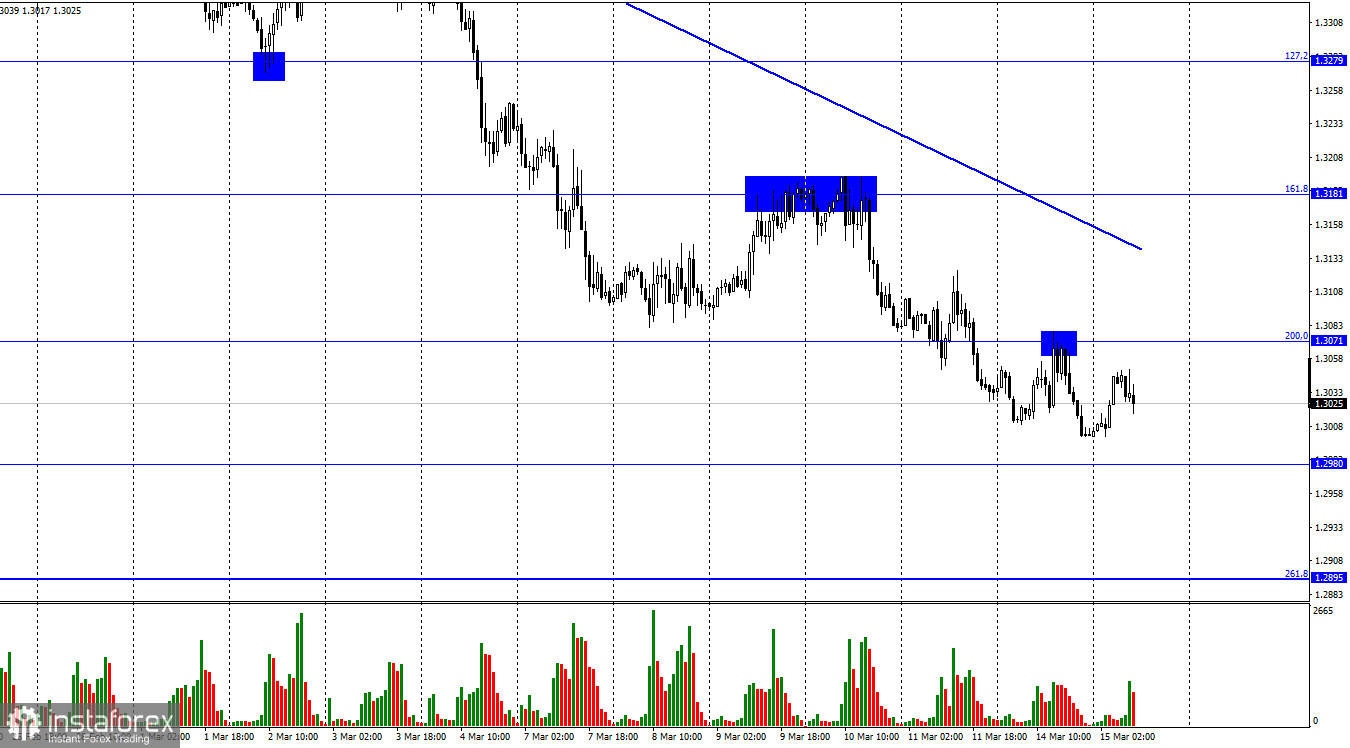

According to the hourly chart, the GBP/USD pair on Monday performed an increase to the corrective level of 200.0% (1.3071), a rebound from it, a reversal in favor of the US currency, and a new fall. On Tuesday, the pair's quotes attempted to start a new growth process, but it choked very quickly. Although it was today that the pound had a real chance to climb as high as possible. In the morning, several interesting reports were published in the UK that could support the pound. The unemployment rate in January decreased from 4.1% to 3.9%, average wages increased from 4.6% to 4.8%, and the number of applications for unemployment benefits decreased by 48 thousand. Thus, all three reports could support the pound sterling. But they didn't. I believe that traders have already fully focused on the three most important events of this week. The first is the Fed meeting, the second is the Bank of England meeting, and the third is geopolitics.

I have spoken about geopolitics many times. This is a factor that can affect the mood of traders for a long time. But the first two events do not happen so often, and traders are waiting for them. The Bank of England has the most questions right now. It has already raised the interest rate twice, surpassing even the Fed in this indicator. Now we are talking about the third rate increase. At least most traders believe in it. However, from my point of view, everything may not go according to plan, because quite unexpectedly for many, the UK has become one of the most zealous opponents of Russia in recent weeks, has imposed many sanctions, and by the end of the year is going to completely abandon the import of oil and gas from the Russian Federation. Inflation in the UK is also growing, and growing rapidly, and high oil prices will only spur the growth of prices for everything else. Thus, the Bank of England also needs to fight high inflation. But will it want to do this in the face of new geopolitical and economic risks? It is quite possible that at the meeting on Thursday, it will be decided to put the rate hike cycle on pause. In this case, the pound may again be under pressure.

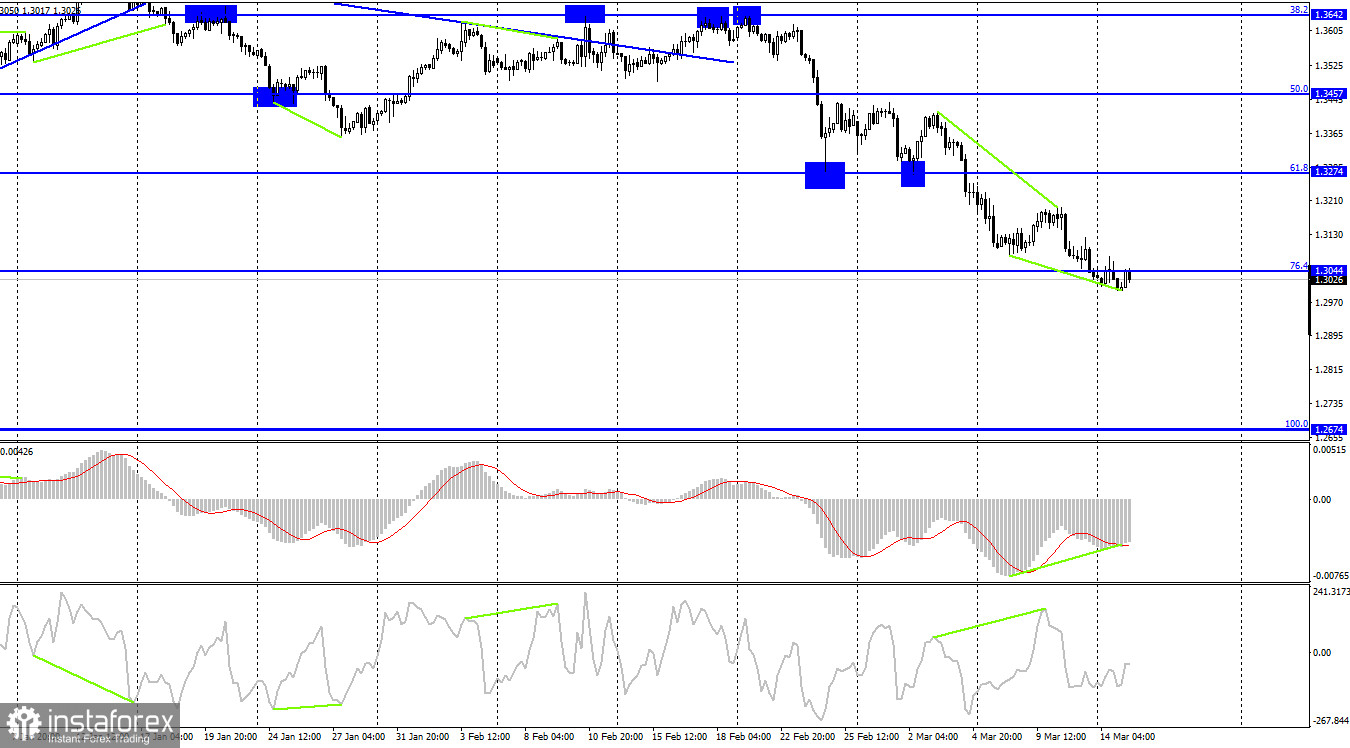

On the 4-hour chart, the pair secured under the corrective level of 76.4% (1.3044). However, the bullish divergence of the MACD indicator allows us to count on a reversal in favor of the British currency and some growth in the direction of the Fibo level of 61.8% (1.3274). The consolidation of quotes under the last low of divergence will increase the probability of a further fall in the direction of the corrective level of 100.0% (1.2674).

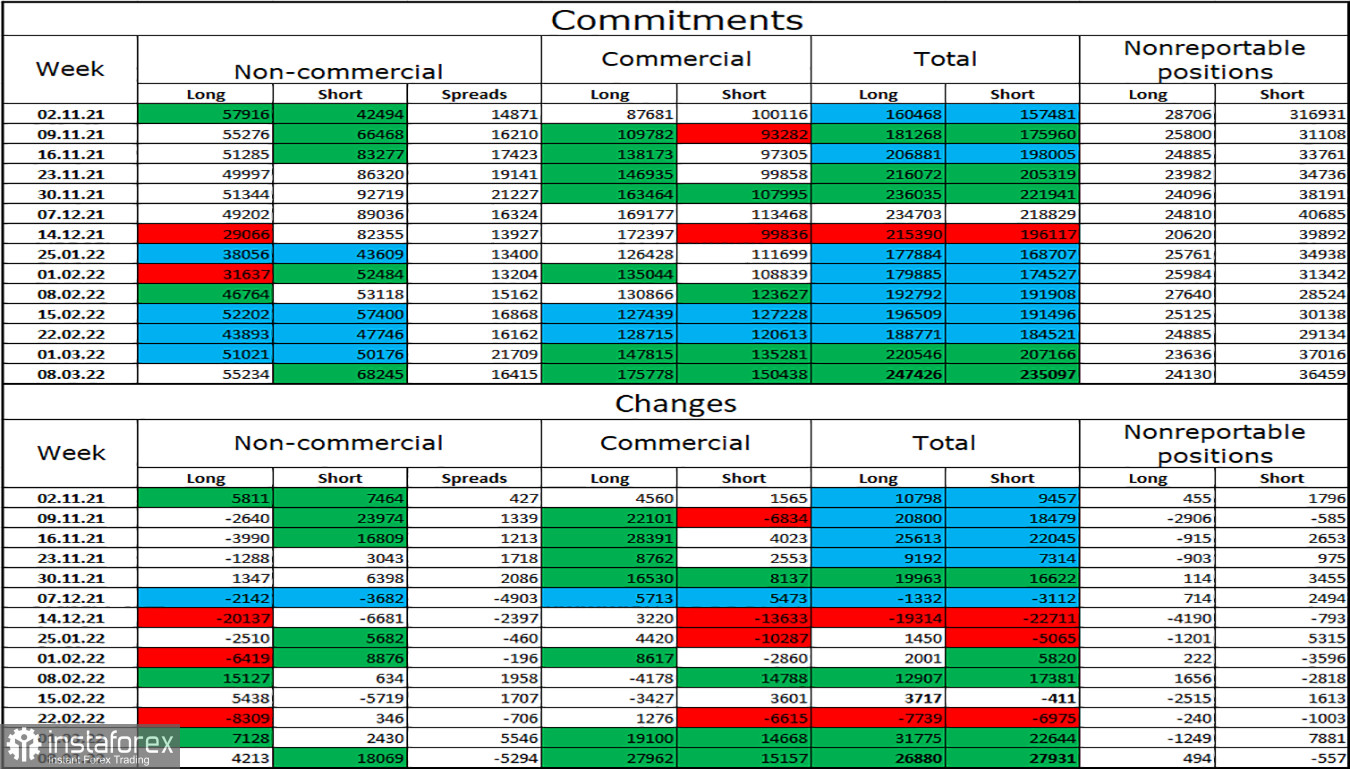

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts increased in the hands of speculators by 4,213, and the number of short contracts increased by 18,069. Thus, the general mood of the major players has become more "bearish", and the number of short contracts has increased significantly. Thus, everything is in order now, and the ratio between long and short contracts for speculators corresponds to the real state of things. The British dollar is falling, and the big players are selling the pound more than buying it. Nevertheless, I draw the attention of traders to the fact that the mood of major players changes too often and too sharply, and the British dollar has been falling for quite a long time.

News calendar for the USA and the UK:

UK - change in the number of applications for unemployment benefits (07:00 UTC).

UK - unemployment rate (07:00 UTC).

UK - change in the level of average earnings (07:00 UTC).

US - producer price index (12:30 UTC).

On Tuesday, the calendar of economic events in the UK contains three entries, but they are already known to traders. There are no interesting entries in the USA today, so for the rest of the day, I do not count on the influence of the information background on the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommended new sales of the pound when closing below the level of 1.3044 with targets of 1.2980 and 1.2895, but now we also need to wait for the cancellation of the bullish divergence of the MACD indicator. I do not recommend buying a pound today, since all factors remain in favor of the dollar.