The Fed ends its two-day meeting today, and decisions on the rate, changes in monetary policy, summary of economic forecasts and the final conference press by Jerome Powell will be presented in the evening. Most likely, volatility will be low before the announcement of results because traders will wait whether or not the central bank will take more aggressive actions amid signs of a weakening economy. The Empire State manufacturing index has already fallen into negative territory, hitting -11.8, the lowest level in almost two years. That indicates a sharp weakening of momentum, even before the Fed starts to raise rates.

USD/CAD

The Canadian economy is growing stably, which, together with strong inflationary pressures, suggests further aggressive rate hikes by the Bank of Canada. After all, the labor market report for February already turned out to be better than in the US, posting a 337,000 increase in jobs, which is a very strong indicator for a country with a population 10 times smaller. The unemployment rate also fell from 6.5% to 5.5%, indicating that employment is growing in all sectors without exception.

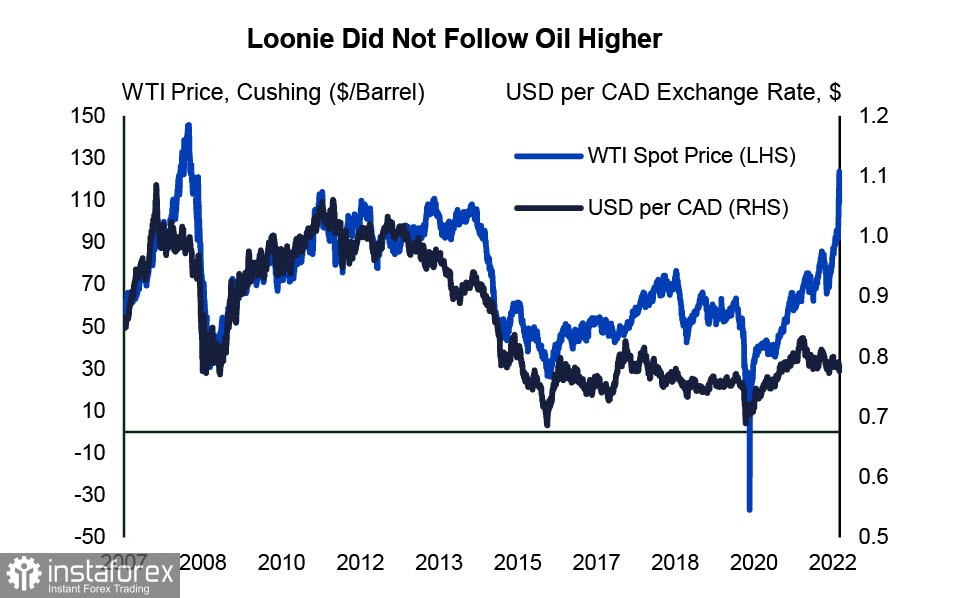

As for oil, prices rolled back to $100 per barrel, however, this level is supported by both the Canadian stock market and the CAD exchange rate. So far, strong geopolitical tensions are preventing CAD from rallying, but the upside potential is strong.

Pressure from higher gas and oil prices is weighing on gasoline prices, which in Canada already rose 32% y/y in January, with an equally impressive rise expected in March. Companies will try to pass on higher energy costs to consumers, which in turn will increase inflation.

At the moment, the forecast for rates is four increases this year, that is, plus 1% to the current level of 0.5%, which is somewhat less than the Fed. That will not let the yield spread to grow, but inflation in Canada already hit 5.1% in January, so there is actually a need to make an adjustment for real yield. And considering that the yield of 10-year GKOs in Canada and the US is currently almost the same, it is likely that real yield in Canada will remain higher even amid a faster rate hike by the Fed.

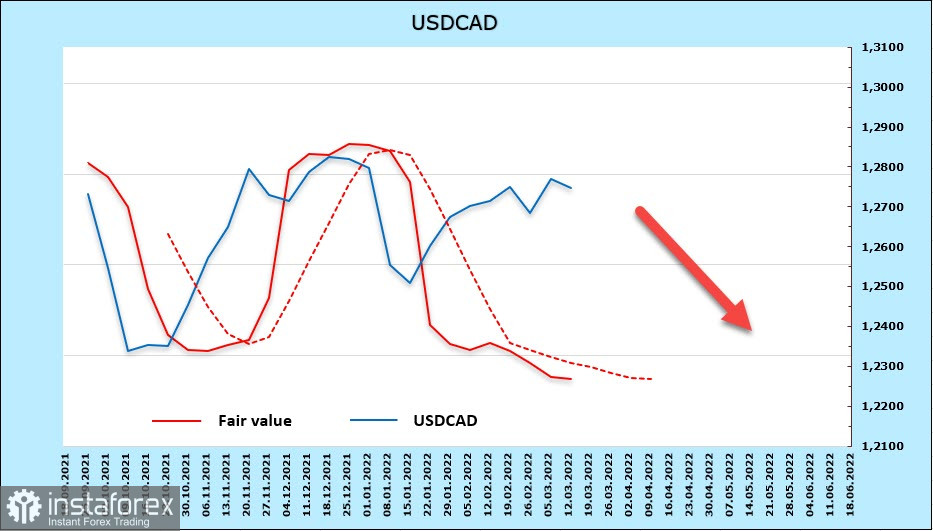

In terms of CAD, net long positions are down 516 million over the week, with the settlement price below long-term average. This suggests that downside potential remains in USD/CAD.

The probability of growth to 1.30 also decreased, primarily because the pair is more likely to dip to 1.2580. The release of February data on consumer inflation will also increase volatility in the afternoon.

USD/JPY

The Japanese economy looks stable even though exports and imports rose lower than expected in February. It grew by only 19.1% m/m, but gained 34% y/y, which is better than expected. Industrial production, meanwhile, is recovering to sub-like levels, while a rollback in commodity prices reduces the burden on importers. But that is all just the visible side despite the fact that the budget for the 22nd fiscal year was approved in February, an additional budget of 10 trillion yen is already being considered in order to block the rise in commodity prices. The dominant idea is that income redistribution is not enough to revive the economy, and the best way to generate demand is through government spending. Needless to say, Japan's government debt level is among the highest in the world.

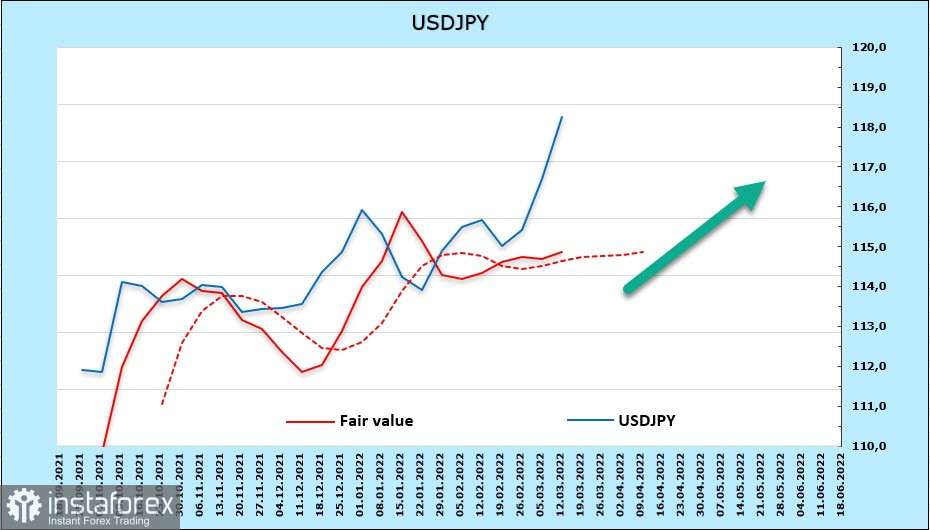

In terms of yen, a rather noticeable reduction in the short position is observed, from 1440 million to 6.036 billion. The settlement price is also above the long-term average, which means that bullish momentum remains.

USD/JPY has quickly reached a 5-year high of 118.60. The probability of further growth is high, however, that increases the chances of a correction. If that happens, support will be 116.30/50, while the target is 125.90.