Gold crashed in the short term and now is trading at 1,776 at the time of writing. It has dropped by 2.78% from Tuesday's high of 1,824 to 1,773 today's low. XAU/USD turned to the downside as the Dollar Index rallied.

As expected, the FED, ECB, SNB, and BOE increased the interest rates by 50 bps. Further rate hikes are natural as long as the inflation remains high. The US reported mixed data earlier today.

Tomorrow, the Eurozone, UK, and US manufacturing and services figures could move XAU/USD. Both sectors are expected to remain in the contraction area.

XAU/USD Hovers Above Support!

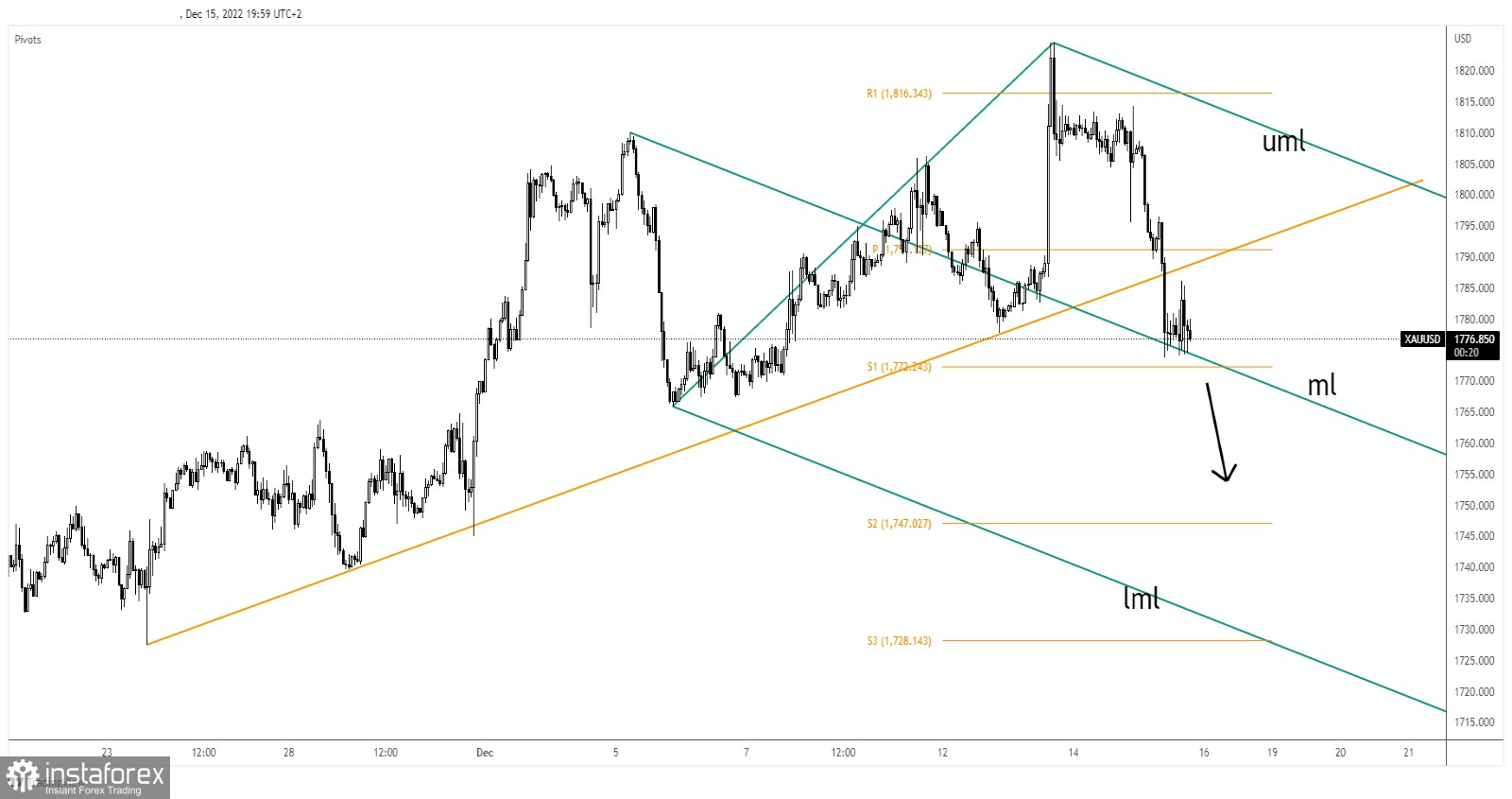

From the technical point of view, XAU/USD ignored the weekly pivot point of 1,791 and the uptrend line which represented downside obstacles. Now, it has found temporary support on the median line (ml) of the descending pitchfork.

The weekly S1 (1,772) represents a downside obstacle as well. After its massive drop, we cannot exclude a temporary rebound. The rate could come back to test and retest the broken levels.

XAU/USD Forecast!

A valid breakdown below the median line (ml) and below the S1 (1,772) opens the door for more declines. This is seen as a short signal.