Hello, dear traders!

The most important macro events that could have a significant impact on GBP/USD will be the interest rate decisions by the US Federal Reserve and the Bank of England as well as their heads' rhetoric. Nevertheless, other macro reports also deserve traders' close attention. At the moment of writing, data on the United Kingdom labor market should come out. The PPI and its core value will be the most significant events on the United States macroeconomic calendar today. Let's now take a look at the daily chart.

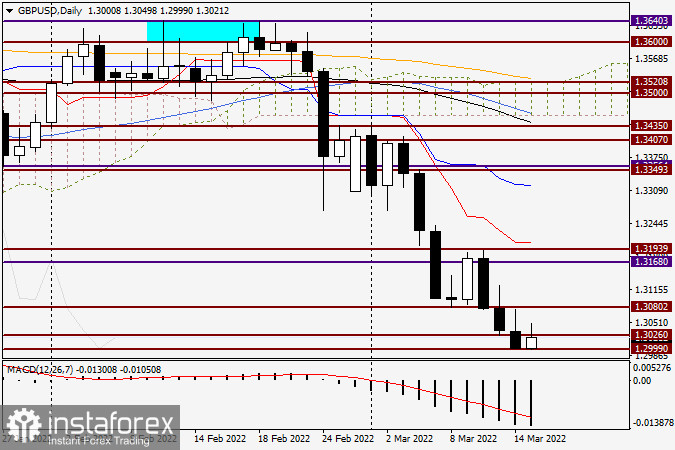

Daily

Unlike the euro, the pound sterling showed no growth yesterday. Ahead of the BoE monetary policy meeting and the possibility of a 25 basis points rate hike, the British currency is feeling some pressure. Given the dovish ECB and the hawkish BoE, it is not exactly clear why the pound is getting weaker compared with the euro. The British pound may be experiencing strong pressure versus the dollar because of the bullish euro/pound cross rate. Oftentimes, EUR/GBP has a significant impact on the major currency pairs of EUR/USD and GBP/USD.

Yesterday, GBP/USD fell to the psychological and historical level of 1.3000. GBP bear tried to close below the mark, but the quote settled exactly at 1.3000. Today, the pair will attempt to advance. As for EUR/GBP, the pair remains bullish. There is little doubt that this factor is adding pressure on the British currency versus the dollar and limits its current upside potential. Meanwhile, data on the United Kingdom labor market came out better than expected. The unemployment rate fell to 3.9%, below market expectations of 4%. However, the market's reaction to such strong results is rather strange as the pound showed absolutely no growth. Anyway, anything can happen in the markets. Therefore, you should always be prepared for any price movement as well as any outcome. It seems that the downtrend on GBP/USD is getting deeper. Such a possibility and the reaction of market players will become more evident after both central banks announce their monetary policy decisions.

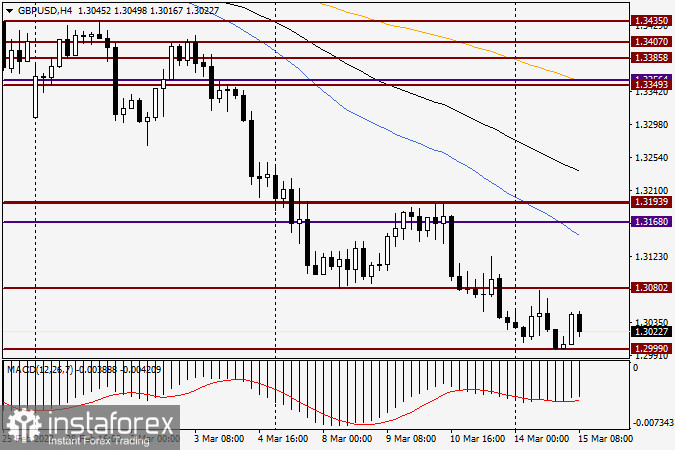

H4

Despite the strong labor market report, the pound remains under bearish pressure, according to the H4 chart. However, the situation may soon reverse, and the sterling will strengthen against its American counterpart. If so, the nearest target level will stand in the 1.3075-1.3080 range with the broken 1.3080 barrier. In spite of bearish pressure and strong labor market results, it would be unwise to go short at the round level of 1.3000. The quote may hover around this mark for a while, expecting the regulators' decisions. Therefore, short positions could be considered above the established range. If no rebound takes place, you should refrain from trading GBP/USD for a while.

Best of luck!