Given the tense geopolitical situation in Ukraine, the world has taken action and grabbed most of Russia's reserves. Biden has dropped a financial bomb on Russia. An important financial blockade was made by him by excluding payments related to energy, given Europe's dependence on Russian oil and natural gas. This is important because the prices of commodities such as oil and wheat are skyrocketing. China thus finds itself in the fortunate position of a commodity crisis to strengthen its currency.

Russia is one of the world's largest commodity exporters. However, due to sanctions, Russian goods are now less desirable than goods from other countries. The People's Bank of China, which has vast amounts of domestic money sitting in the US that may now be withdrawn, may sell treasury bonds to finance the purchase of Russian goods for protection. Apart from giving China control over inflation, such actions could lead to a shortage of goods and a recession in the West. This is worth paying attention to!

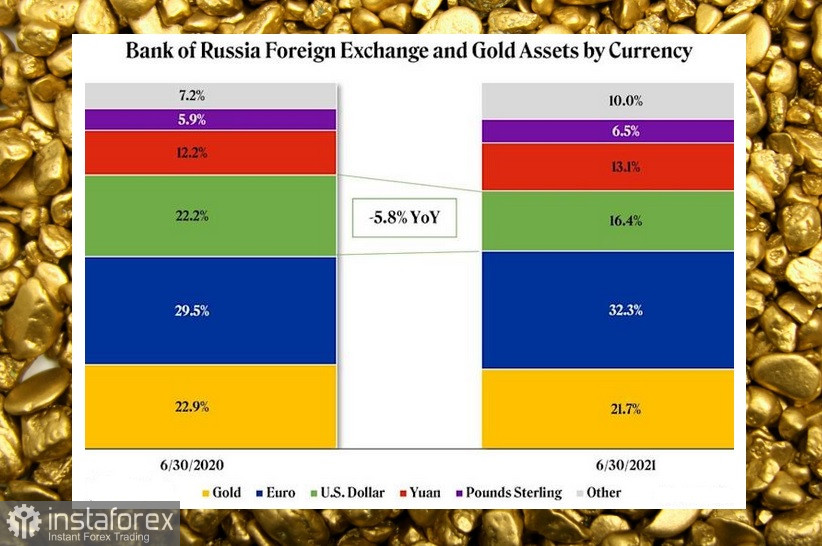

For the past few years, Russia has been selling assets in US dollars for gold.

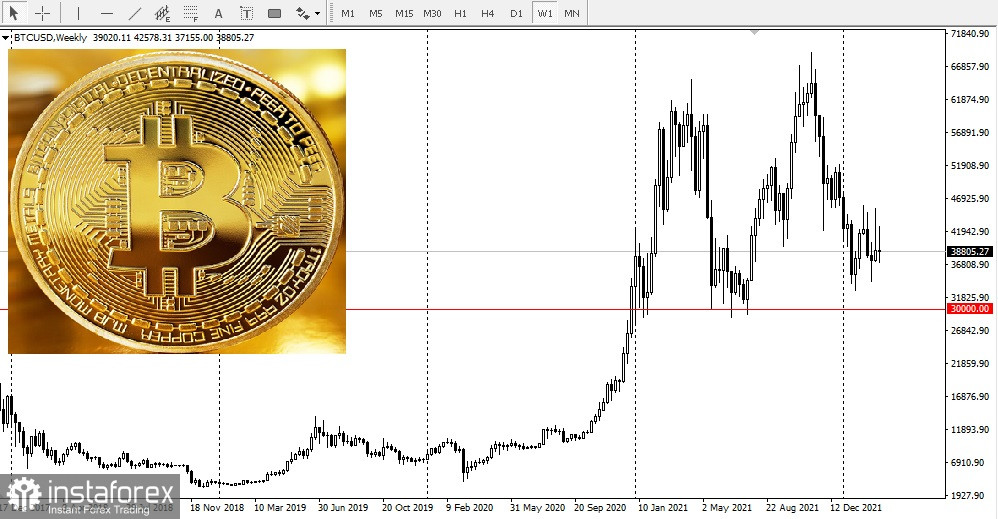

If we associate Russia's partial ban on the use of SWIFT, a messaging system that supports international banking transactions, with the new confiscation risk related to US domestic money, we can see the beginning of a new currency regime. We now face a world in which there may be a greater focus on external money, such as gold and other commodities, as countries increase their reserves. Alternatively, they may turn to bitcoins.

If we associate Russia's partial ban on the use of SWIFT, a messaging system that supports international banking transactions, with the new confiscation risk related to US domestic money, we can see the beginning of a new currency regime. We now face a world in which there may be a greater focus on external money, such as gold and other commodities, as countries increase their reserves. Alternatively, they may turn to bitcoins.