Hello!

Despite the fact that a review on the USD/CHF pair was completed on Monday, today it is advisable to analyze this trading instrument again. In today's article the main attention will be focused on the technical picture. However, the most significant event for the USD/CHF pair should be taken into account. The US Federal Open Market Committee will make a decision on the interest rate this evening. The federal fund rate is expected to rise by 25 basis points. In half an hour later, Fed Chairman Jerome Powell will hold a press conference. Notably, these important events can cause a very strong volatility in the currency market and significantly affect the price dynamics of the USD/CHF and other currency pairs. Therefore, it is likely that today's outlook and recommendations may not come true. The Fed rhetoric and the market participants' reaction to the above events are of crucial significance. Now it is advisable to analyze the USD/CHF charts. Although the weekly timeframe was already analyzed on Monday, I think it is appropriate to discuss it again.

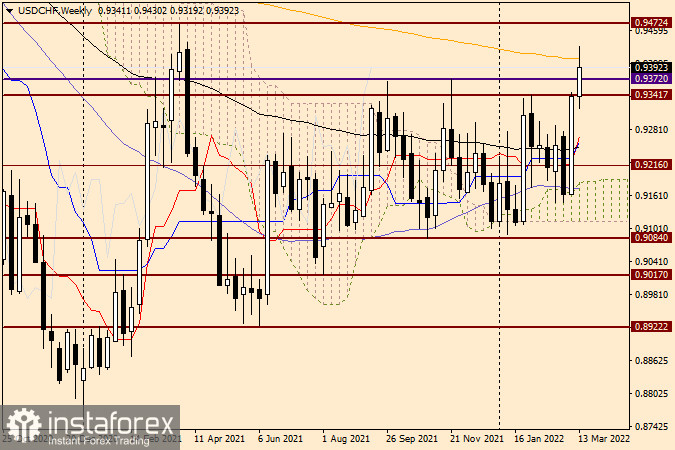

Weekly

As assumed in the previous article on USD/CHF, the pair continued to rise and reached the orange 200-exponential moving average. The USD/CHF pair met strong resistance at this level. This aspect was also mentioned in the previous review. If the weekly trading closes above the 200 EMA and even above the key resistance level of 0.9472, it will be possible to consider that the pair completed consolidation and can continue the upward trend. If the Fed decision and Powell's comments are not favorable to the market participants, a reversal candlestick pattern with a very long upper shadow may appear on the weekly timeframe. In this case, the pair's upside potential will be considered exhausted. Therefore, it is recommended to sell the pair.

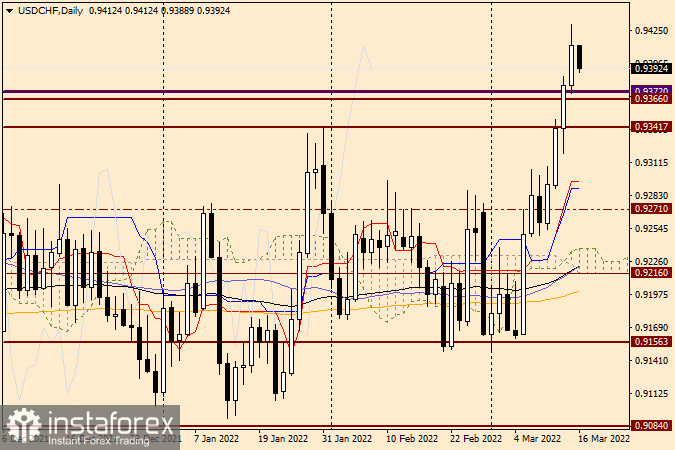

Daily

Notably, two candlesticks in a row closed above the strategically significant resistance level of 0.9372 on the daily chart. I believe a true breakout of a level or line is indicated by the closing above (or below) three successive candles. According to the technical analysis, today's trading is extremely significant for the USD/CHF pair. At the time of completing the article, the pair had already attempted to pullback to the broken resistance at 0.9372. Moreover, traders had a chance to buy the pair. The pair may sink even more in the short-term amid increased volatility related to the Fed events. Then, it will sharply rebound upwards and try to continue its unprecedented growth. It is possible to try buying the pair from the current price levels or after another decline towards 0.9372. As for beginners and those who do not focus on risky trading, I recommend staying out of the market today and waiting for the daily closing. Currently, I believe the main trading idea is to buy the pair after it pulls back to 0.9372

Good luck!