The complete absence of any macroeconomic data is not something significant or fundamental, since the development of events in the markets depends solely on what is happening in Ukraine. Macroeconomic statistics are of no importance now. Moreover, all the published data so far show what it was before the start of the special operation of the RF Armed Forces.

Since its inception, the world has changed dramatically. Europe is already facing skyrocketing inflation and even restrictions on the number of goods sold per person. It is quite obvious that absolutely all macroeconomic indicators will drop strongly in the near future. The European Union is already predicting not only an increase in inflation, but also a resumption of recession. The likelihood of such a development of events is extremely high.

So it's not surprising that the last two trading days of the past week, the single European currency was only engaged in losing its positions. Since the beginning of the special operation, it has decreased by almost four hundred points. Over the weekend, the situation has not changed, so the single European currency is likely to continue this trend.

Only a cessation of hostilities can change what is happening in the markets. However, negotiations have so far yielded nothing. People still continue to die. As a result, the flow of refugees to Europe is only increasing. Which of course exacerbates the situation with rising prices. So the only thing that can help the single European currency now is the cessation of hostilities. In principle, this is the only thing that the whole world needs now.

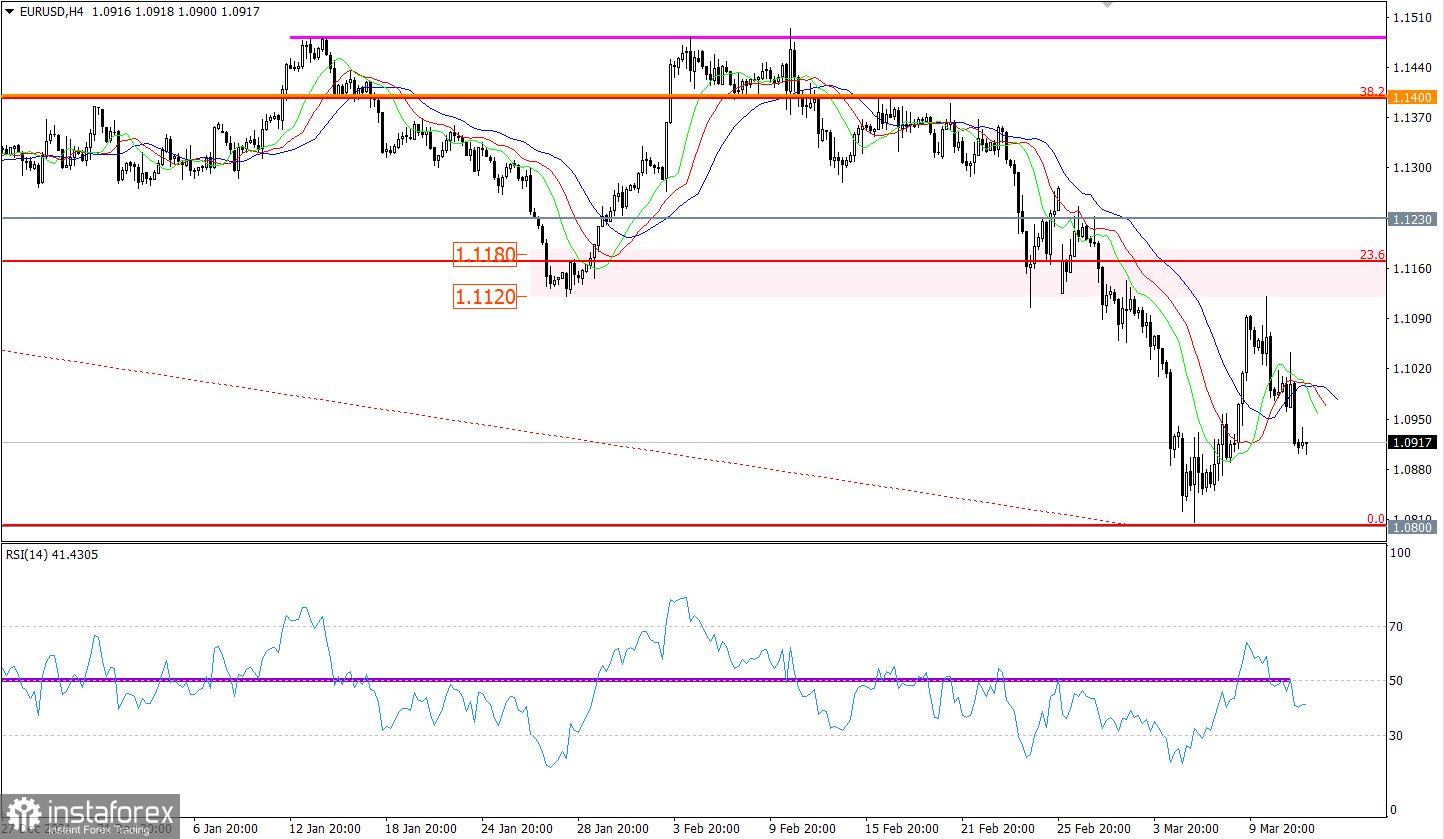

The EURUSD currency pair has restored the downward movement by more than half of the recent corrective movement. This move signals that dollar positions are again seen as the main ones in the market.

The RSI technical instrument moves in the lower area of the indicator in the four-hour and daily periods. This means that interest in short positions prevails among traders.

The Alligator H4 indicator confirmed the completion of the correction by the intersection between the MA lines. After that, the indicator rushed down. Alligator D1 is holding downward trends. There are no intersections between MA lines.

Expectations and prospects:

It can be assumed that the downward sentiment will eventually lead traders to the recent pivot point of 1.0800, which will signal a prolongation of the medium-term trend in the market.

Comprehensive indicator analysis gives a sell signal in the short, intraday, and medium-term periods due to the price reversal.