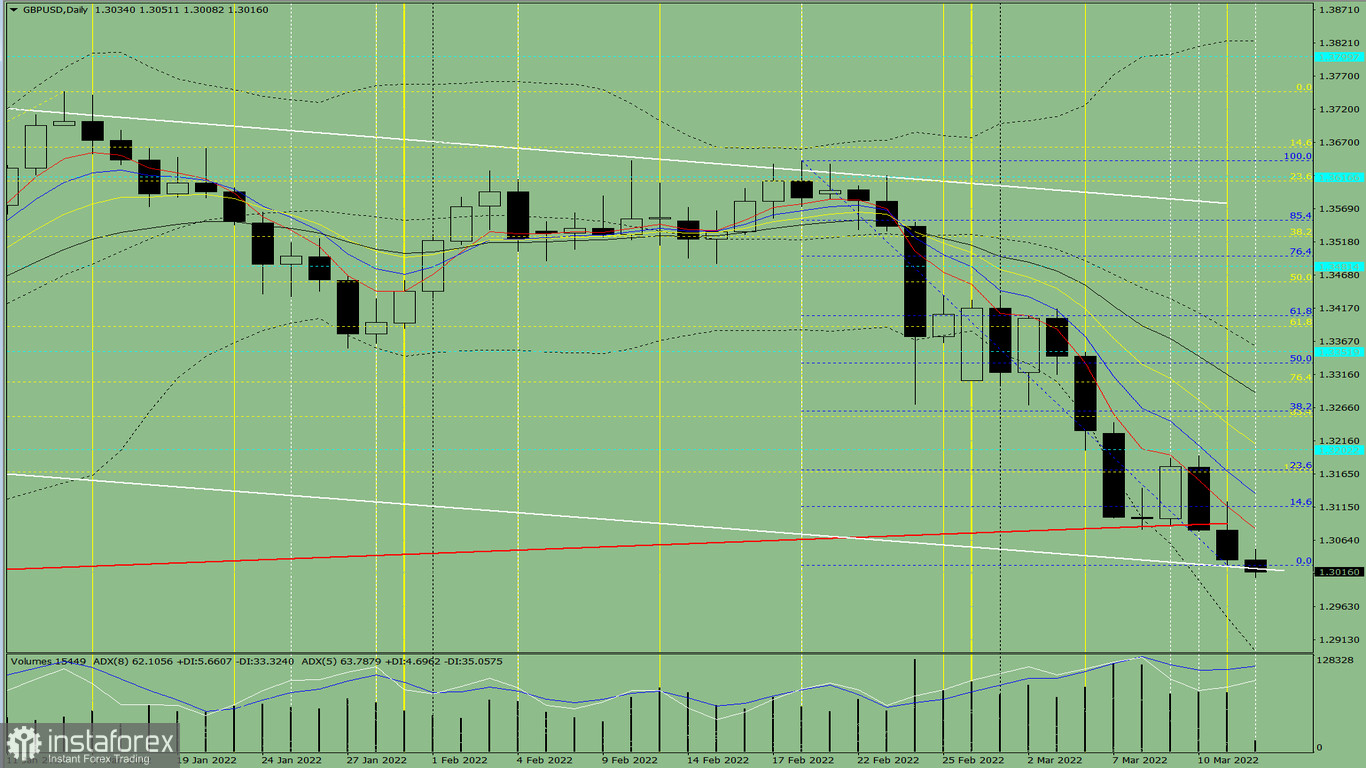

Trend analysis (fig. 1).

On Monday, the price is likely to rise from the level of 1.3034 (closing of Friday's daily candlestick) to an upward target of 1.3116, the Fibonacci retracement level of 14.6% (blue dotted line). When testing this level, the pair may grow to the target level of 1.3171, the Fibonacci retracement level of 23.6% (blue dotted line).

Fig. 1 (daily chart).

Complex technical analysis:

- indicator analysis– up;

- Fibonacci retracement levels - up;

- trading volumes - up;

- candlestick analysis - up;

- trend analysis - up;

- Bollinger lines - up;

- weekly chart-up.

Conclusion:

Today, the price is likely to rise from the level of 1.3034 (closing of Friday's daily candlestick) to an upward target of 1.3116, the Fibonacci retracement level of 14.6% (blue dotted line). When testing this level, the pair may grow to the target level of 1.3171, the Fibonacci retracement level of 23.6% (blue dotted line).

Alternatively, the price may decline from the level of 1.3034 (closing of Friday's daily candle) to the target level of 1.2895, which is the lower limit of the Bollinger line indicator (black dotted line). From this level, it may rise to 1.3116, the Fibonacci retracement level of 14.6% (blue dotted line).