EUR/USD

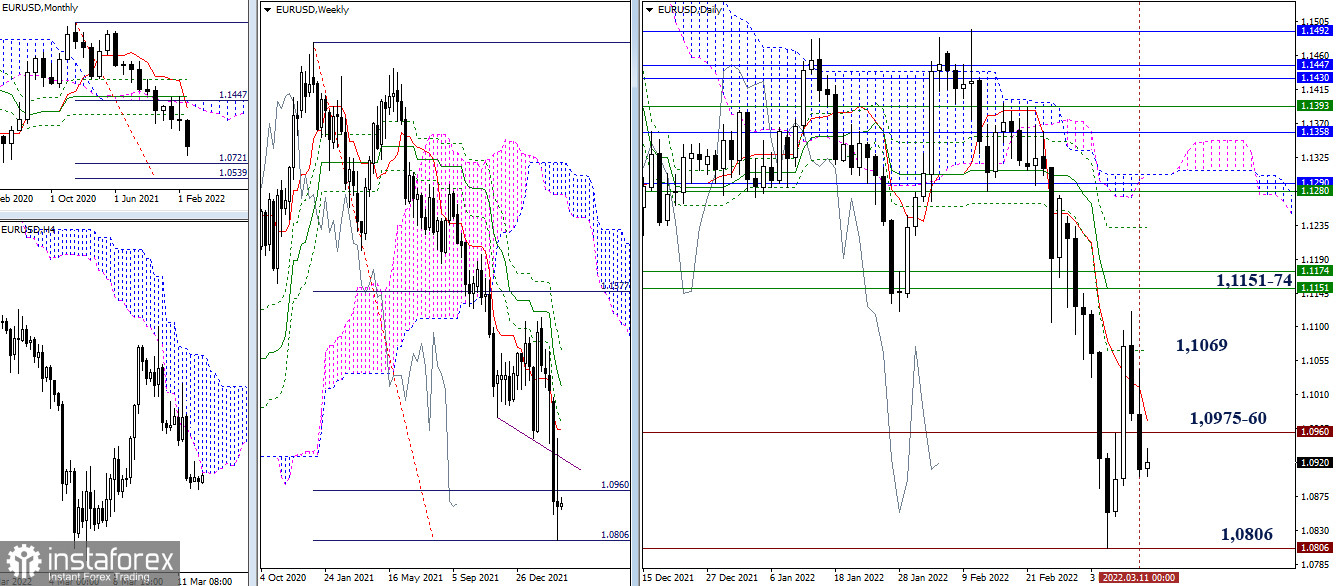

When executing the point-to-point target for the breakdown of the weekly Ichimoku cloud (1.0806), the pair formed a minimum extremum and stopped the decline. The subsequent corrective rise, after testing the daily resistance, was also suspended. As a result, the pair closed last week with a candle of uncertainty, while maintaining the value and location of the most important levels in this area.

The center of attraction in the current conditions may be 1.0975-60 (daily short-term trend + the first target of the weekly target). Among the nearest upward targets today, 1.1069 (daily Fibo Kijun) and 1.1151-74 (weekly levels + daily Kijun) can be noted. The main downward reference remains the minimum extremum (1.0806), consolidation below which will restore the downward trend and go beyond the weekly target.

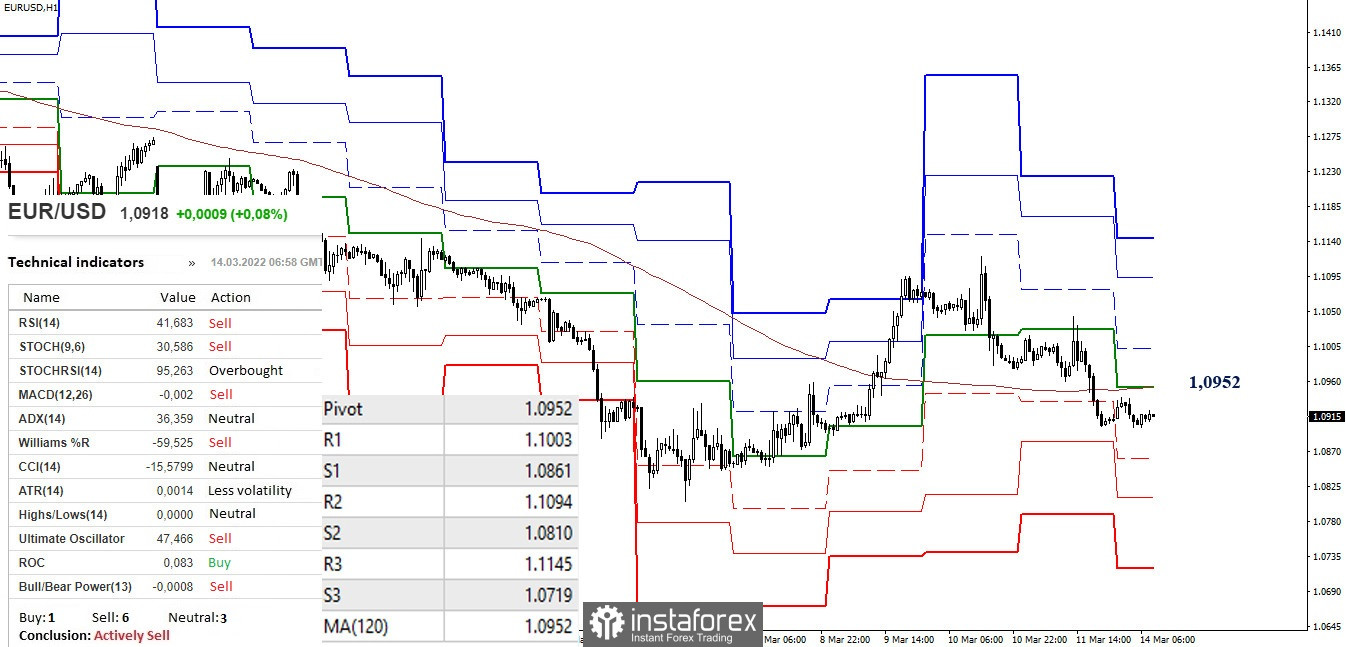

The key levels of the lower timeframes have united at the line of 1.0952 (central pivot point of the day + the weekly long-term trend). The persistence of uncertainty will keep the pair in the zone of attraction of key levels. Consolidation and working above or below the levels will empower those who can organize it. Attempts to change the situation may lead bulls to test the resistance of the classic pivot points (1.1003 - 1.1094 - 1.1145), and bears, if they are active, can be expected at the boundaries of the support of the classic pivot points (1.0861 – 1.0810 – 1.0719) within the day.

***

GBP/USD

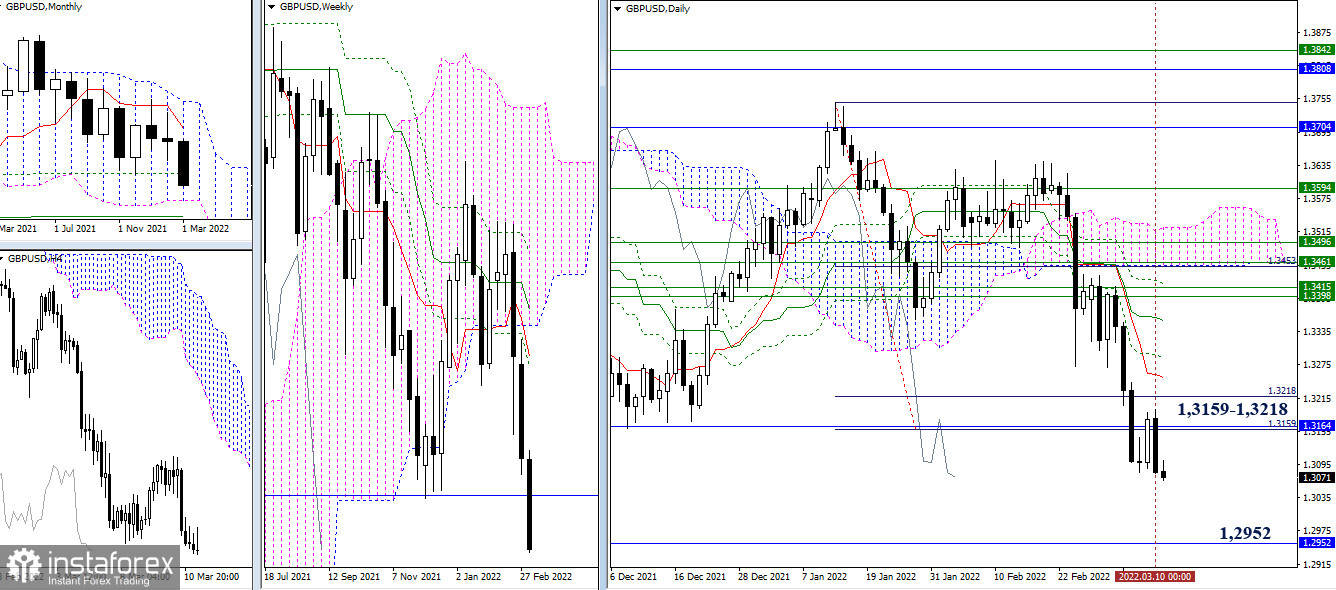

Last week ended as optimistic as possible for bearish players, who, having retested the broken daily target, set a new low at the close of the week. If the bears retain their potential and continue to decline, then the nearest downward reference points in this area are now the monthly levels of 1.2952 and 1.2830. When bulls restore their positions, the levels passed the day before, now combined in the resistance zone in the region of 1.3159 - 1.3218, will play the role of priority tasks.

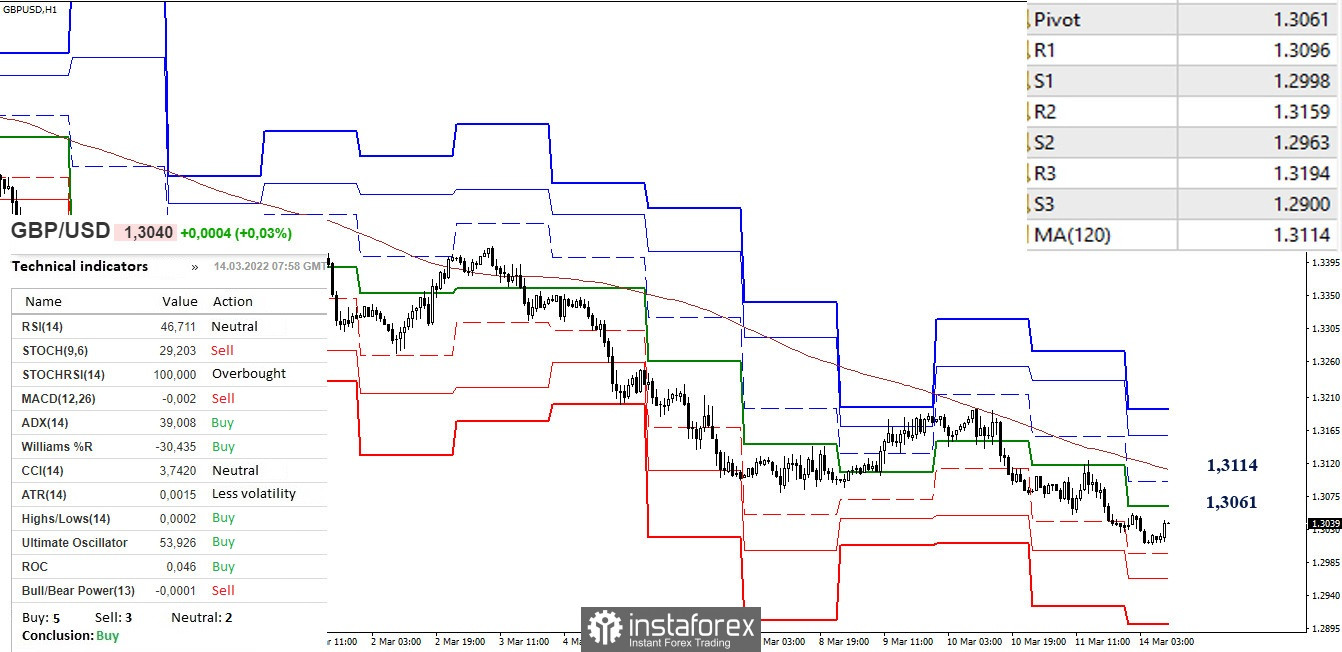

In the lower timeframes, the main trend is downward, but at the moment there is a corrective rise. The main reference points for the emerging correction in the current situation are the key levels of 1.3061 (central pivot point) and 1.3114 (long-term weekly trend). Further upward references within the day will be the resistance of the classic pivot points (1.3159 - 1.3194). When the correction is completed and the decline continues, the reference points for bears will be the support of the classic pivot points (1.2998 – 1.2963 – 1.2900).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)