Despite the fact that the fighting in Ukraine does not stop, and Ukrainian officials are increasingly talking about strong progress in the negotiation process, the world's media pay somewhat less attention to everything that is happening. Judging by the headlines, it seems that the situation has not changed in any way. But in fact, the attention of the largest mass media simply switched to today's meeting of the Federal Open Market Committee. This is rather due to the fact that no new sanctions are being imposed, and no statements are even being made on this topic. But the Federal Reserve will almost certainly raise the refinancing rate from 0.25% to 0.50%. At least, until quite recently, Fed Chairman Jerome Powell stated this in almost direct text. Which, in general, is atypical for the head of the US central bank. Indeed, the continued growth of inflation, and the full understanding that this process can only accelerate, leaves no other option but to tighten monetary policy. Formally, the very fact of raising the refinancing rate should contribute to the dollar's growth, but recently it has strengthened so much. And it's not just the flight of capital from around the world to the United States, provoked by the events in Ukraine. The dollar has been steadily rising since June last year, when the Fed announced plans to wind down the quantitative easing program and raise interest rates. Based on them, at the end of this year, the refinancing rate should rise to 1.00%. And this is at least. In other words, there is simply nowhere for the dollar to grow, since all these increases are already embedded in quotes. Nevertheless, the very fact of the rate increase will lead to a local increase in the US currency. It's about symbolism, since the last time, the refinancing rate was raised in 2018. But then, almost certainly, the market will quickly recoup this growth and the quotes will return to their current positions. Much will depend on Powell's subsequent comments. After all, if the growth of inflation forces to raise interest rates, then what is happening in the world as a whole, especially taking into account the sanctions confrontation, requires several other measures. First of all, we are talking about the quantitative easing program, which apparently needs to be expanded. In principle, Powell himself hinted at something similar, saying that it is necessary to reconsider plans to tighten the parameters of monetary policy. So the outcome of today's meeting may well be the subsequent weakening of the dollar. And quite a long time.

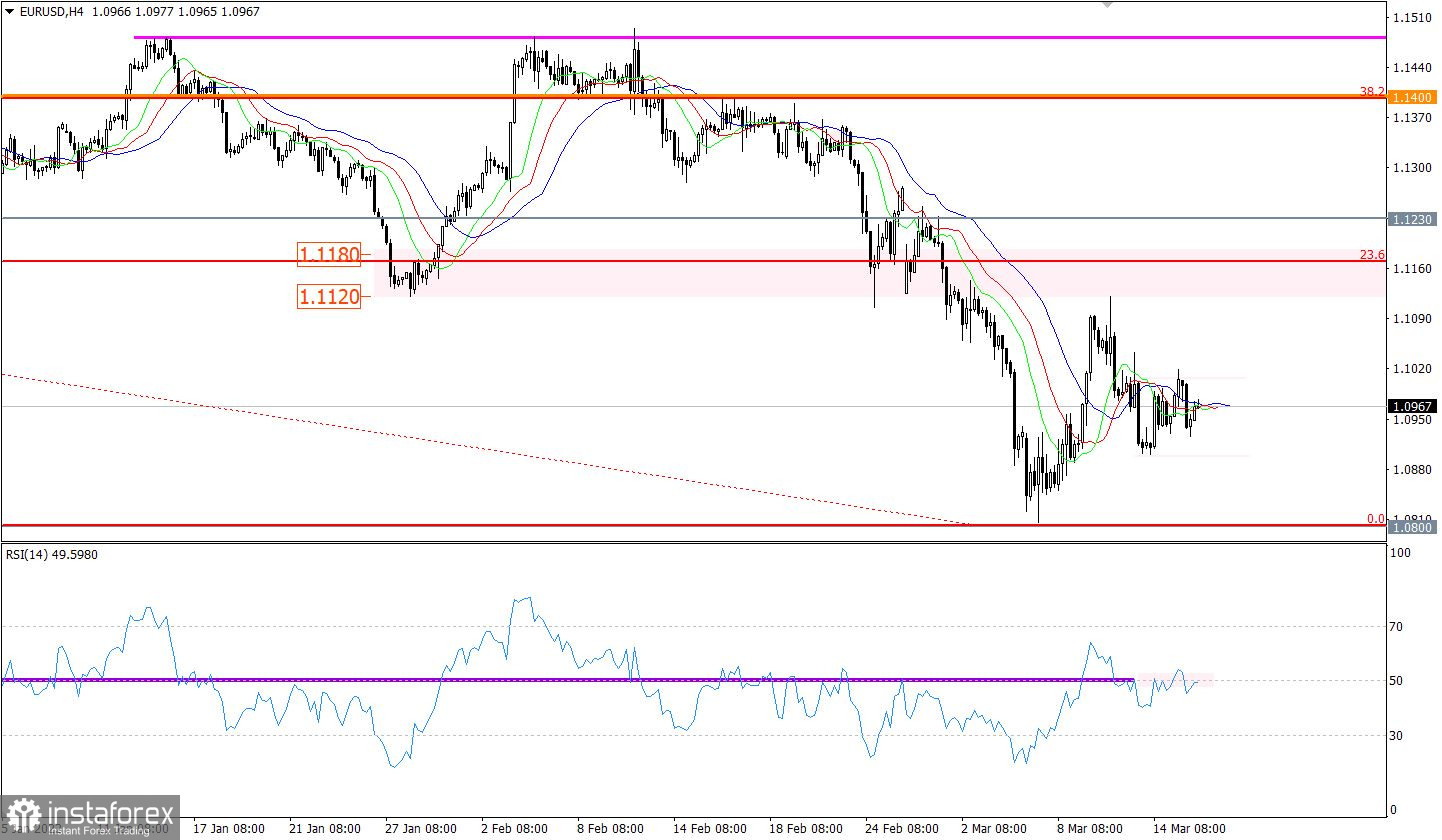

The EURUSD currency pair, in an attempt to return the buyer to the market, bounced off the variable pivot point of 1.0900, which eventually rolled back the quote to the 1.1000 level area. At this step, the volume of long positions exhausted the possible potential, which led to a slowdown in the market.

The RSI technical instrument moves along the 50 line in a four-hour period, which confirms the stagnation stage.

The Alligator H4 indicator has an interlacing between the moving MA lines, which proves the fact of stagnation. Alligator D1 is still focused on the medium-term downward trend, there is no intersection between the MA lines.

Expectations and prospects:

In this situation, price stagnation plays the role of accumulation of trading forces, with a high probability it will lead to new jumps in the market. Traders consider the values of 1.0900 and 1.1020 as signal levels. Keeping the price outside one of the levels will indicate an impulse price move.

Complex indicator analysis has a variable signal in the short-term and intraday periods due to the lateral amplitude. Indicators in the medium term signal a sale, due to a downward trend.