Analysis of Tuesday's trades:

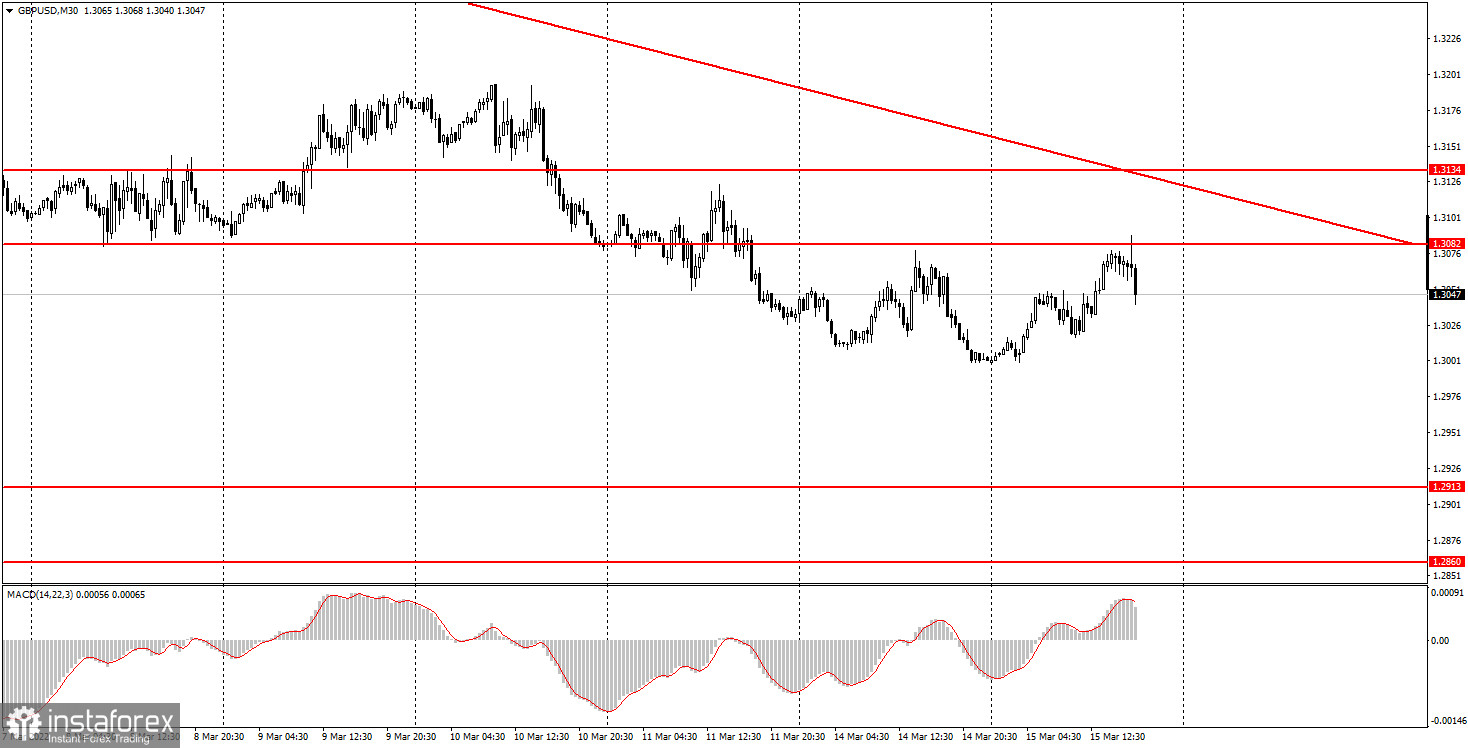

30M chart of GBP/USD

On Tuesday, GBP/USD somewhat retraced up. However, its corrective move was weaker than that of EUR/USD. The pair reached 1.3082 and rebounded from it. The quote is now ready to resume its downtrend, which is supported by the trend line. Let's hope the Bank of England and the US Federal Reserve do not announce decisions that could disappoint the market. For instance, if the US regulator hikes rates by just 0.25%. In recent months, traders were preparing themselves for a 0.50% increase. Above all else, raising the rate by 0.25% will not be able to tame growing inflation in the United States. Therefore, any forecasts should not be made before the monetary policy meetings of both central banks. The technical picture now indicates a downtrend, but the situation may reverse by the end of Thursday. You could give an outlook for the pound as soon as the trend line is broken.

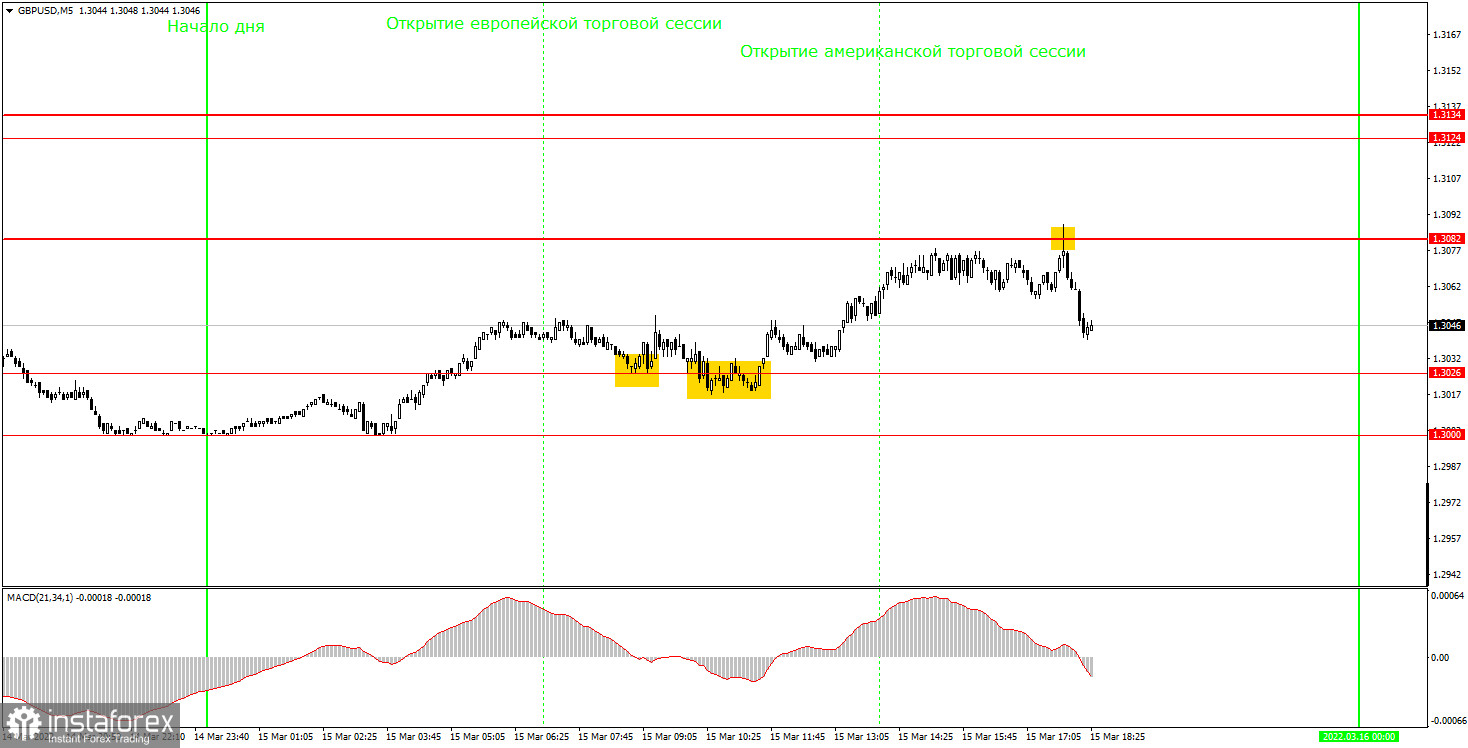

M5 chart of GBP/USD

In the M5 time frame, the technical picture looked very nice. There were just three signals produced, but all of them were accurate. Thus, when the pair rebounded from 1.3026 for the first time, it failed to continue the upward move and had to return to 1.3026. When the quote rebounded from the mark for the second time, it headed towards 1.3082 and then pulled back. So, beginner traders were able to yield a profit of about 25-30 pips from their buy trades. A pullback from 1.3082 generated a sell signal. A short position from this mark could have bought a trader some 20 pips of a profit. By the end of the day, such a trade should have been closed manually. Thus, even 40 pips of profit at the time of a total volatility of 87 pips is seen as a pretty good result. What is important is the fact that not a single false signal or unprofitable trade was made during the day.

Trading plan for Wednesday:

In the 30M time frame, the pair has been retracing up for several days. However, it no longer matters as the technical picture may drastically change on Wednesday and Thursday. The downtrend is likely to resume today with the target at 1.2913. However, if unexpected decisions are made at the monetary policy meetings of the BoE and the Fed, the upward move may extend. The target levels in the 5M time frame are seen at 1.2913, 1.3000, 1.3026, 1.3082, 1.3124-1.3134, and 1.3193. A stop-loss order should be set at the breakeven point as soon as the price passes 20 pips in the right direction after a trade has been opened. No macro events will unfold in the United Kingdom on Wednesday. Meanwhile, the outcome of the Fed's meeting and Chairman Powell's press conference will catch traders' interest. The US retail sales report, however, will be of secondary importance to the market. Notably, the outcome of the Fed's meeting will become known late at night, but the novice should have already exited the market by that time in any case.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to interpret charts:

Support and resistance levels can serve as targets when buying or selling. You can place Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in long-term trading.