The European Union, as Josep Borrell said, seems to have really exhausted all possibilities for sanctions against the Russian Federation. The new sanctions package can be called purely symbolic, as it affects only a number of individuals and legal entities. In addition, Brussels intends to apply to the World Trade Organization to suspend the most favored nation treatment for the Russian Federation. But this point will have practically no effect, since Russia has not exported any goods to Europe anyway, except, of course, for raw materials. So the introduction of protective duties, especially against the backdrop of full-scale sanctions, will not affect the Russian economy in any way. It turns out that at least the European Union does not intend to further intensify the sanctions confrontation, and it is quite possible that the Russian Federation will reciprocate. Which, of course, somewhat calms the market participants.

But another point is much more important. If we believe the statement of the official representatives of Ukraine, the negotiation process seems to have moved from a dead point and some kind of peace agreement will be reached in the near future. At least Aleksey Arestovich, adviser to the head of the office of the Ukraine President, said that it could be achieved within a week. And this means that hostilities may soon stop, and with it, the flow of refugees to Western Europe will stop. And after all, it is the hostilities that are the main reason for the rather large-scale weakening of not only the single European currency, but also the pound. The very prospect of their termination in the near future is already contributing to their growth, which we have been observing since yesterday. If the situation does not change and moves in this direction, then growth will continue.

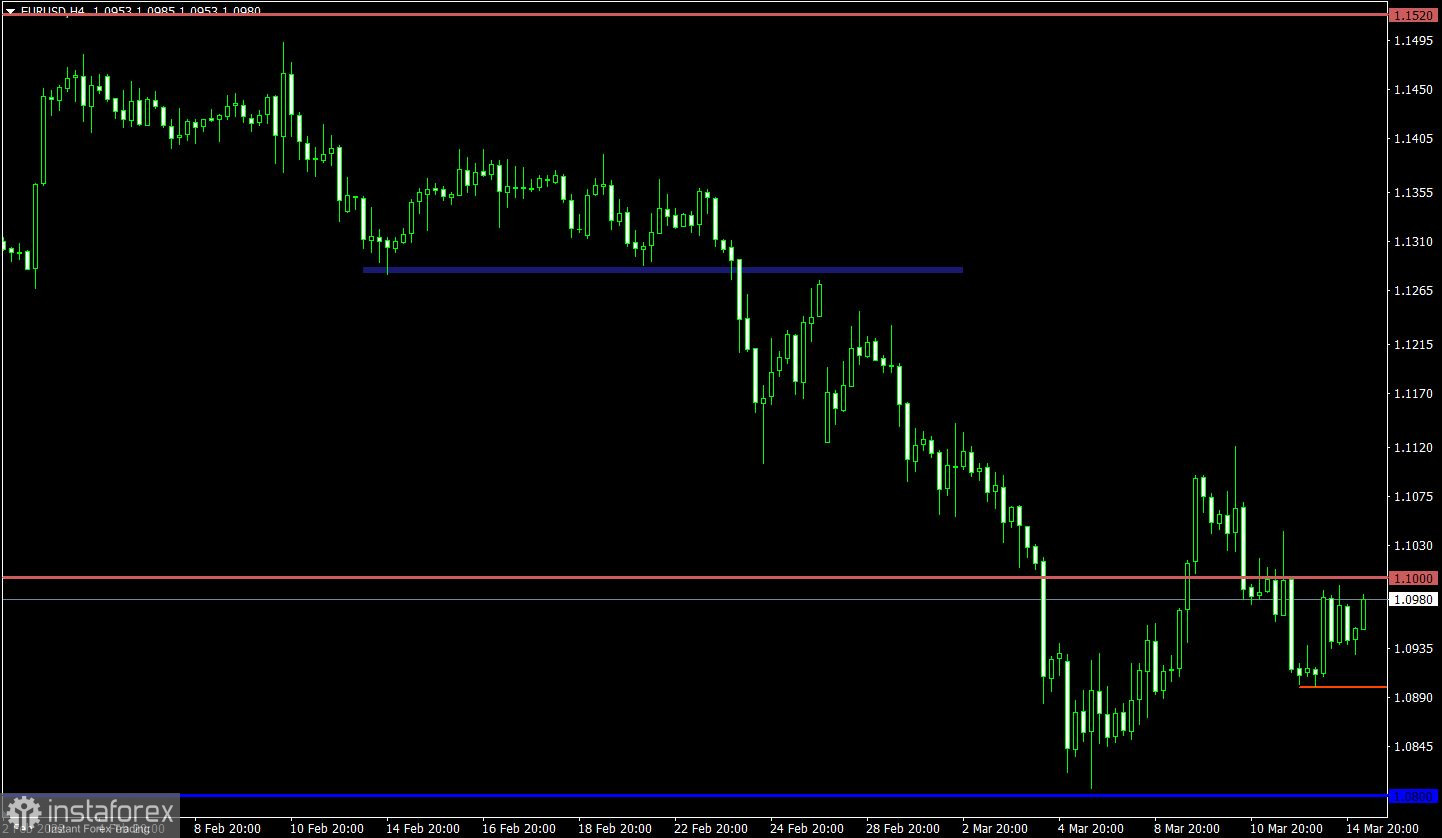

The EURUSD currency pair slowed down the downward cycle around the value of 1.0900, where at first there was a stagnation, and then a price pullback. It can be assumed that the pullback stage is still relevant in the market, but in order for the volume of long positions to increase, the quote needs to stay above the level of 1.1000. Otherwise, another attempt to break through the value of 1.0900 is not ruled out.

The GBPUSD currency pair, during a rapid downward movement, reached the level of 1.3000, where there was a reduction in the volume of short positions and, as a result, a pullback. In this situation, the psychological level is the main barrier to sellers. Thus, the subsequent increase in the volume of short positions will occur only after the breakdown of this level with confirmation in the form of holding the price below the value of 1.2950. Until then, traders are considering the pullback stage.