The new trading week is expected to be volatile amid geopolitical tensions, the March meeting of the US Federal Reserve, and the publication of important macro reports in the eurozone and the United States. All these fundamental factors are likely to trigger extreme volatility for all the dollar currency pairs.

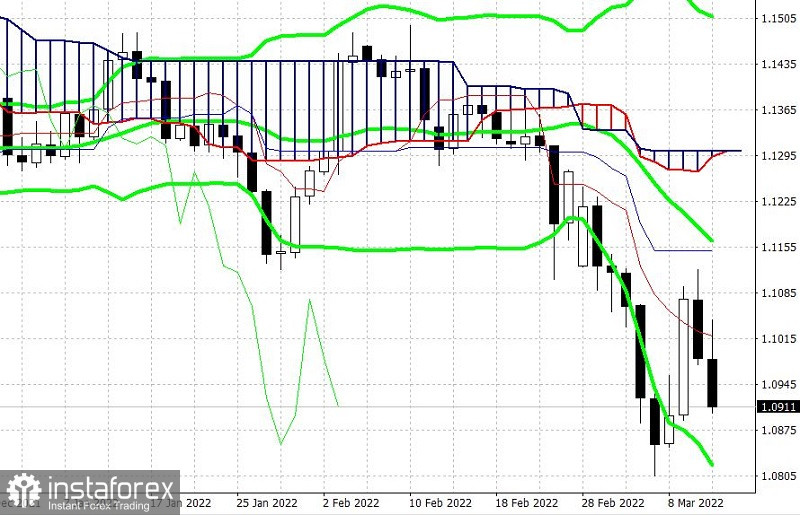

The greenback may strengthen further this week, allowing bears to drive the EUR/USD pair down to 1.0810. The preliminary fundamental background stands in favour of a stronger dollar. Decreasing risk appetite and a hawkish outcome of the March FOMC meeting will allow the dollar bulls to start yet another rally. The euro, in its turn, is expected to incur losses due to increasing risks of stagflation and the dovish rhetoric of the ECB. The ZEW index, scheduled for this week, will reveal current economic sentiment in the eurozone.

On Monday, March 14th, the macroeconomic calendar will be empty. Therefore, geopolitical developments will set the tone for trading during the day. The Ukrainian conflict will not be the only one in focus. Traders will also pay attention to Taiwan and the Middle East. On Sunday, missiles hit areas around the US consulate in Iraq's Erbil. Iran-backed militia groups in Iraq had used armed drones to attack the US troops deployed near the airport before. However, there have been no such attacks for several months. The missiles were fired from outside Iraq's borders, according to the regional government. Against this backdrop, tensions between Washington and Tehran may escalate, some analysts say. In this light, demand for the greenback may mount. However, this fundamental factor is likely to have a short-term impact as the US Department of State showed a neutral reaction to the missile attack and just condemned it. US officials said there were no reports of casualties from the attack.

Speaking of the Ukrainian conflict, it will only provide background support to the dollar and exert similar pressure on the euro. The negotiation teams for peace talks say they stay in touch via video chat. The greenback as a safe haven will enjoy growing demand and the euro will feel pressure until any breakthrough is achieved.

As for Taiwan, China has adopted a more aggressive stance, saying it will firmly oppose any separatist activities seeking "Taiwan independence". "Taiwan will eventually return to the embrace of the motherland," China's Foreign Ministry said. The Ministry of National Defense said China will not tolerate Taiwan independence and hinted that the country is ready to use tough measures. These statements clearly reflect Beijing's rhetoric.

The ZEW index will exert additional pressure on the euro this week. In Germany, the figure is estimated to plunge to 5 points in March from 54 points in February. In the eurozone, it is forecast to plummet to 10 points versus 48 points. If actual results come in line with market expectations, the euro will come under tremendous pressure.

Aside from geopolitical developments, the March FOMC meeting will be the central event this week. Its outcome will be announced on Wednesday. The Federal Reserve is expected to hike rates by 25 basis points. A 50 basis points increase is unlikely, according to analysts. The labor market has fully recovered to the pre-crisis level and inflation keeps growing, paving the way for a 25 basis points hike. Amid turmoil in financial markets caused by recent geopolitical developments, the likelihood of a more aggressive stance seems less possible.

Experts doubt that the US central bank will announce the reduction of its balance sheet at the meeting. They assume the Fed's chairman will just hint that the regulator is ready for it but will not specify the timing and the size of the balance sheet reduction. So, the greenback is likely to either maintain its current positions or strengthen against the basket of all currencies after the FOMC meeting.

Demand for the dollar will remain strong in the short-term. Any rebounds of the euro/dollar pair could be used for going short. The euro is very weak right now, while the greenback is in demand as investors shift towards safe-haven assets.

Technically, the pair is in the downtrend, which is confirmed by the Ichimoku indicator on the daily chart. In all the higher time frames, the price is either below the lower band or between the middle and the lower bands of the Bollinger Bands indicator. Support stands at the lower band of the Bollinger Bands indicator on the daily chart, in line with the 0.0810 level. It would be wise to take a profit in this price range.