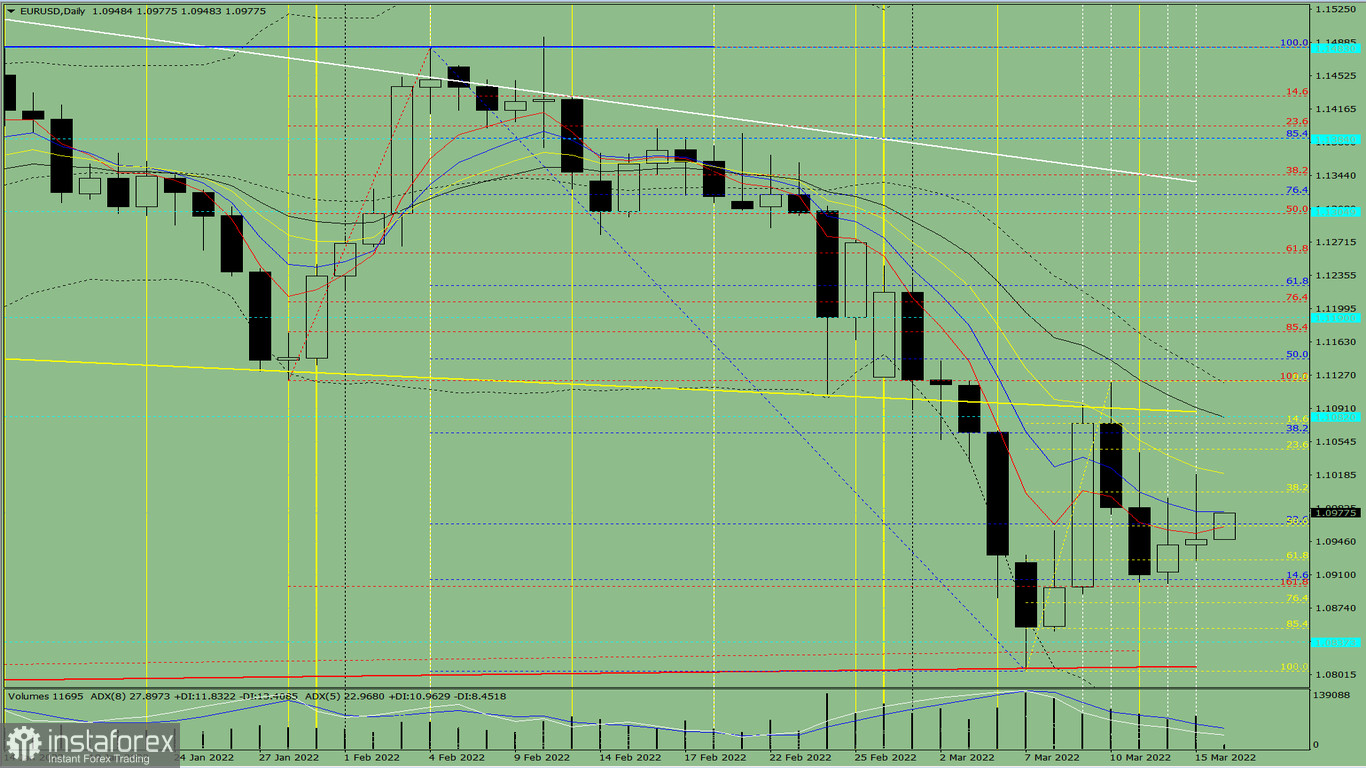

Trend analysis (Fig. 1).

The market may move up on Wednesday from the level of 1.0949 (close of yesterday's daily candle) to the target level of 1.1019, the upper fractal (the daily candle from 03/15/2022). After testing this level, the price may continue to move upward to the target level of 1.1064, the 38.2% retracement level (blue dotted line). Much will depend on the news that comes out at 18:00 UTC.

Fig. 1 (daily chart).

Comprehensive analysis:

- Indicator analysis - up;

- Fibonacci levels - up;

- Volumes - up;

- Candlestick analysis - up;

- Trend analysis - up;

- Bollinger Bands - up;

- Weekly chart - up.

General conclusion:

The price may move up from the level of 1.0949 (close of yesterday's daily candle) to the target level of 1.1019, the upper fractal (the daily candle from 03/15/2022). After testing this level, the price may continue to move upward to the target level of 1.1064, the 38.2% retracement level (blue dotted line).

Alternative scenario: from the level of 1.0949 (close of yesterday's daily candle), the price may move up to the target level of 1.1019, the upper fractal (daily candle from 03/15/2022). After testing this level, the price may start moving down to 1.0897, the 161.8% target level (red dotted line). When testing this level, the price may move upward to the target level of 1.0965, the 23.6% retracement level (blue dotted line).