EUR/USD

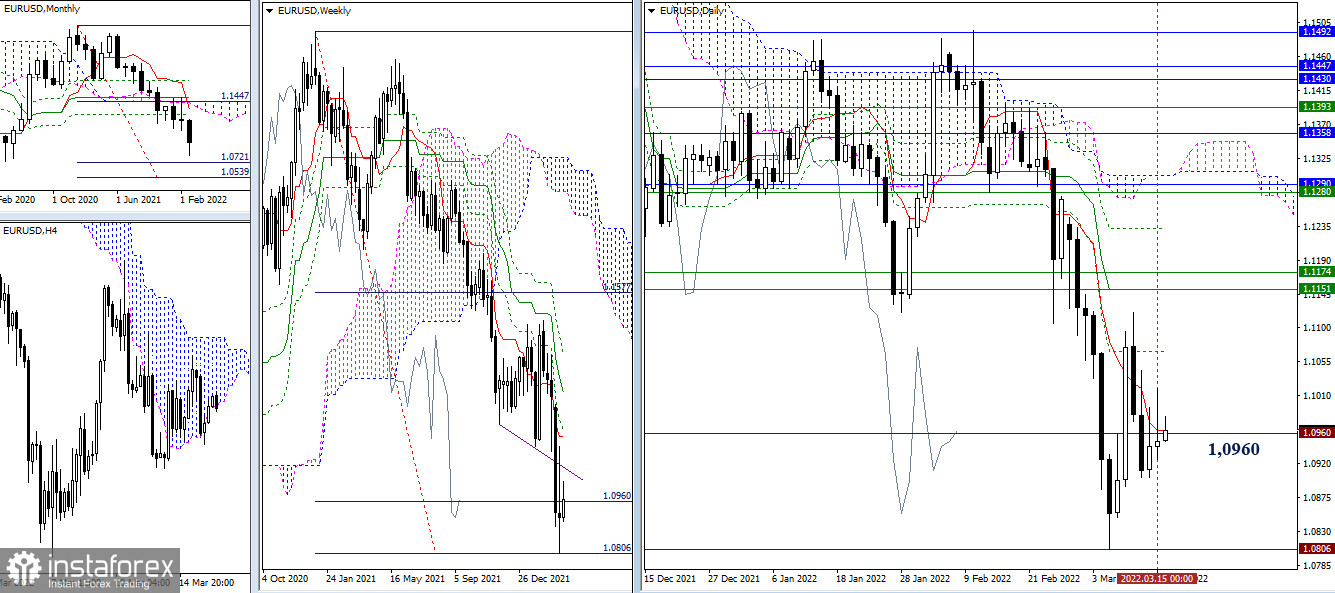

The situation has not changed significantly. The pair remains in the zone of attraction and influence of the daily short-term trend (1.0964) and the first target of the weekly target for the breakdown of the Ichimoku cloud (1.0960). Due to this, the nearest upside targets today remain at 1.1069 (daily Fibo Kijun) and 1.1151-74 (weekly levels + daily Kijun), and the minimum extremum (1.0806) remains the main downward target, consolidation below which will restore the downward trend and go beyond the weekly target.

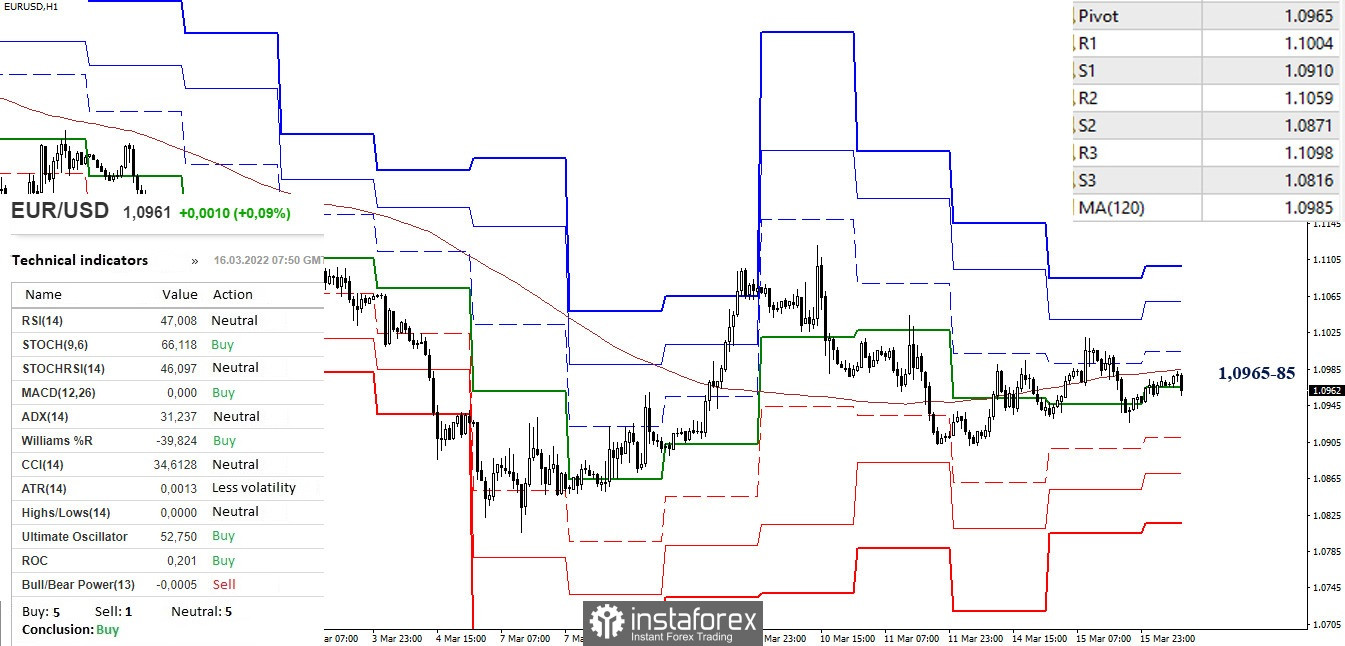

The uncertainty and consolidation of the higher timeframes have led lower timeframes spinning around key levels and neither side has been able to achieve a confident advantage lately. Work in the zone of attraction 1.0965-85 (central pivot point + weekly long-term trend) will maintain the current distribution of forces. Upward targets within the day are located at 1.1004 – 1.1059 – 1.1098 (resistance of classical pivot points). Downward targets in case of a decline are the support of the classic pivot points 1.0910 - 1.0871 - 1.0816.

***

GBP/USD

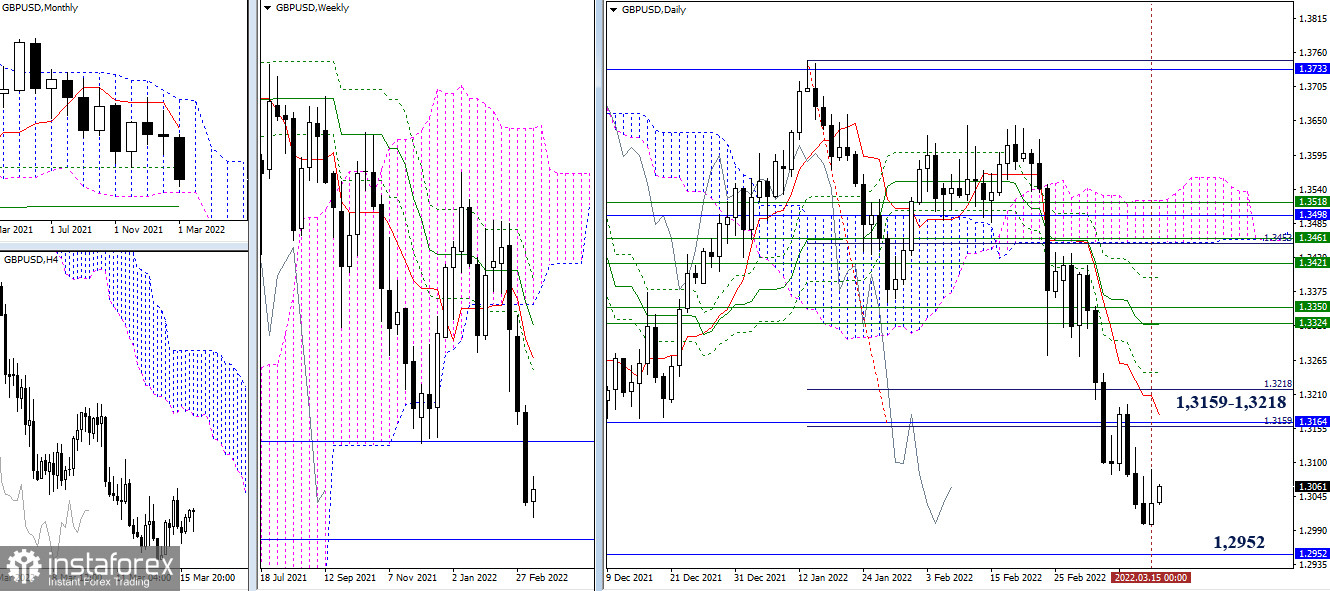

The decline stopped. We observe deceleration, but there is no full-fledged corrective movement yet. Among the nearest upward targets, it is necessary to note the resistance zone 1.3159 - 1.3218 (daily levels + daily target for the breakdown of the Ichimoku cloud + monthly Fibo Kijun). Downward interests continue to focus on testing and overcoming the lower boundary of the monthly cloud (1.2952).

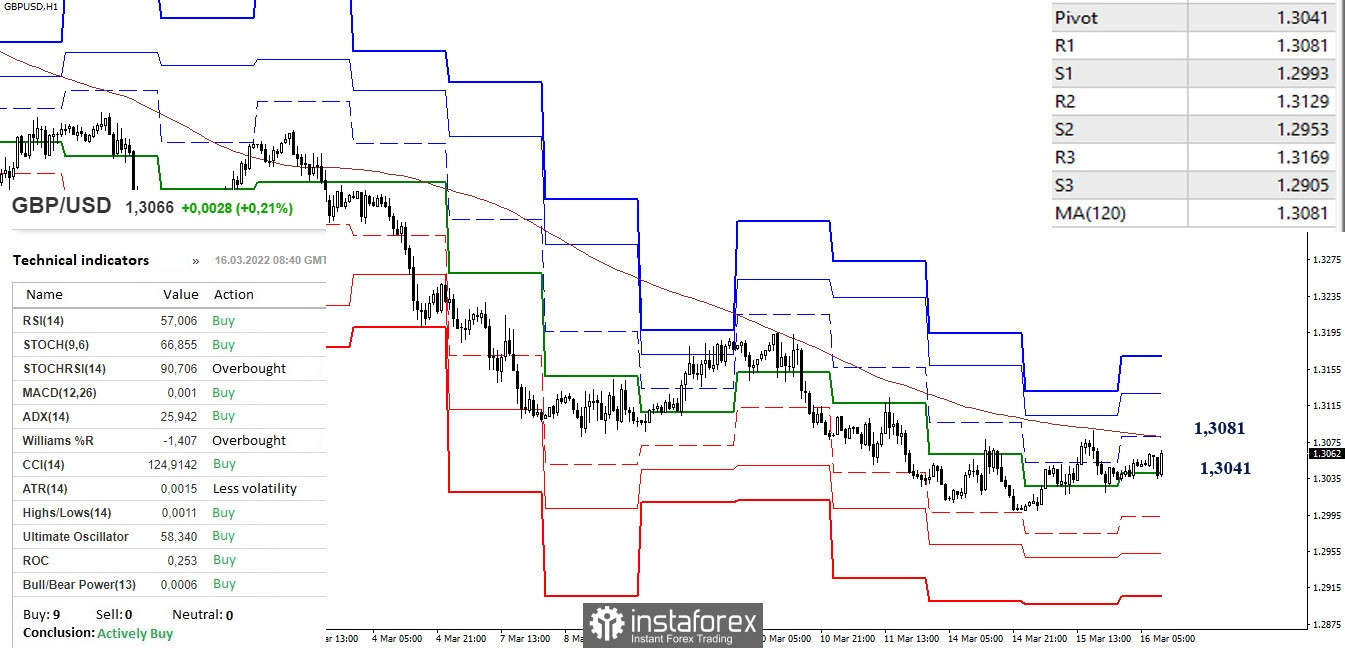

On the lower timeframes, the pair continues to remain below the key level - the weekly long-term trend (1.3081). Consolidation above and reversal of the moving average can change the current balance of forces. In this case, it will be possible to mark the landmarks R2 (1.3129) and R2 (1.3169) for an intraday rise. When support decreases, you can note on 1.2993 - 1.2953 - 1.2905 (classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)