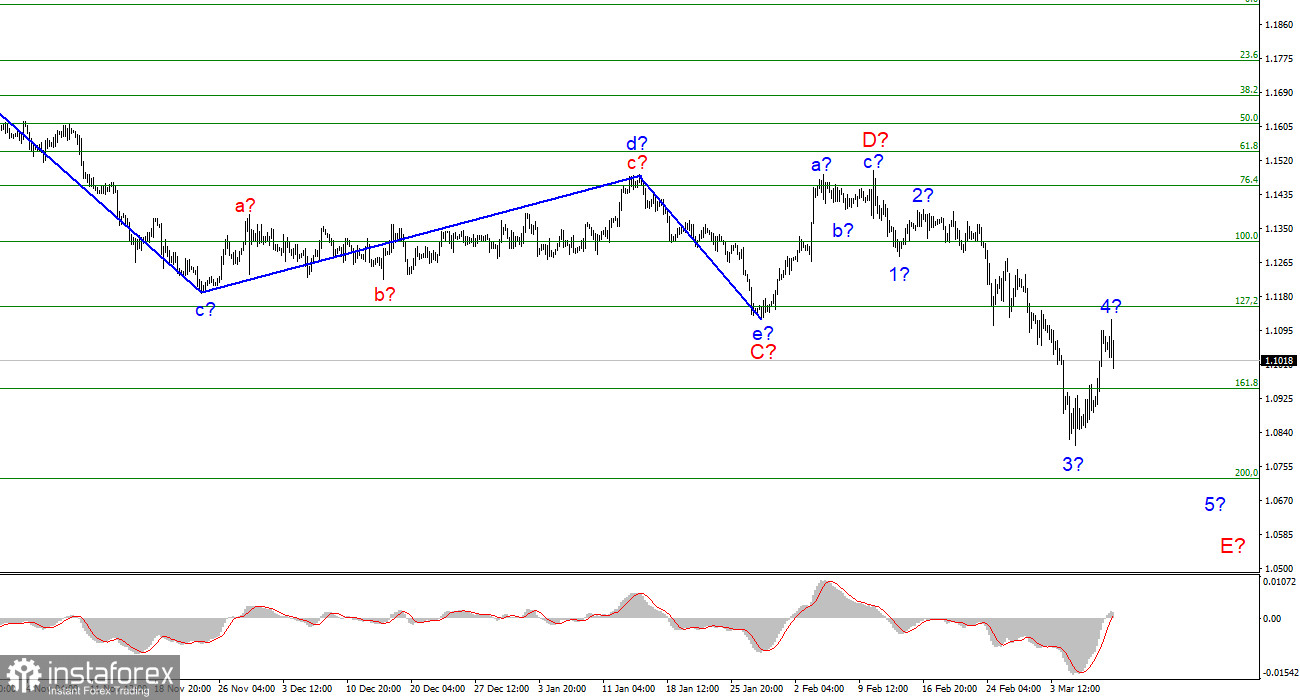

The wave marking of the 4-hour chart for the euro/dollar instrument still does not change and looks quite convincing. At this time, the construction of the proposed wave E is continuing, which should take a five-wave form. The low of the previous wave was broken, so the construction of a downward trend section is preserved. I have applied small waves to the wave marking, but they are most likely not internal waves in E, but internal waves in the first wave in E. That is, the entire wave E can take a much longer form than it is now. One way or another, the internal wave marking of this wave indicates that wave 4 has now been completed, and the construction of wave 5 has begun. If this assumption is correct, then the decline in quotes will continue next week. After the completion of the first wave in E, you will need to get confirmation that this is only the first wave, and wave E itself will not receive a shortened form. This will largely depend on geopolitics. If the military conflict in Ukraine intensifies, it may lead to a new drop in demand for the European currency.

The euro is falling even when there are no reasons for it.

The euro/dollar instrument fell by 80 basis points on Friday. Before the military conflict in Ukraine, 80 points per day was considered a very strong movement. But now the instrument travels such distances almost every day. This suggests that market activity has grown and remains high. Strangely enough, but on Friday, there were no new reasons for the fall in demand for the euro. Yesterday, the news background was practically absent, however, the market found a reason to resume selling the instrument. The only report of the day is the consumer sentiment index from the University of Michigan. However, its value turned out to be worse than market expectations, and it can also be called important only with a very big stretch. Thus, I believe that it did not have any impact on the market.

But there were a lot of economic statistics a day earlier. And I am inclined to believe that the market has continued to work it out. Let me remind you that inflation in the United States continues to accelerate, and next week the Fed will hold its second meeting this year, at which a decision on raising the rate will be made almost one hundred percent. Therefore, I am not at all surprised by the new appreciation of the dollar. Do not forget that even though the geopolitical conflict in Ukraine has moved into a less acute phase, it is still not completed and may turn into a long-term conflict. Such as we have observed in the last 8 years in the Donbas. Almost no one doubts that sanctions against Russia will not be lifted in the coming years, but more and more restrictions will probably be introduced. All this suggests that it is simply impossible to talk about improving the situation now. The worse the relations between the EU and Russia will be, the more expensive oil and gas will cost, which is very unprofitable for the European economy.

General conclusions.

Based on the analysis, I conclude that the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". The construction of the next corrective wave has been completed, and a successful attempt to break through the 161.8% Fibonacci mark indicates that the market is ready for new sales of the euro currency.

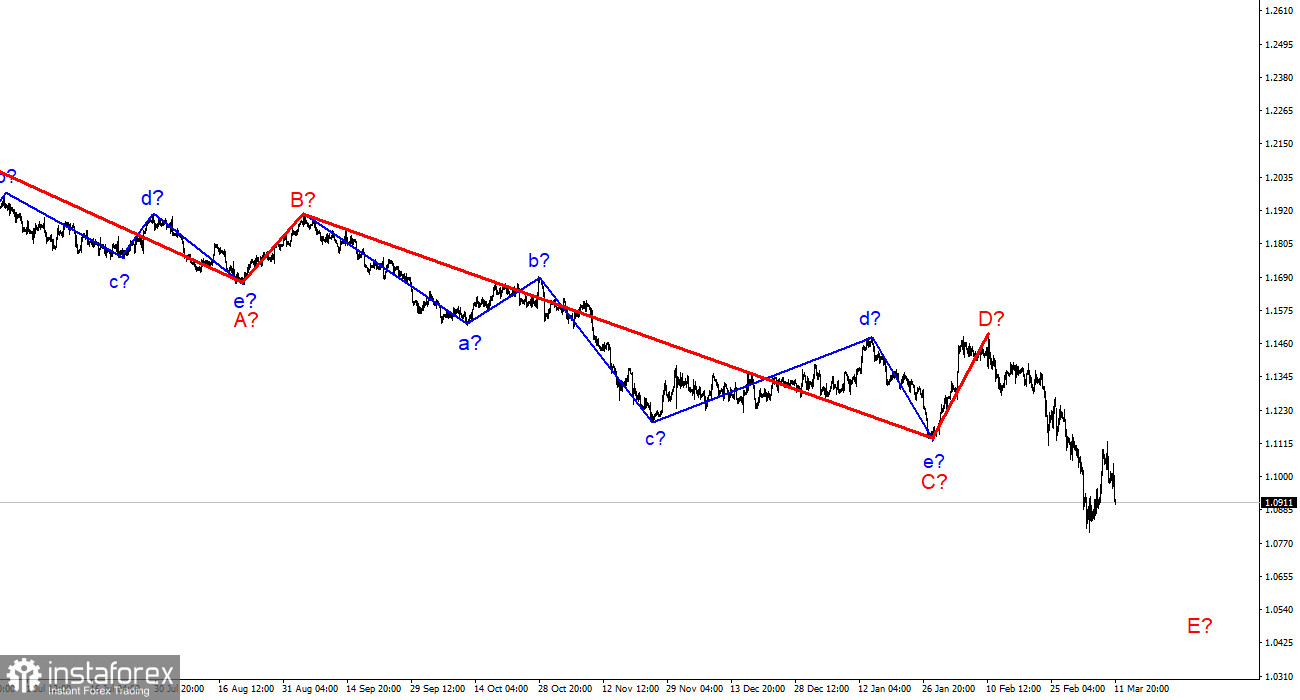

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has already updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built now, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will decline for a long time, although a couple of weeks ago many expected to build a new, upward trend section.